The Best Performing Tech & Communication Stocks in 2023

The Best Performing Tech & Communication Stocks in 2023

After nearly two months of trading, several key market narratives have emerged in 2023, and one of them is undoubtedly the rebound in the tech sector.

As most investors and traders are well aware, 2022 was a tough year for tech stocks, with the Nasdaq Composite correcting by over 30% last year.

But bullish sentiment has swept the markets in 2023, and of the major market indices, the Nasdaq Composite has been the clear leader. So far this year, the Nasdaq Composite is up roughly 14%, which is significantly more than the 7% gain in the S&P 500, and the 2% gain in the Dow Jones Industrial Average.

In addition to the technology sector, the communications services and consumer discretionary sectors have also set a furious pace to start the year, as highlighted below.

2023 Sector Performance (year-to-date)

- Consumer Discretionary (XLY), +16.4%

- Communications Services (XLC), +15.3%

- Technology (XLK), +12.4%

- Financials (XLF), +6.4%

- Industrials (XLI), +4.9%

- Materials (XLB), +4.7%

- Consumer Staples (XLP), -1.2%

- Healthcare (XLV), -2.8%

- Utilities (XLU), -2.9%

- Energy (XLE), -3.4%

Interestingly, the three top-performing sectors listed above also happened to be the worst performing sectors in 2022, with communications services down roughly 37% last year, and the consumer discretionary and technology sectors down 36% and 27%, respectively.

Optimism in the 2023 stock market appears to stem from two primary themes—a resilient underlying U.S. economy, and aggressive cost-cutting measures embraced by the corporate sector.

Last year, concerns over the health of the U.S. economy weighed significantly on the stock market. However, actual performance in the U.S. economy in 2023 has been far better than expected.

For example, the January jobs report—which was released in early February—revealed that the U.S. economy added more than 500,000 during the first month of 2023. That was a huge upside surprise, and has undoubtedly eased anxieties over a potential economic recession.

The jobs report also eased concerns that corporate earnings are about to fall off a cliff. And as most are well aware, underlying stock valuations are closely linked to corporate earnings—a key development that may help explain why stocks have rebounded during the first eight weeks of 2023.

Moreover, some companies have also embraced aggressive cost-cutting measures to help reign-in expenses, especially in the technology sector. Leaner operations typically translate to improved earnings, which means the cost-cutting measures adopted by the corporate sector have been another incremental positive when it comes to stock valuations.

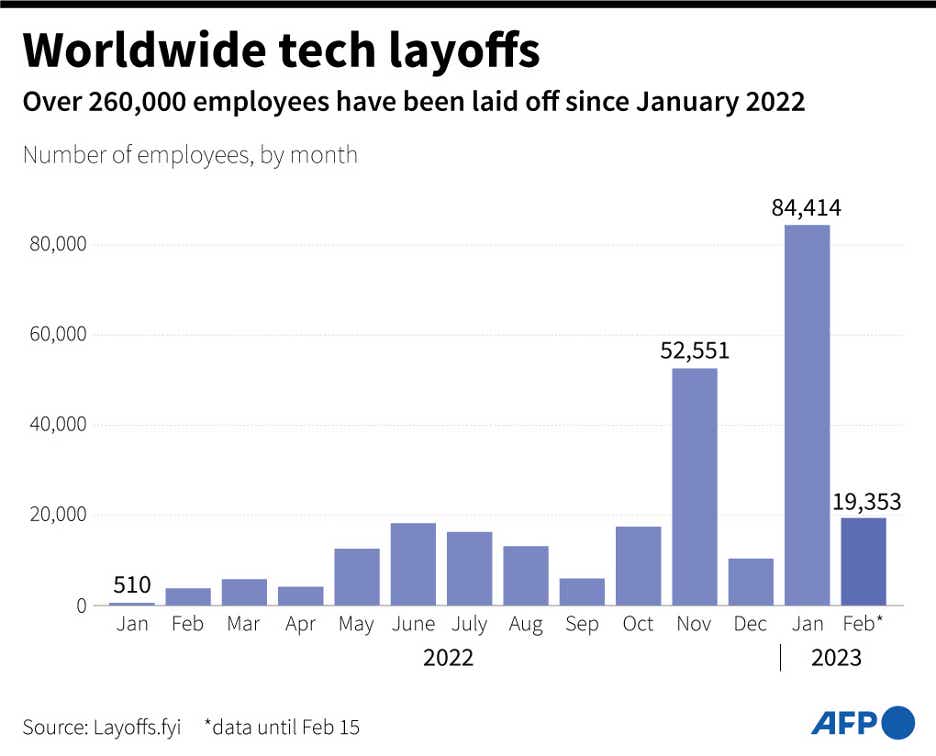

Unfortunately, those cost-cutting measures often involve layoffs. But so far, the bulk of the layoffs have been observed in the tech sector, as shown in the graphic below.

If the layoffs spread to other sectors of the economy, that would be an incremental negative, and potentially trigger a reversal in the stock market. Because a flood of new layoffs could trigger a sharp contraction in consumer spending.

The big question, therefore, is how long the current paradigm will hold.

Can the economy continue to grow in the face of higher interest rates? Or will higher rates ultimately force the corporate sector to embrace further cost-cutting (i.e. layoffs)?

Nobody knows for certain the answers to these questions. But investors and traders can closely monitor key reports on the economy—such as the upcoming jobs report on March 10, 2023—for potential red flags.

Top Stocks to Watch in the Tech Sector

Considering the impressive gains made in the technology and communications services sectors to start the year, there have been a large number of single stocks that have outperformed during the first two months of 2023.

Listed below are 15 of the best-performing stocks from the technology and communications services sectors. The list is limited to companies that produce at least $2 billion in annual revenues, and associated year-to-date stock performance.

Top Performing Stocks in the Technology Sector during 2023

- Diebold (DBD), +100%

- Opendoor Technologies (OPEN), +70%

- Offerpad Solutions (OPAD), +66%

- Compass (Comp), +65%

- Spotify (SPOT), +53%

- Kyndryl Holdings, +46%

- Nvidia (NVDA), +44%

- Roblox Corp (RBLX), +41%

- Twilio (TWLO), +41%

- Meta Platforms (META), +40%

- Applovin Corp (APP), +39%

- Seagate Tech (STX), +33%

- Vizio (VZIO), +32%

- Western Digital (WDC), +30%

- On Semiconductor (ON), +28%

Top Performing Stocks in the Communications Services Sector during 2023

- Clear Channel (CCO), +76%

- Millicom (TIGO), +51%

- Cimpress (CMPR), +34%

- Trinet (TNET), +32%

- Criteo (CRTO), +32%

- Telephone and Data (TDS), +29%

- The Andersons (ANDE), +28%

- United States Cellular (USM), +24%

- Franchise Group (FRG), +24%

- Bright Horizons (BFAM), +24%

- Liberty Latin (LILA), +21%

- Advantage Solutions (ADV), +21%

- Transunion (TRU), +20%

- Constellium (CSTM), +19%

- Wex (WEX), +16%

To learn more about trading the sector ETFs, check out this installment of Options Jive on the tastylive financial network.

For daily updates on everything moving the markets—including key developments in the tech sector—readers can also monitor tastylive, weekdays from 7 a.m. to 4 p.m. CDT.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices