Will Stocks Roll Over as Soggy US Retail Sales Threaten Growth?

Will Stocks Roll Over as Soggy US Retail Sales Threaten Growth?

By:Ilya Spivak

Stocks may swoon if retail sales data shows tariffs are already hurting US economic growth

- Markets convulse amid rumors Trump might fire Fed Chair Powell

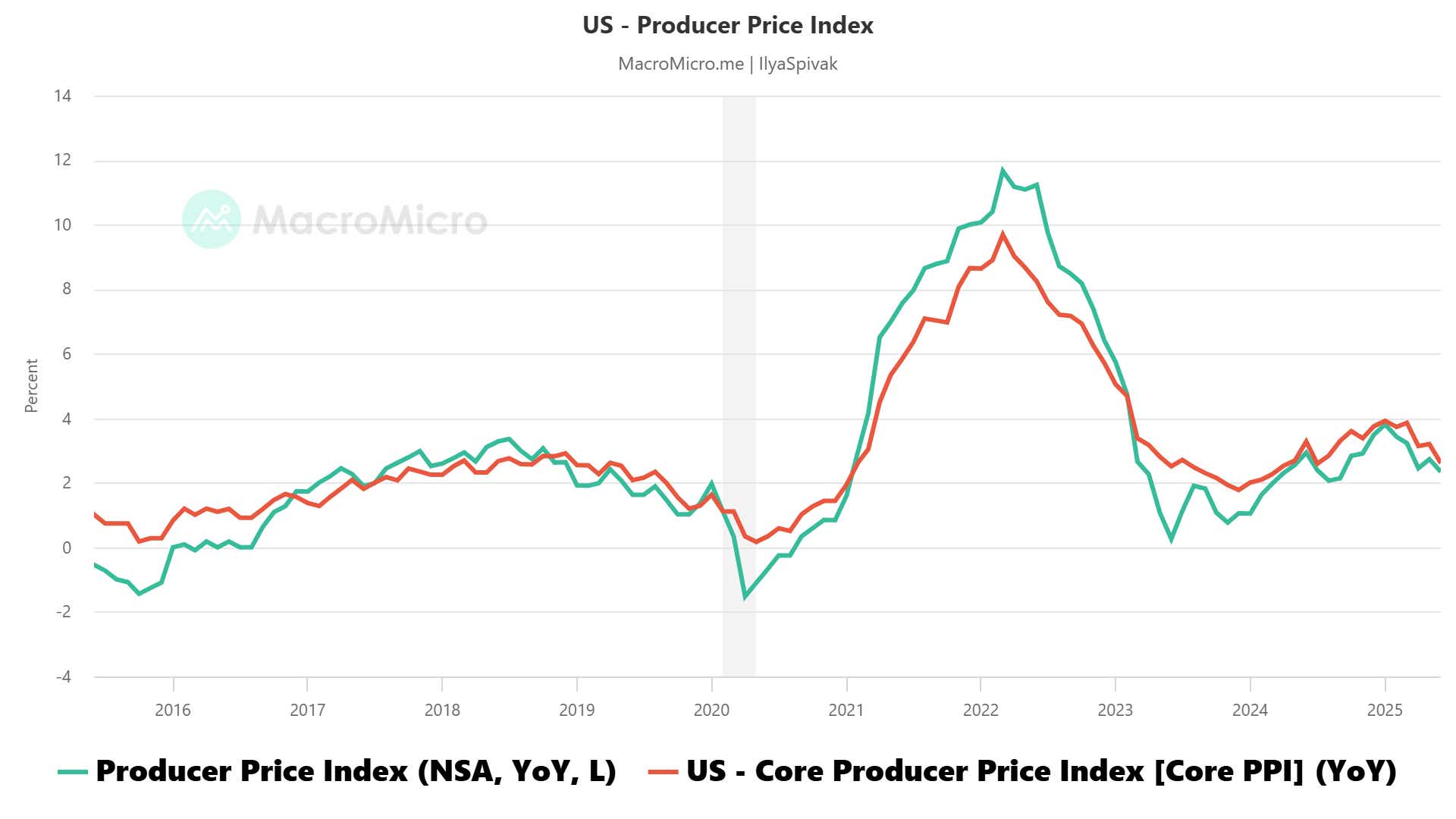

- US PPI data echoes growing concerns about emerging tariff impact

- All eyes now on US retail sales figures for a check on recession risk

Financial markets seesawed as news outlets lit up with rumors warning that US President Donald Trump is getting ready to fire Federal Reserve Chair Jerome Powell, only to be quickly quashed by the chief executive himself. A letter was reportedly drafted to sack the central bank chief, and the idea floated to members of Congress.

The US dollar plunged alongside stocks and Treasury bonds, echoing the “sell America” price action on display in early April when the White House unveiled its so-called “reciprocal” tariffs scheme. As with that episode however, signs of acute market panic spurred the President into a prompt reversal. Stocks, bonds and the greenback bounced on cue.

Speaking with reporters a mere hour after the rumors began to swirl, Trump said in response to a direct question about whether Powell will be fired that he is “not planning on doing anything,” adding that “we get to make a change in 8 months.” He would not commit to ruling anything out but said that dismissing the Fed Chair is “highly unlikely”.

US PPI data echoes market concerns about emerging tariff impact

Earlier in the day, producer price index (PPI) data showed that wholesale inflation slowed slightly more than expected in June. The headline measure rose 2.3% year-on-year, undershooting forecasts calling for 2.5%. The core gauge excluding volatile food and energy prices ticked down to 2.6% versus 2.7% expected.

While these readings marked nine- and eleven-month lows respectively, the reports internals echoed signs of emerging tariff-linked inflation appearing in consumer price index (CPI) figures earlier this week. Wholesale goods prices rose 0.3% from the prior month, the most since February.

Costs fell 0.1% on the services side, reflecting a steep 4.1% month-on-month drop in traveler accommodation and a 2.7% decline in airline passenger costs. Wholesalers’ margins idled overall, but the squeeze for intermediate demand continued for a third consecutive month after an eye-watering 2% monthly drop in April, the biggest in 12 years.

Taken together, this seems to reflect belt-tightening among service providers alongside ongoing efforts by firms at the early stages of the US supply chain to shield consumers and final distributors from tariff-related input costs. Their appetite to bite the bullet may be waning however, rising goods prices in PPI and CPI appear to show.

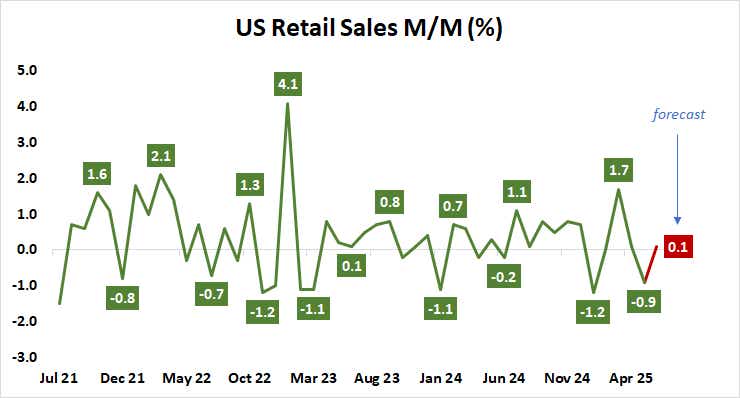

All eyes on US retail sales data for a check on recession risk

The spotlight now turns to US retail sales data. A modest rise of 0.1% in June is expected. While that would amount to a modest improvement from the 0.9% decline in May, the absence of a spirited push to front-run incoming tariff hikes slated for August would be glaring, especially as goods inflation linked to the new levies starts to surface.

Consumption is the overwhelmingly dominant driver of US economic growth, accounting for close to 68% of gross domestic product (GDP). Tariff-induced anomalies in imports and inventories aside, first-quarter growth data showed a worryingly small contribution on this front, coming in at the weakest in almost two years.

Price action across major markets in the first half of the year hints that the markets are worried about an economic downturn and want the Fed to cut interest rates accordingly, but this week’s inflation data suggests this is a distant prospect. Soft retail sales data may amplify concerns, hurting stocks and lifting the dollar on haven demand.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts #Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit #tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices