Crude Oil Prices Fall on Inventory Build as Traders Weigh Fed and Industry Reports

Crude Oil Prices Fall on Inventory Build as Traders Weigh Fed and Industry Reports

Crude Oil Prices Unchanged as Traders Weigh Fed Action and Inventory Levels

Crude oil (/CL) traded lower on Thursday to about 78.05 a barrel. Energy traders are conflicted on the commodity’s direction amid an uncertain Fed rate hike path that has been complicated by strong U.S. labor market, robust retail sales and stubborn inflation. That uncertainty rose on Thursday when U.S. factory gate prices increased more than expected, rising 6% in January from a year ago.

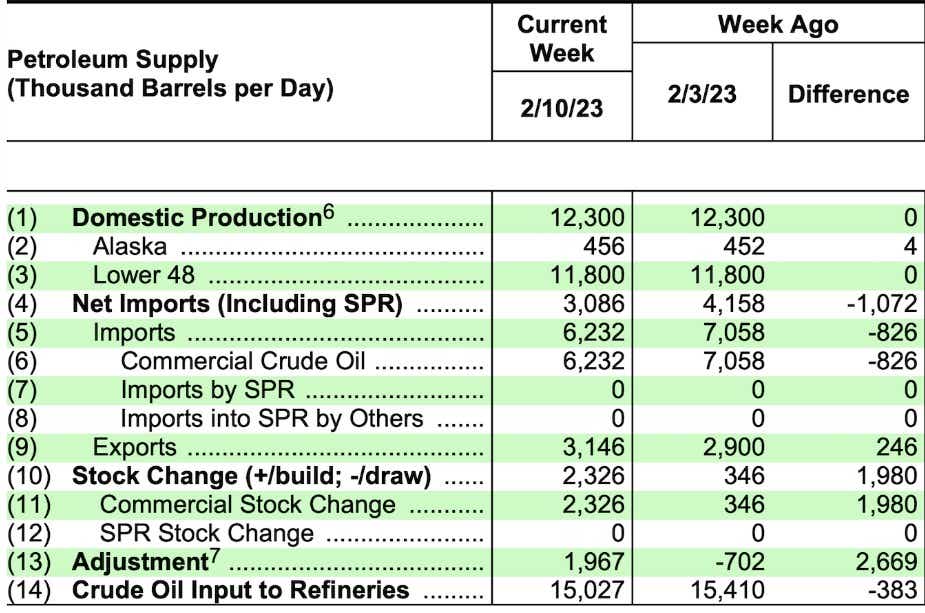

Meanwhile, U.S. oil inventory levels quickly rising. The U.S. Energy Information Administration (EIA) reported a 16.28-million-barrel build to crude oil stocks for the week ending February 10, smashing the consensus forecast by more than 15 million barrels. The prior week saw a 2.4-million-barrel increase. U.S. commercial crude inventories rose to about 8% higher than the five-year average for the February 10 period, according to the EIA.

While motor gasoline stocks rose by 2.3 million barrels, distillate fuel inventory fell and is about 15% below its five-year average. There is also evidence that demand for both fuel product types is falling. The total products supplied, a measure of implied demand, for gasoline and distillate fuel over the last four weeks fell by 3.2% and 15.6% compared to the same period a year ago. Overall domestic production remained constant at 12.3 million barrels per day (mb/d).

A large deviation from expectations would normally elicit a price reaction but an adjustment of 1.97 mb/d skewed the report’s insight. The EIA’s adjustment is shown on table 1. line 13 and represents a balancing item. Without getting into the agency’s methodology, a large positive adjustment typically means that the amount of oil being removed from the market—mostly made up of exports and refinery consumption—was previously overcounted. For example, a cargo ship exporting distillate products is mistakenly classified as crude oil, causing an undersupply imbalance.

Industry Reports Point to Bullish Market Dynamics

A report from the Organization of the Petroleum Exporting Countries (OPEC), released on Tuesday, pointed to bullish factors for oil prices, particularly in the second half of 2023. OPEC increased its global oil demand growth outlook for 2023 by 100k barrels per day (bpd) to 2.3 (mb/d), marking the first positive revision in three months. OPEC estimates 29.4 mb/d to balance demand, up 200k barrels from the prior report and about 500k more than January’s production.

A rebound in China’s economy following the removal of most Covid restrictions appeared to influence the assessment. Much of that demand growth is expected in the second half of this year, forecasting third and fourth-quarter annual growth at 1.1 mb/d and 1.5 mb/d, respectively.

On the supply side, the cartel’s report sees non-OPEC production growth slowing by 1.4 mb/d to 67 mb/d, citing a 900k bpd reduction in Russian output to 10.13 mb/d, a drop of 50k bpd from the last report. Moscow announced an oil production cut last week that sent crude prices to the highest since January. Alexander Novak, Russia’s Deputy Prime Minister, said a 500k bpd production cut is planned for March.

A report from the International Energy Agency (IEA) raised its 2023 demand outlook to 101.9 mb/d, while it expects Russian production to fall by about 1 mb/d by March. The Paris-based group sees China driving a large portion of demand growth.

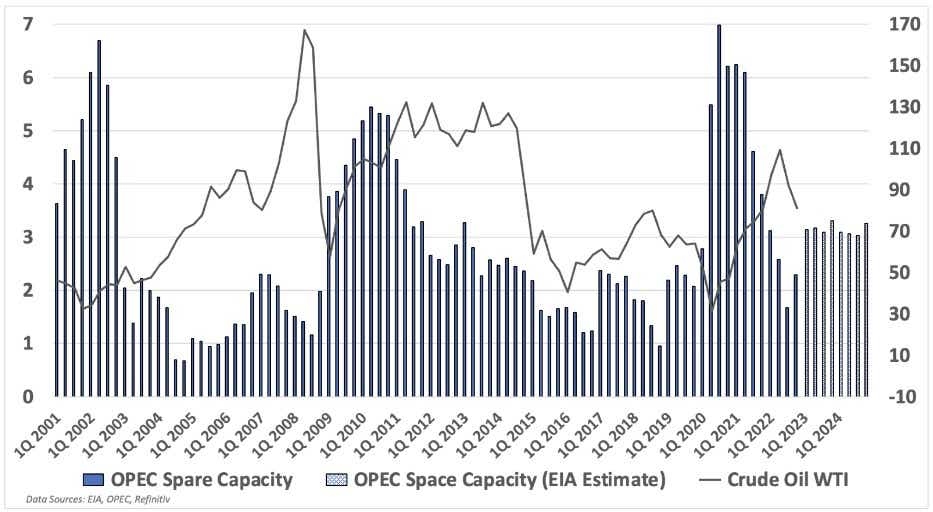

That said, OPEC may reverse its production cuts that were announced in November to help balance markets. But OPEC’s spare capacity is currently limited to about 3.5 mb/d of surplus capacity, leaving prices susceptible to shocks that could push prices above $100 per barrel or higher should markets swing into deficit later this year. The chart below illustrates the correlation between prices and spare capacity. The United States will likely have to increase the number of barrels it pumps to record levels.

Crude Oil Volatility Compresses as Price Searches for a Direction

Oil market volatility is trading near the lowest levels in over a year as measured by the IV rank (IVR) in crude oil futures (/CL). That may reflect the conflicting fundamental nature between an oversupply in the market and Chinese demand hopes.

The low volatility is attractive for long strategies that would benefit from increases in IV, such as long calls and long puts. For those without a directional bias but expecting an IV expansion, a long strangle could benefit from a sharp price swing. However, those strategies are sensitive to theta decay.

Several high-impact events next week may lead to a recalibration in Fed rate hike bets. The FOMC Minutes will cross the wires on Wednesday, and the Fed’s preferred inflation gauge, the PCE Price Index, is due on Friday. Weekly inventory data is also in focus.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices