Trading in the First Half of 2025 Hints at Risk of Recession

Trading in the First Half of 2025 Hints at Risk of Recession

By:Ilya Spivak

Price action could mean the markets are preparing for an economic downturn

- Stock market performance has been lavishly flattered by a sinking US dollar.

- Falling bond yields point to solid Treasuries demand and incoming Fed rate cuts.

- Crude oil prices indicate traders are more worried about weak growth than geopolitical risk.

The first half of 2025 offered no shortage of twists and turns for global financial markets. Traders found themselves under constant assault from factors ranging from conflict in the Middle East and in Ukraine to a shocking dismantling of global trade norms by the United States, the same country that gave birth to them.

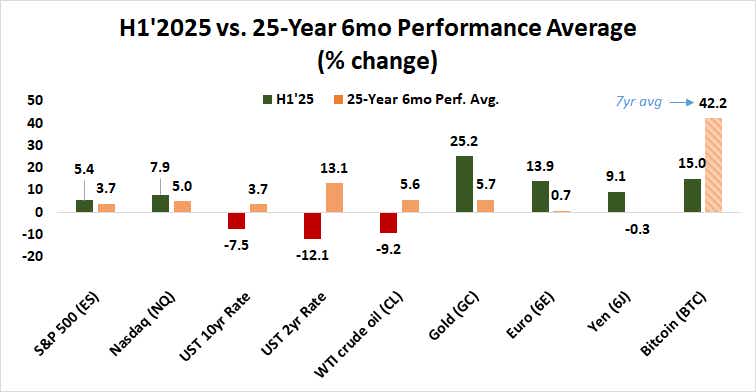

Yet price action in the world’s top markets leaves a different impression than the headlines might suggest. Take stocks. The bellwether S&P 500 rose 5.4% in the first half of the year. That’s a bit higher than the long-term average of 3.7% for a six-month period in the last 25 years.

The tech-tilted Nasdaq fared slightly better. It rose 7.9%, topping the historical average of 5%. All the same, these moves pale in comparison to a dramatic fall in the US dollar. It lost an eye-watering 13.9% against the euro and 9.1% against the yen. Gold, an anti-fiat stalwart, surged 25.2%. These moves vastly outstrip normal six-month swing dynamics.

This reveals that Wall Street performance has been lavishly flattered by the greenback’s weakness. If one’s returns were expressed in another major currency, buying and holding US stocks so far this year would have been a losing proposition. The stocks seem to be enjoying a heroic rally, but the move’s foundation appears vulnerable.

It is tempting to take this as evidence of a “sell America” bias, envisioning capital pouring out of the US amid the Trump administration’s bellicose policymaking. However, this also is not what it seems. Treasury bond yields have fallen across maturities since the beginning of the year, signaling solid appetite for sovereign US assets.

The yield on the benchmark 10-year Treasury bond fell 7.5% in the first half of the year. The rate on the two-year note fell 12.1%. This seems to say two things. First, the markets are quite willing to believe in the faith and credit of the US government and lend it long-term money at friendly borrowing costs. Second, monetary stimulus is ahead.

Finally, for all the fire and fury of Israel’s war with Iran and Washington’s shock decision to engage in the action directly, crude oil prices traded down 9.2% in the first six months of 2025. This seems to show that, whatever supply disruption risk the markets might perceive, they find demand concerns more potent.

Are the markets signaling recession?

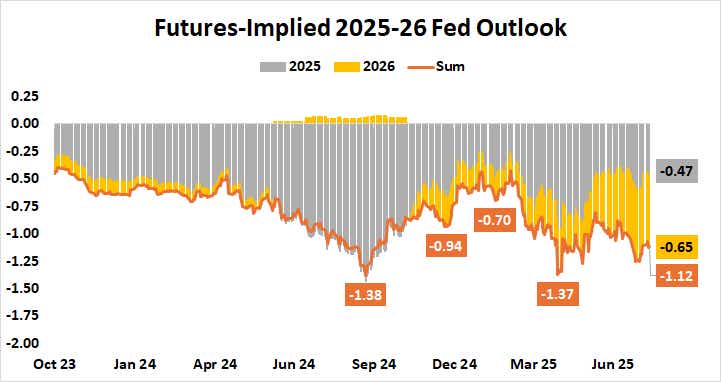

Considered together, an ominous way forward seems to emerge. Bold headlines about wars and tariffs increasingly seem like background noise, and the US-based architecture of global finance seems solidly intact. Still, incoming economic pain looks set to rattle appetite for risk and force a reluctant Federal Reserve to act.

The implications for major assets in the second half of the year may be as dramatic as they are unexpected. Stocks may turn lower as traders acclimate to the din of incoming news and refocus on a simple realization: A slowing US economy threatens to stress the single point of failure for global economic growth.

The ensuing “risk off” shift in tone for global financial markets may drive Treasury bonds and the US dollar up in tandem, reviving their appeal as havens of safety and liquidity in times of stress. Perhaps this is why the currency has begun a cautious rebound, even as the markets’ rate cut bets have veered sharply more dovish than those of the Fed.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts #Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit #tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.