Can a Rate Hike Breathe Life into the Euro?

Can a Rate Hike Breathe Life into the Euro?

By:Ilya Spivak

The euro looks deeply troubled as prices flatline even amid growing expectations of another ECB interest rate hike

- Reuters reports the ECB will lift its inflation outlook while cutting economic growth projections.

- Markets respond with a hawkish shift in ECB rate hike bets, but the euro looks the other way.

- Sellers may drive the currency lower if the central bank opts to move into wait-and-see mode.

The euro is struggling even as markets move to price in an interest rate hike from the European Central Bank (ECB) this week. That bodes ill for the single currency.

At the start of this week—a mere 48 hours ago—swaps market pricing reflected a cumulative 75% probability that the ECB will issue another 25-basis-point rate hike before the end 2023. September was seen as the meeting when the increase was most likely—with a probability of 41%.

This calculus has changed. Reuters reported that the central bank will upgrade its inflation outlook to put price growth above 3% next year while downgrading the economic growth outlook for this year and 2024, citing an anonymous source “with direct knowledge of the matter."

That activated a hawkish rethink in the markets. One more rate hike for this year is now fully priced. September is still seen as the likeliest time for the increase, with a probability of nearly 65%. It is expected to be reversed by mid-year with the start of an easing cycle.

Currency markets yawned at the adjustment. The euro is trading little-changed against a basket of its major counterparts. It is on course to finish the day flat against the U.S. dollar. That speaks to potent underlying weakness. Any asset unable to find strength in such a textbook example of supportive news-flow seems to be deeply unloved by investors.

Markets unimpressed even as ECB rate hike expectations grow

The markets’ skepticism echoes the deep predicament facing ECB officials, and the way in which they seem likeliest to address it.

The latest round of purchasing managers index (PMI) data neatly summarizes a steady stream of downbeat Eurozone economic data, showing the regional economy shrank for a second month in August. Meanwhile, inflation expectations priced into the bond and swaps markets are trending stubbornly higher. This adds up to divergent policy cues.

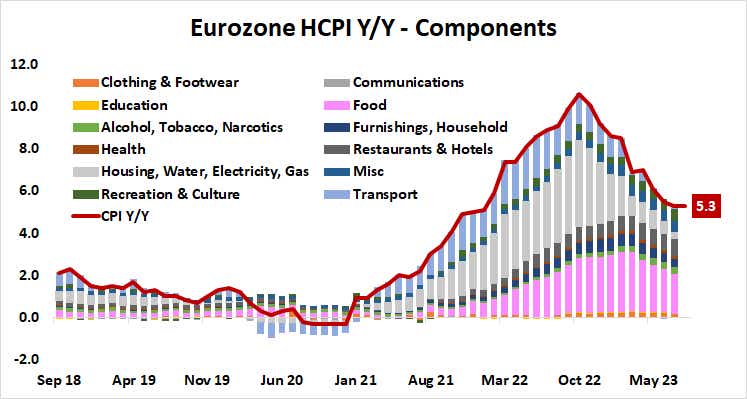

At this point, Eurozone inflation is mainly upheld from the “goods” side of the ledger, with food prices making a standout contribution. Trying to bring down food inflation with interest rate hikes is a suspect endeavor, because there isn’t much the ECB can do to cool demand.

With that in mind, tightening policy further at this stage would be mostly performative. Policymakers might reckon it a necessary step to burnish their inflation-fighting credentials, though how much that matters at this stage is unclear given the markets’ uninterested response to the latest repricing of expectations.

Euro may drop if the ECB opts to hold fire

Alternatively, the doves on the ECB Governing Council may prevail in keeping rates unchanged, reasoning that disinflation will happen on its own over time as growth sputters. Tightening the screws further when the economy is already flirting with recession seems unnecessary.

The euro looks troubled either way, but selling pressure may heat up in the latter scenario. Forcing a dovish about-face in expectations if ECB President Lagarde and company hold fire now that a rate hike has been fully discounted is likely to inspire sellers, threatening to push the currency back toward the 1.06 level against the greenback.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices