Yen May Weaken on BOJ Inaction, But the Trend Still Points Higher

Yen May Weaken on BOJ Inaction, But the Trend Still Points Higher

By:Ilya Spivak

The Japanese yen may turn lower after five weeks of blistering gains. A pullback may be a buying opportunity.

- The Bank of Japan is likely to disappoint bets on a hawkish policy reversal.

- Imported food prices make for the wrong kind of inflation for BOJ officials.

- Any near-term weakness in the Japanese yen may be a buying opportunity.

The Japanese yen extended its blistering rally for a fifth week. The currency has added over 6% against the U.S. dollar since the upturn began in mid-November. It now faces a critical test of strength as the Bank of Japan (BOJ) prepares to deliver a closely watched monetary policy announcement.

Investors have been speculating about the possibility of a sea change in BOJ monetary policy for a year since the central bank roiled markets by taking the first step to weaken its cap on the 10-year Japanese government bond (JGB) yield in December 2022.

The arrival of Governor Kazuo Ueda—who took the reins from outgoing BOJ chief Haruhiko Kuroda in April – helped underpin the sense that some kind of major readjustment is afoot. Unusually for the head of Japan’s central bank, his background is in academia instead of government.

What’s more, he comes from the stable of transformative policymakers groomed by visionary economist Stanley Fischer. Other notable disciples include former Federal Reserve and European Central Bank (ECB) leaders Ben Bernanke and Mario Draghi, respectively.

Inflation in Japan: the price is wrong

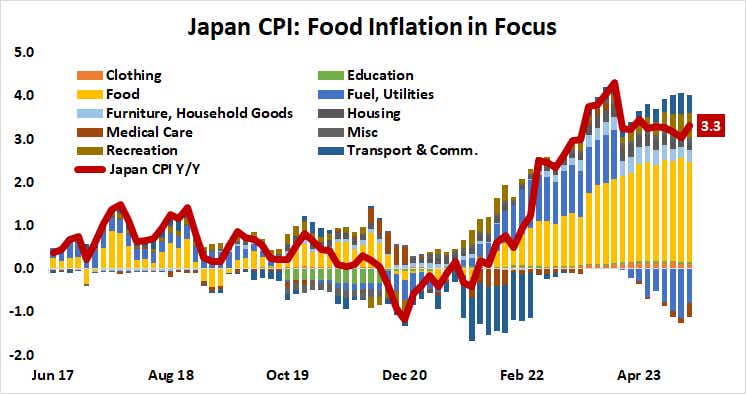

That Japanese inflation has accelerated alongside global prices has helped fuel the hawkish narrative. The benchmark consumer price index (CPI) measure of inflation showed prices grew 3.3% year-on-year in October. That marked the 19th consecutive month that it exceeded the BOJ target of 2%.

Comments from the central bank’s leadership helped create a sense of urgency around this month’s policy update. Mr. Ueda told the Diet—Japan’s parliament—that the BOJ’s job will become more challenging after year-end. Deputy Gov. Ryozo Himino gave a speech arguing that lifting interest rates would be less harmful than expected.

As it stands, the markets are not expecting a rate hike at this week’s meeting. The policy target rate, now at -0.1%, is expected to emerge from negative territory by mid-2024 and reach 0.2% by year-end. Scrapping the 0% yield cap on 10-year JGB rates—so-called “yield curve control” (YCC)—is widely seen as a prerequisite.

With no immediate changes likely on the menu, financial markets will focus on the guidance on offer in the central bank’s policy statement as well as Ueda’s post-meeting press conference. Market-watchers expecting a dialing-up of hawkish signaling may be in for a disappointment.

Bank of Japan: no pressure

First and foremost, Japan’s inflation is running hot for all the wrong reasons. Strip out food prices, and the headline consumer price index (CPI) rate drops to just 0.6%. Japan produces less than 40% of its own food, making this an imported problem. BOJ officials have stressed that they need to see sustainable, domestically driven price growth to shift gears in earnest.

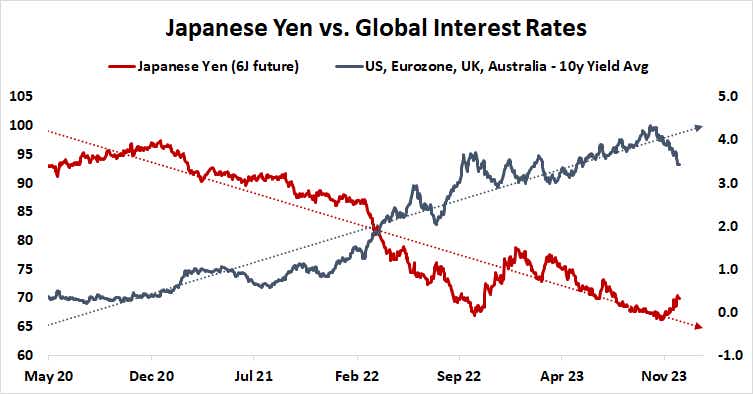

Second, there seems to be little urgency to follow up on last year’s moves to weaken YCC. The symmetrical thresholds for BOJ-tolerated departures from the 0% cap have been incrementally widened from 0.25% to 1%. That was done to avoid pitting the central bank against a hawkish Fed, whose rate hike cycle pressured yields higher globally.

Now that this pressure has evaporated alongside speculation that the U.S. central bank is finished raising rates and will begin to cut them next year, there seems to be little reason to rush YCC’s demise. The BOJ has ample time to finish the “policy review” launched this year. From there, Japan’s demographics will make any normalization slow and modest.

This might see the yen spike lower as hawkish speculation fizzles. Losses may be short-lived if a dovish turn in global monetary policy drives rates lower, reversing the perennially yen-negative “carry trade” dynamics that made it a standout loser amid the 2021-2022 tightening cycle. A near-term pullback may yet be a buying opportunity.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices