USD/JPY: Yen Aiming Higher Despite Bank of Japan Inaction

USD/JPY: Yen Aiming Higher Despite Bank of Japan Inaction

By:Ilya Spivak

The Bank of Japan will disappoint bets on a major policy revamp but the yen will probably continue higher anyway

- The Bank of Japan readies rate decision amid policy “sea change” speculation.

- It's likely that hawkish-sounding comments from Governor Ueda are aimed at the yen.

- The global retreat from rate hikes will lead the yen higher without BOJ action.

Speculation about a tectonic change in Bank of Japan (BOJ) monetary policy continues to swirl as the central bank prepares to deliver September’s rate decision. Traders who are betting on a sea change may be disappointed.

Much has been made of an interview with BOJ Governor Kazuo Ueda published in Yomiuri Shimbun —one of Japan’s five major newspapers—earlier this month. He said that officials might have enough information by year-end to judge if wages will continue to rise, signaling that the recent inflation rise is becoming entrenched.

Ueda pointedly added that—while the path to price stability, defined by a 2% inflation target, remains a long one—scrapping negative interest rates could be the required response if wage growth seems sustainable. Markets expect that the end of the BOJ’s yield curve control (YCC) policy of capping the 10-year Japanese government bond (JGB) yield would have to precede any adjustment of the target rate.

This implies that a reversal of years of ultra-loose monetary policy may be imminent. That perked up the markets’ interest/ Traders have suspected the arrival of Mr. Ueda—the first academic economist to lead the BOJ and a disciple of transformative monetary economist Stanley Fischer—would mark some kind of big-splash policy rethink.

BOJ officials sprang into action as speculative interest swelled. Comments from unnamed sources “familiar with the matter” from within the central bank quickly emerged on the newswires to clarify that the governor was not intending to signal the direction in which a decision on wages and rates would be made, and that a call for more easing could well be the result of an earlier assessment.

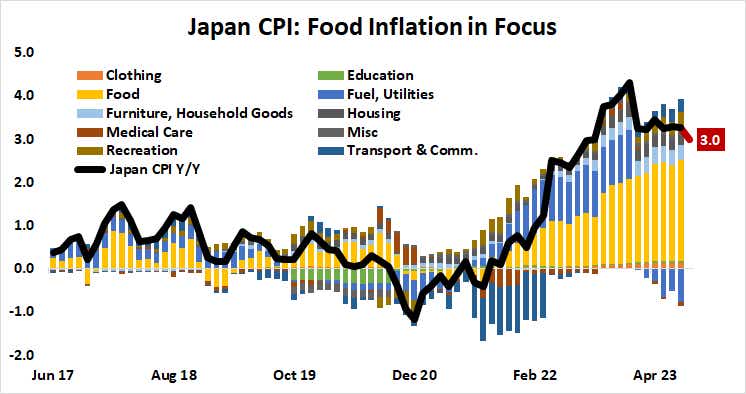

Japanese inflation is underpinned by food prices

Looking through the smoke and mirrors, the BOJ is likely to stay the course for now. Japanese consumer price index (CPI) inflation printed at 3.3% in July. It is expected to decline to 3% when August numbers cross the wires on Friday. While that is certainly elevated relative to the 2% objective, it could be powered by temporary forces.

Food inflation amounts to the biggest contributor to price growth, much like the situation in the Eurozone and in the United Kingdom. A gauge of global food prices from the United Nations (UN) suggests they fell to a 28-month low in August after peaking last year. It tends to lead worldwide inflation trends by about seven months.

So, some progress is already on display, and more is signaled ahead. Moving ahead with ending YCC against this backdrop seems unlikely. The BOJ has struggled for decades to revive sustainable inflation, fruitlessly pushing against demographic forces making the return of pricing power elusive. The central bank seems anything but trigger happy.

Bank of Japan jawboning aimed at capping yen weakness

Ueda’s comments were probably aimed at countering weakness in the Japanese yen. The currency was trading at a 10-month low against the U.S. dollar as the governor made his splashy comments. Cabinet Secretary Hirokazu Matsuno has been even more overt about officials’ concern, saying Japan would not rule out any options to curb what it judged to be excessive moves in the exchange rate.

As it happens, the yen may be on the path to recovery already. The currency surged 0.7% against a basket of its major counterparts—the biggest one-day gain since Ueda’s comments—after policy announcements from the Bank of England (BOE) and Swiss National Bank (SNB) surprised on the dovish side, extending a global retreat from tightening (as expected). Analysts penciled in rate hikes from both central banks this week, and both opted against one.

This extends an emerging trend. The Federal Reserve also signaled a pause in its rate hike cycle this week. Similar indications have emerged from the Bank of Canada (BOC), the Reserve Bank of Australia (RBA) and the European Central Bank (ECB) in September. That probably speaks to building concerns about global recession.

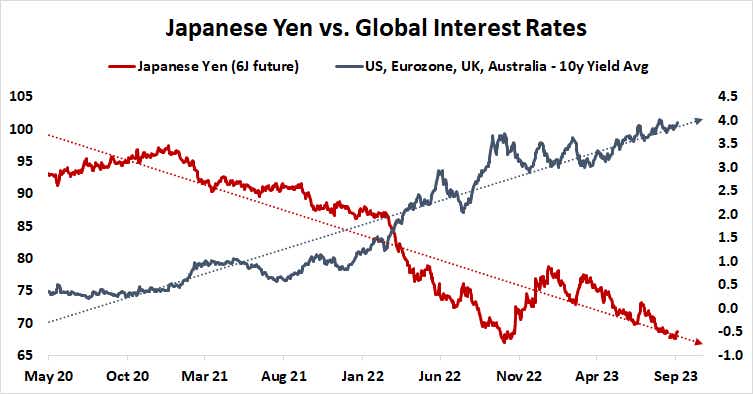

The yen tends to weaken when global rates rise, encouraging domestic and foreign investors to borrow cheaply in the perennially low-yielding currency to buy higher-paying assets and extract the differential as an income stream. When yield spreads stop widening because rates outside Japan hit a ceiling, traders unwind exposure to this so-called “carry trade," buying back yen to pay down their currency loans and driving it higher.

If global central banks have decided that the time has come to stop tightening the screws, the yen is likely to continue higher. The BOJ surely understands this. That means Ueda and company will probably keep rhetoric open-ended enough that speculation doesn’t swing sharply in the opposite direction and weaken the currency but stop short of an actual policy change. That might be a bump in the road for the yen, but global trends make further gains seem likely.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices