Options Assignment | When Will I Be Assigned Stock?

Options Assignment | When Will I Be Assigned Stock?

By:Mike Butler

Don't let assignment cause you anxiety!

When we talk to our customers, one of their biggest fears when learning how to trade options is getting assigned stock (because remember, when you buy/sell an option, you control 100 shares of that option’s stock). Well, I’m hoping to help you put that anxiety to rest with this post.

Assignment of stock when trading options is just like being given a pop quiz in school - it’s generally unexpected, and usually not a good feeling!

Some people like to be assigned stock as a part of their strategy (i.e. one of the follow traders, Woody, likes to sell puts at a strike price that he is comfortable being assigned stock at, and will always take the assignment when his options are expiring in the money), but this post is more focused on those who do not want to be assigned stock.

The 3 most common questions we get asked related to trading options and being assigned stock are:

What situations would cause me to get assigned stock?

What can I do to prevent being assigned stock?

And…If I am assigned, what should I do?

WHEN WILL I GET ASSIGNED?

Let's tackle the first question that asks...when you invest in options, what scenario would cause you to be assigned shares of stock?

The most common way you will be assigned stock is if you short (sell) an option that expires in the money.

Assignment Risk: Buying An Option

When you buy an option (a call or a put), you cannot be assigned stock unless you choose to exercise your option. Plain and simple, the purchaser of an option contract will always have the choice to exercise the option, but not the obligation to do so.

Let’s say you bought an Apple (ticker symbol AAPL) option a few weeks ago that is set to expire today and the option is in the money (there is never risk of assignment if the option is not in the money), you may do one of two things:

you can let the option expire in the money, which will result in the option being exercised at your strike price and 100 open shares on Monday with a P/L equivalent to the distance between your strike price and the stock price, or...

you can exercise the option and collect 100 shares of the stock

Easy enough to understand, right?

Let’s now break that down even further, by looking at buying calls and buying puts separately to reinforce your understanding.

Assignment When Buying A Naked Call

Remember that if you buy a call, that gives you the right to buy 100 shares of stock at an agreed upon strike price. Let's take a look at an example scenario of getting assigned on a naked call.

As the call buyer, you have the choice whether or not you want to exercise the option. If you exercise your right to purchase shares of the stock (100 shares for each option contract), the seller of the call (let's call him Mike) will automatically have 100 shares called away from his account.

You

Bought a FB (Facebook) call option from Mike, at a strike price of $75

The option is expiring in the money and you decide to exercise the option

You collect 100 shares of Facebook stock from Mike for $75/share (the strike price)

Mike

Sold a FB (Facebook) call option to you at a strike price of $75

The option is expiring in the money and you chose to exercise it

Mike is forced to sell you 100 shares of Facebook stock (even if he doesn’t have the stock in his possession)

If Mike owns the stock already (like in a covered call position), his stock will be called away. If he does not own the stock, he will now be assigned -100 shares of stock per option contract. If Mike does not have enough buying power to short the stock, he will be forced to close the position immediately by his broker and will be charged an assignment fee (on top of regular commission rates).

The proper term for being assigned negative shares of stock is called being ’short stock’. Think about it like this. When you buy stock, you are taking a bullish position because the only way you profit from stock ownership, is if the stock goes up. But what if you wanted to take the opposite side of the bet by just investing in stock (a bearish position)? You would short the stock and own negative shares.

Assignment When Buying A Naked Put

If you purchase a put option, remember that that gives you the right (but not the obligation) to sell shares of stock at an agreed upon strike price. This means that if the put option expires in the money, the put seller has the obligation to purchase the stock at the same strike price if the option owner exercises their option. Let's again reference our example in which you are buying an option from Mike.

As the put buyer, if you exercise your right to sell stock, then Mike will automatically be sold 100 shares of stock per option contract. If the new stock is something Mike wants to keep, he certainly can if he has the available funds in his account. If he chooses to do so, he will now own 100 shares/contract at the strike price.

You

Bought a FB (Facebook) put option from Mike, at a strike price of $72

The option is expiring in the money and you decide to exercise the option

You sell 100 shares of Facebook stock to Mike for $72/share (the strike price)

Mike

Sold a FB (Facebook) put option to you at a strike price of $72

The option is expiring in the money and you chose to exercise it.

Mike must purchase 100 shares of Facebook stock from you (even if he doesn’t have enough money in his account)

If Mike does not have enough capital to buy the stock, he will still own the stock temporarily, but will be forced to close the position immediately (this is usually a margin call from your broker) and he will be charged an assignment fee (in addition to the regular commission fees).

ASSIGNMENT WHEN BUYING A CALL/PUT SPREAD

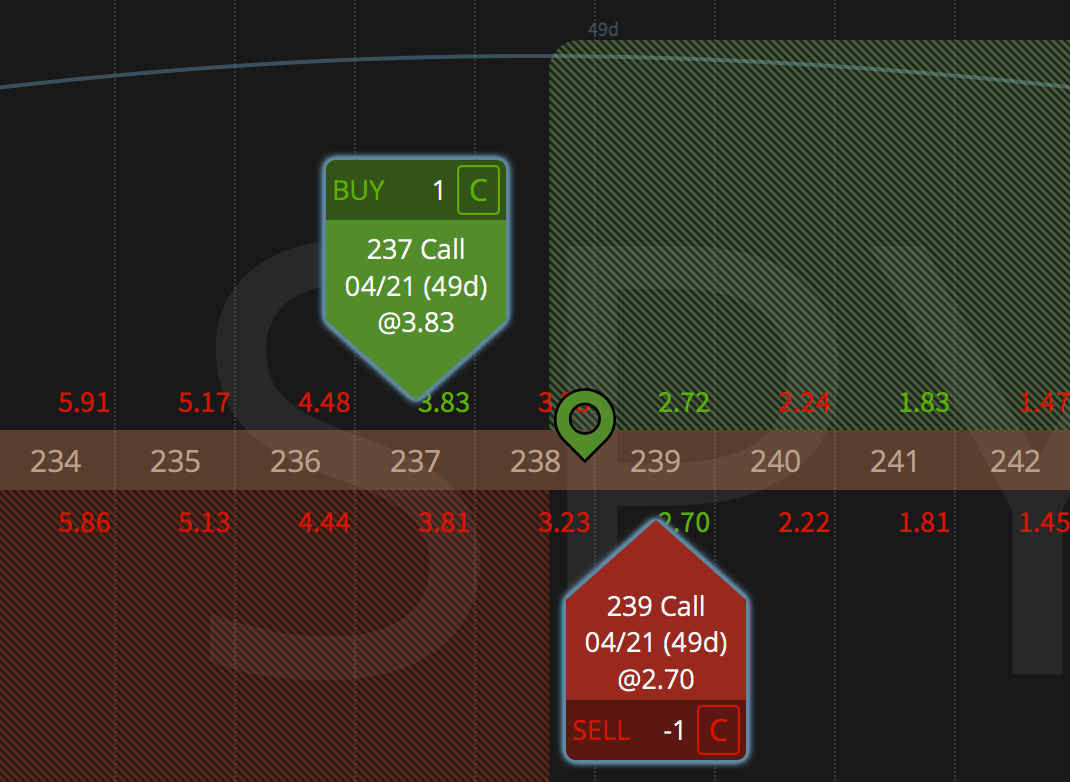

Example of a long call spread - notice the green long call is in the money.

Remember that a vertical spread is made up of buying one option and selling the same type of option (both options would be calls or puts).

Vertical spreads offer more protection than naked options when it comes to assignment. This isn’t to say there is less risk involved in actually getting assigned, but you have more tools to mitigate being long or short stock.

When buying a call spread or put spread, the risk of assignment is determined by how much of the spread is in the money. If both legs are in the money at expiration, you could still be assigned, but since your other leg is in the money, you can exercise that to collect max profit. If only one strike is in the money (the short strike - aka the option that you sold), that is where you run the risk of assignment.

When you’re the option buyer, you have the power over assignment. If you are the option seller, that is a different story...

Assignment Risk: Selling An Option

When you sell an option (a call or a put), you will be assigned stock if your option is in the money at expiration and the counterparty exercises the option. As the option seller, you have no control over assignment, and it is impossible to know exactly when this could happen. Generally, assignment risk becomes greater closer to expiration. With that said, assignment can still happen at any time.

Let’s say you sold a GOOG (ticker symbol for Google) option a couple weeks ago that is set to expire today and the option is in the money and exercised. In this scenario, you will automatically be assigned 100 shares of stock (if you sold a call then you would be assigned -100 shares of stock and if you sold a put, you would be assigned 100 shares of stock).

ASSIGNMENT WHEN Selling A NAKED CALL

Unlike when you are the buyer of a naked call, when you're the seller of a naked call option, you do not have control over assignment if your call expires in the money (it only has to be $.01 in the money). In this scenario, you will automatically be forced to sell 100 shares of stock to the purchaser of the option if the option is exercised.

Let's go back to the example with you and Mike. If you sell a GOOG call option to Mike at a strike price of $525 and Mike decides to exercise (because the option is in the money), you have to sell him 100 GOOG shares per option contract for $525/share. Even if you do not have GOOG stock you will still have to sell Mike the shares (in which case you will be short 100 shares of GOOG stock).

Mike

Bought a GOOG (Google) call option from you, at a strike price of $550

The option is expiring in the money and Mike decides to exercise the option

Mike collects 100 shares of Google stock from you for $550/share (the strike price)

You

Sold a GOOG (Google) call option to Mike at a strike price of $550

The option is expiring in the money and Mike chooses to exercise it

You must sell Mike 100 shares of Google stock (even if you don’t have the stock in your possession)

Don't forget, if you do not close the trade or roll it before expiration and do have to sell the shares, you will also be charged an assignment fee and regular commission fees.

*One Important Note: there is additional assignment risk when a company has upcoming dividends (dividends are when a company distributes cash to shareholders). Essentially, if the extrinsic value on an ITM short call is LESS than the dividend amount, the ITM call owner will have good reason to exercise their option so that they can realize the dividend associated with owning the stock.

ASSIGNMENT WHEN SELLING A NAKED PUT

Similar to selling a naked call, when you sell a naked put, you again do not have control over assignment if your option expires in the money at expiration. If your short put expires in the money at expiration and exercised, you will be assigned 100 shares of stock at the option's strike price and charged an assignment fee plus commissions.

Last time with the example, I swear (from my experience, repetition is key to understanding options): if you sell Mike a naked put that is expiring in the money and Mike chooses to exercise those shares, you will have to buy 100 shares of GOOG stock per option contract, at $525/share. And again, you will be charged an assignment fee and commission fees.

Mike

Bought a GOOG (Google) Put Option from you at a strike price of $525

The option is expiring in the money and you Mike chooses to exercise it. You must buy 100 shares of GOOG stock from Mike (even if you don't have enough money in your account)

You

Sold a GOOG (Google) put option to Mike at a strike price of $525

The option is expiring in the money and Mike chooses to exercise it

You must purchase 100 shares of Google stock from Mike (even if you don’t have enough money in your account)

ASSIGNMENT WHEN SELLING A Call/Put Spread

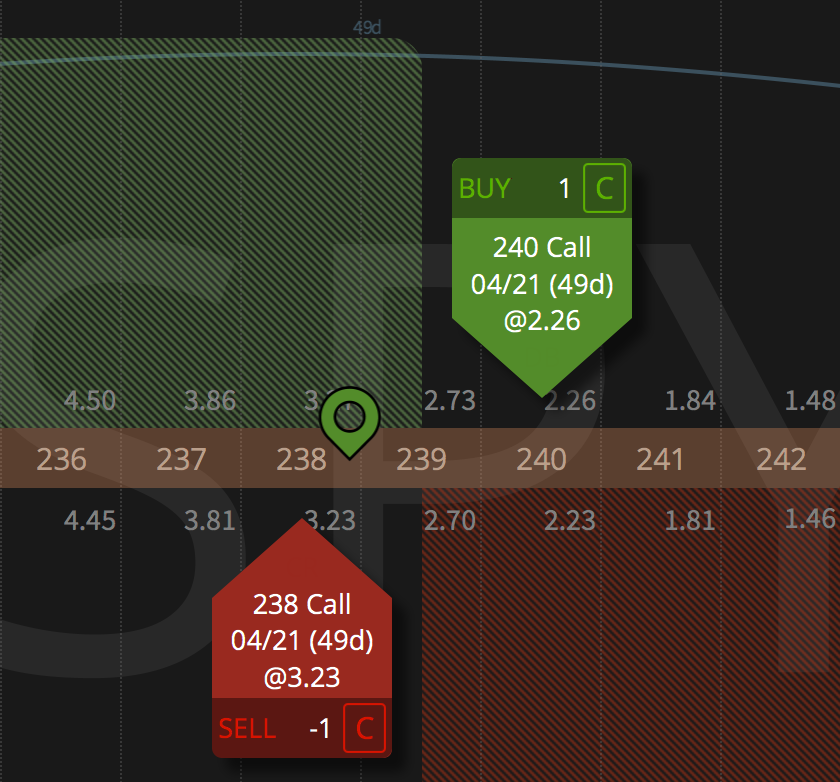

Example of a short call spread - notice the red short call in the money.

When you sell a put spread or call spread, the assignment risk comes from your short strike expiring in the money (just like when you buy a call/put spread). If both strikes expire in the money, they will essentially cancel each other out and you will not be assigned (you will be assigned on the short strike, and then you can excercise your long strike).

If you sell a call spread and the short strike is in the money at expiration, you will be forced to sell 100 shares per option contract to the buyer. If you sell a put spread and just the short strike is in the money at expiration, you will be assigned 100 shares of stock per contract.

Preventing Assignment

How can you avoid being assigned before it happens? There are two ways:

You can close the trade before it expires and take any profit or loss on the trade

You can roll the trade to extend the days to expiration, giving you more time to be right

When it comes to assignment, we totally understand the fear investors have. That's why the tastytrade trading platform was designed with a feature that can help prevent you from being assigned with a quick glance. Whenever you sell an option that is in the money, or has moved in the money, there is an 'ITM' symbol that will show up on your portfolio page.

Despite our best efforts to avoid unwanted assignment, it can still happen from time to time. This leaves new investors wondering what to do if this scenario occurs...

What Happens If I am assigned?

I imagine I looked a little like this when I realized I had been assigned.

Assignment can happen pretty easily if you are not monitoring you positions on a regular basis (and can happen even if you are).

Just last week, I had an ITM option expire on a day where I was wrapped up in meetings and projects, and ended up being assigned stock. If you get busy during the day or if you are trading an illiquid underlying (in which case there may not be any buyers/sellers available so you cannot close the position), this can happen to you.

We mentioned the following scenarios before, but wanted to hammer the points home in the event that you are assigned. There are two things that can happen if you sold an option that has expired in the money...

If you were assigned stock and had the money to cover the shares in your account, then you can choose to hold the long (or short) stock, or buy/sell the shares back for a profit or loss.

If you were assigned shares and don't have the money to cover the shares you were assigned (the term for this is a margin call), you will need to buy/sell back the shares ASAP. If you do not, the broker will do it for you before the end of the trading day.

Recap

There's a lot of information in this post, so let's recap the most important takeaways:

Assignment can happen at any time - it is contolled by the option buyer.

If you do not have enough funds in your account to cover long or short stock, you should close the position immediately (or your broker will do it for you).

Spreads give more protection against being assigned, but they do not protect you unless BOTH legs are in the money.

If you have a short call position, there is additional assignment risk if that call is in the money at the time of the dividend.

If you ever have any questions about assignment, don't hesitate to reach out to our support team at support@tastylive.com!

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices