Option Spreads: A Trader’s Guide to Defined Risk Strategies

Option Spreads: A Trader’s Guide to Defined Risk Strategies

Option Spreads Don’t Eliminate Risk, But They Can Help Traders Define And Manage It

-

Option spreads combine multiple legs to create strategies with defined risk and reward characteristics, offering a vehicle to express a wider range of market outlooks than single-leg trades.

-

Core spreads—straddles, strangles, calendars, and verticals—enable traders to target volatility, time decay, or directional moves while maintaining clearly defined outcomes.

-

Spreads with more than two legs, such as iron condors and butterflies, offer added flexibility—allowing traders to fine-tune risk and reward for specific market outlooks.

Options have become one of the most dynamic tools in today’s financial markets. With trading at record levels, the market has grown more active, accessible, and liquid than ever before. While many traders begin with “naked” calls and puts, option spreads offer a more versatile way to express views on the market—delivering defined risk, unique payout profiles, and flexibility across bullish, bearish, and neutral scenarios.

A spread is simply a combination of multiple options positions that work together to form a single strategy. Most involve two legs—whether both bought, both sold, or one of each—but some use three or four legs to target market conditions with even greater precision. These multi-leg spreads give traders more tools to fine-tune outcomes, making them useful across environments ranging from volatile breakouts to quiet consolidations.

Regardless of the number of legs, the principle is the same: option spreads are about shaping risk and reward. Some are designed to capture explosive moves, others to profit from calm markets, and many to capitalize on changes in volatility or time decay. The common thread is that each spread forces a conscious trade-off—accepting limits on potential reward in exchange for greater control over cost and risk.

Today, we’ll introduce some of the most common spreads, outline their key risk/reward profiles, and walk through hypothetical examples to help illustrate how each one works in practice.

Straddles and Strangles

Straddles and strangles are among the simplest spreads and often serve as a trader’s first step beyond single-leg options. A straddle involves buying or selling both a call and a put at the same strike and expiration, while a strangle uses out-of-the-money options instead of at-the-money. Both can be structured as long/long (buying both legs) or short/short (selling both legs).

The risk/reward profile changes depending on structure. A long straddle or strangle is a defined-risk trade with significant upside potential. It thrives when the underlying makes a large move in either direction. On the other hand, the maximum loss is the premium paid—making it costly if the underlying trades in muted fashion. A short straddle or strangle, on the other hand, collects premium upfront and profits if the underlying sits still, but carries growing losses if the stock breaks sharply higher or lower.

For example, suppose the hypothetical stock TSTY trades at $100. Selling the $100 call and the $100 put for $5 each yields $10 in total premium. The position profits anywhere between $90 and $110, with the maximum profit ($10) realized if TSTY closes at exactly $100. Losses can become significant the further the stock moves away from those breakeven levels. Conversely, buying both options costs $10 upfront. In this case, the breakevens are also $90 and $110, but the position only starts profiting once the stock moves beyond those levels—offering attractive upside if the move is large enough.

Straddles and strangles are versatile ways to trade volatility—whether the goal is to capture a sharp move in either direction, or to profit from quiet, rangebound trading. But that flexibility comes with trade-offs: long versions risk losing the entire premium if the market fails to move, while short versions expose the trader to potentially significant losses as the stock moves beyond the breakeven points.

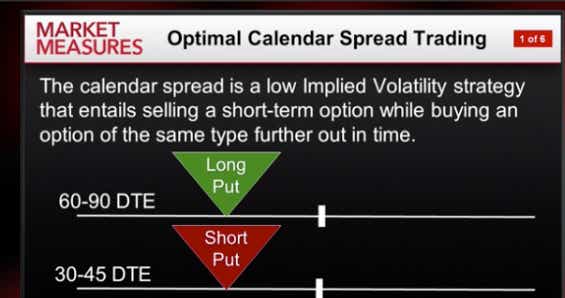

Calendar Spreads

Most traders gravitate toward long calendars. This structure is created by selling the near-term option and buying the longer-dated option. During the life of the short option, the spread performs best if the underlying price stays close to the strike, because the near-term option decays more quickly while the longer-dated option holds its value.

Once the front-month option expires, the trader is left with only the longer-dated option—essentially a long call or put. At that stage, a larger move in the underlying or an increase in implied volatility becomes more desirable. The opposite trade, the short calendar, leaves the trader with a naked short option once the near-term expires, which exposes them to unlimited risk and explains why this version isn’t utilized as often.

For example, suppose a trader buys a 60-day $50 call and sells a 30-day $50 call for a net debit of $1. The position does best if the stock hovers near $50 for the next month, allowing the near-term option to decay. After expiration, the remaining long option can gain value if the stock makes a bigger move or if implied volatility rises. In this example, the maximum risk is limited to the $1 debit paid.

Some traders are drawn to calendar spreads because they combine the benefits of front-month premium decay with the potential to profit if volatility picks up later. This structure, however, demands precise timing: too much movement early can negatively affect the short leg, while too little movement later can limit the long option’s payoff. For this reason, some traders choose to close the spread before the near-term option expires—locking in the time-decay advantage—rather than carrying the back-month contract forward on its own.

Vertical Spreads

Vertical spreads are among the most versatile two-leg option strategies. They involve one long option and one short option of the same type (both calls or both puts), with the same expiration but different strikes. The four basic versions—call debit, call credit, put debit, and put credit spreads—each reflect a different directional view.

The key feature of verticals is that they provide defined risk and defined reward. Because the long and short legs offset one another, the maximum possible loss and maximum possible gain are both known upfront. Debit verticals (long spreads) require an upfront cost and profit if the underlying moves in the expected direction, while credit verticals (short spreads) bring in premium upfront and profit if the underlying fails to move too far against the position. In both cases, risk and reward are defined, making them easier to size and manage than naked options.

For example, buying the $95 call for $7 and selling the $100 call for $5 creates a call debit spread with a $2 net cost. Here, the maximum loss is $200 (the debit paid), while the maximum gain is $300 (the difference between strikes minus the debit). On the flip side, a call credit spread—selling the $95 call and buying the $100 call—would collect premium upfront and profit if the stock stays at or below $95, but would be capped in losses if the stock moves higher.

Verticals are popular because they are relatively cost-efficient and straightforward to manage. They can also be tailored for both bullish and bearish outlooks. For a deeper dive into how verticals work, readers can check out this link.

Takeaways

Options spreads allow traders to express a wider range of market outlooks, while also providing structure and control. Straddles and strangles allow traders to position directly around volatility, whether by capturing large moves through long positions, or profiting from stability through short positions. Calendars introduce the element of time, rewarding traders who can anticipate shifts in volatility while keeping risk defined. Verticals, meanwhile, clearly define both maximum risk and maximum reward, making them capital-efficient and easy to manage.

For those considering more advanced positions, option spreads aren’t limited to just two legs. More complex structures—such as iron condors, butterflies, and ratio spreads—layer three or four positions together, allowing traders to fine-tune risk and reward with greater precision. These strategies can be powerful tools for targeting very specific market conditions, but they demand a deeper understanding of how multiple options interact and influence one another.

Whether the goal is to trade earnings, capitalize on volatility, or hedge against risk, spreads provide a flexible toolkit for aligning strategies with a trader’s market view and risk tolerance. To learn more about the option spreads, readers can explore the resources highlighted below:

Andrew Prochnow has traded the global financial markets for more than 15 years, including 10 years as a professional options trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices