Peabody Energy $BTU Leans Into U.S. Coal as AI Power Demand Surges

Peabody Energy $BTU Leans Into U.S. Coal as AI Power Demand Surges

Peabody’s rally hints that coal might be staging an AI-fueled comeback

Peabody is doubling down on its U.S. thermal coal business just as power demand from data centers is hitting record highs, making its Powder River Basin assets newly strategic.

Second-quarter results showed lower earnings year-over-year but stronger PRB volumes, lower costs, and positive operating cash flow despite weaker seaborne pricing.

Shares trade at just 0.9x book and 0.8x sales—below sector medians—offering potential upside if demand remains strong and new investments drive increased profitability in 2026.

Peabody Energy (BTU) isn’t trying to reinvent the grid—it’s supplying the baseload power that keeps it running. While next-generation providers like Oklo (OKLO), with its micro-reactors, and Bloom Energy (BE), with its fuel cells, have captured headlines as solutions for AI’s rising electricity needs, the reality is that much of this new demand will ultimately be met by traditional power sources. Even coal—long seen as a declining industry—has a critical role to play in keeping the lights on as the world consumes more energy than ever before.

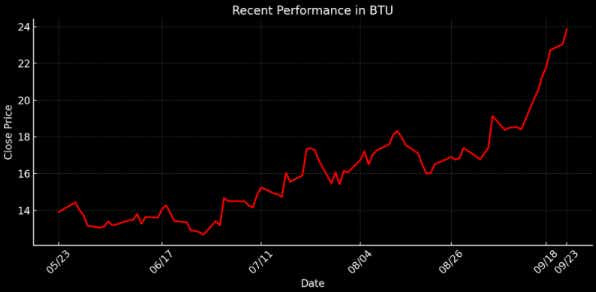

Investors seem to be catching on. BTU shares have rallied more than 150% off their 52-week lows, helped by strong volumes, lower costs, and management’s renewed focus on shareholder returns. Today, we dig into Peabody’s resurgence, and explore whether Peabody’s comeback marks the start of a longer-term re-rating.

Momentum, Cash Flow, and a 2026 Catalyst Ahead

Peabody Energy is one of the world’s largest private-sector coal producers, operating 17 mines across the United States and Australia. The company supplies both thermal coal—used to generate electricity—and metallurgical coal—used to make steel. For years, Peabody sought to pivot away from its domestic thermal coal portfolio in favor of international metallurgical assets to appeal to ESG-conscious investors. But in 2025, that narrative has flipped. Peabody has embraced its low-cost U.S. thermal assets, particularly its dominant position in the Powder River Basin (PRB), at a time when domestic electricity demand is rising at the fastest pace in decades.

That demand growth is being driven by a generational shift in the U.S. power landscape. Data centers—especially those supporting AI and cloud computing—are consuming electricity at unprecedented rates. For context, a single hyperscale data center can consume as much electricity as a mid-sized city, and much of that power must be available 24/7. While renewables and natural gas remain critical to the grid, coal still accounts for roughly 16% of U.S. electricity generation, making it a key pillar of baseload capacity. In this new world order, Peabody’s coal assets have arguably gone from “sunset” to “strategic.”

Peabody’s decision to terminate its $3.8 billion acquisition of Anglo American’s Australian coal mines highlights this renewed focus on its U.S. portfolio. Rather than take on heavy debt for offshore expansion, management has pledged to return 65–100% of free cash flow to shareholders, primarily through buybacks, while driving more value from its core domestic assets. Investors have responded, sending BTU shares more than 150% above their 2025 lows, as the market starts to price in the potential for increased demand, more durable cash flows, and management’s sharpened capital discipline.

Beyond thermal coal, Peabody holds valuable optionality in its portfolio. The Centurion metallurgical coal project in Queensland is on track to begin production in 2026, adding high-margin exposure just as global steel demand is projected to strengthen. Meanwhile, early studies at its PRB mines have confirmed the presence of rare earth elements—materials that could become strategically important as the U.S. ramps up domestic production of critical minerals. Together, these assets position Peabody not merely as a coal miner, but as a diversified energy and materials supplier.

Solid Execution in a Tough Pricing Environment

At the end of July, Peabody reported its second-quarter 2025 earnings results, offering investors an updated look at how the company is navigating softer coal markets. The July 31 release reflected a quarter of lower profitability but solid operational execution, with robust Powder River Basin (PRB) shipments and disciplined cost management helping to offset weaker pricing in seaborne markets.

Adjusted EBITDA came in at $93 million, down sharply from $310 million in the prior-year quarter, reflecting a steep decline in seaborne benchmark prices and the absence of last year’s $80 million Shoal Creek insurance recovery. GAAP net income swung to a loss of $27.6 million (-$0.23 per share), but Peabody continued to generate positive operating cash flow—a sign that the company’s diversified asset base and cost structure remain resilient even as pricing pressures weigh on margins.

The Powder River Basin segment provided the clearest bright spot. Shipments of 20 million tons exceeded expectations, and per-ton costs came in well below company targets, driving a more than $1-per-ton improvement in margins compared to last year. Encouraged by these results, management raised full-year PRB volume guidance by 5 million tons, and lowered cost targets by $0.63 per ton—reinforcing confidence that PRB demand remains robust as utilities work to keep pace with surging electricity consumption.

Peabody ended the quarter with $586 million of cash and nearly $1 billion in liquidity, maintaining one of the strongest balance sheets in the sector. Management declared a $0.075 per share dividend and reiterated its plan to return 65–100% of free cash flow to shareholders, primarily through buybacks. The company also confirmed that development of the Centurion metallurgical coal project remains ahead of schedule, with longwall production now expected to begin in February 2026—a promising catalyst that could expand production and free cash flow as soon as next year.

Peabody’s Strategic Pivot Could be a Valuation Catalyst

Unlike many stocks riding the AI and energy infrastructure wave, Peabody trades at valuation levels that still look grounded in reality. Its trailing GAAP P/E ratio of about 22 is above the coal sector median near 14, but below most broader-market AI infrastructure and utility peers. On a price-to-sales basis, BTU trades at just 0.8x—roughly half the sector median of 1.3—while its price-to-book multiple of 0.9x signals that the market still prices the company at a discount to the replacement value of its assets. Taken together, these metrics suggest that investors have not yet fully repriced Peabody for its improving fundamentals or the potential for a multiyear resurgence in coal-fired baseload demand.

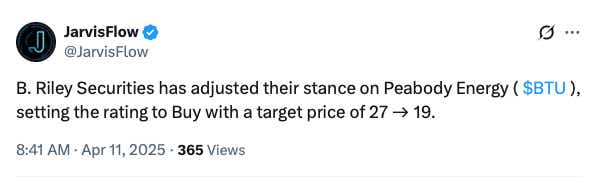

Wall Street sentiment tilts constructive but not euphoric. Of the six analysts covering BTU, four rate the stock a “buy” or “overweight,” while the other two recommend “hold.” The average price target of $20/share sits slightly below the current ~$25 share price, indicating that the stock has already rallied ahead of near-term consensus expectations. Yet with power-related equities and fuel suppliers rallying hard as investors position for rising U.S. electricity demand, Peabody could continue to attract capital flows as a levered play on grid reliability and AI-driven load growth.

Peabody’s story is no longer just about coal—it’s about whether its strategic shift back to U.S. thermal assets and shareholder-first playbook can power a sustained earnings re-rate. Its Powder River Basin operations alone could generate over $200 million in annual EBITDA at today’s prices, even before factoring in the incremental lift from Centurion in 2026. Layer on a net cash balance sheet, an aggressive buyback program, and federal royalty cuts that permanently reduce costs, and the argument builds that BTU should trade nearer—or even above—sector medians on both P/E and P/B multiples.

Peabody Energy Takeaways

Peabody enters the back half of 2025 with tailwinds at its back and a sharper story to tell. Powder River Basin volumes are rising, cost pressures are easing, and management is putting its net cash position to work through aggressive shareholder returns. Meanwhile, the Centurion mine is running ahead of schedule and could deliver a fresh earnings spark in early 2026—right as global steel demand and U.S. power consumption continue to trend higher.

BTU’s valuation remains appealing by most metrics. Sustained PRB strength and an on-schedule Centurion ramp could give Peabody room to grow into a richer multiple—and even re-rate toward peers benefiting from the AI-driven power demand story. Still, the path isn’t without risk: a dip in coal prices or a slowdown in coal-fired generation could quickly shift the narrative, leaving today’s pricing looking more “fair” than “cheap.”

For investors, BTU stands out as a rare combination of cash flow visibility, steady capital returns, and leveraged exposure to two major macro trends: rising U.S. baseload power demand and the metallurgical coal cycle. For active traders, the stock’s volatility—paired with an aggressive buyback—offers compelling opportunities to buy dips, especially if shares revisit the $20 zone where many analysts peg fair value.

To learn more about options-focused trading strategies, readers can follow this link.

Andrew Prochnow has traded the global financial markets for more than 15 years, including 10 years as a professional options trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices