Opportunity in Healthcare?

Opportunity in Healthcare?

Relatively modest movement in the sector’s historical volatility indicates investment possibilities

Forward-looking volatility serves as a gauge of future uncertainty. The higher it climbs, the more uncertain the outlook. Yet when we analyze actual historical volatility in healthcare, the realized movement has been relatively modest.

This disconnect presents a potential opportunity in healthcare stocks.

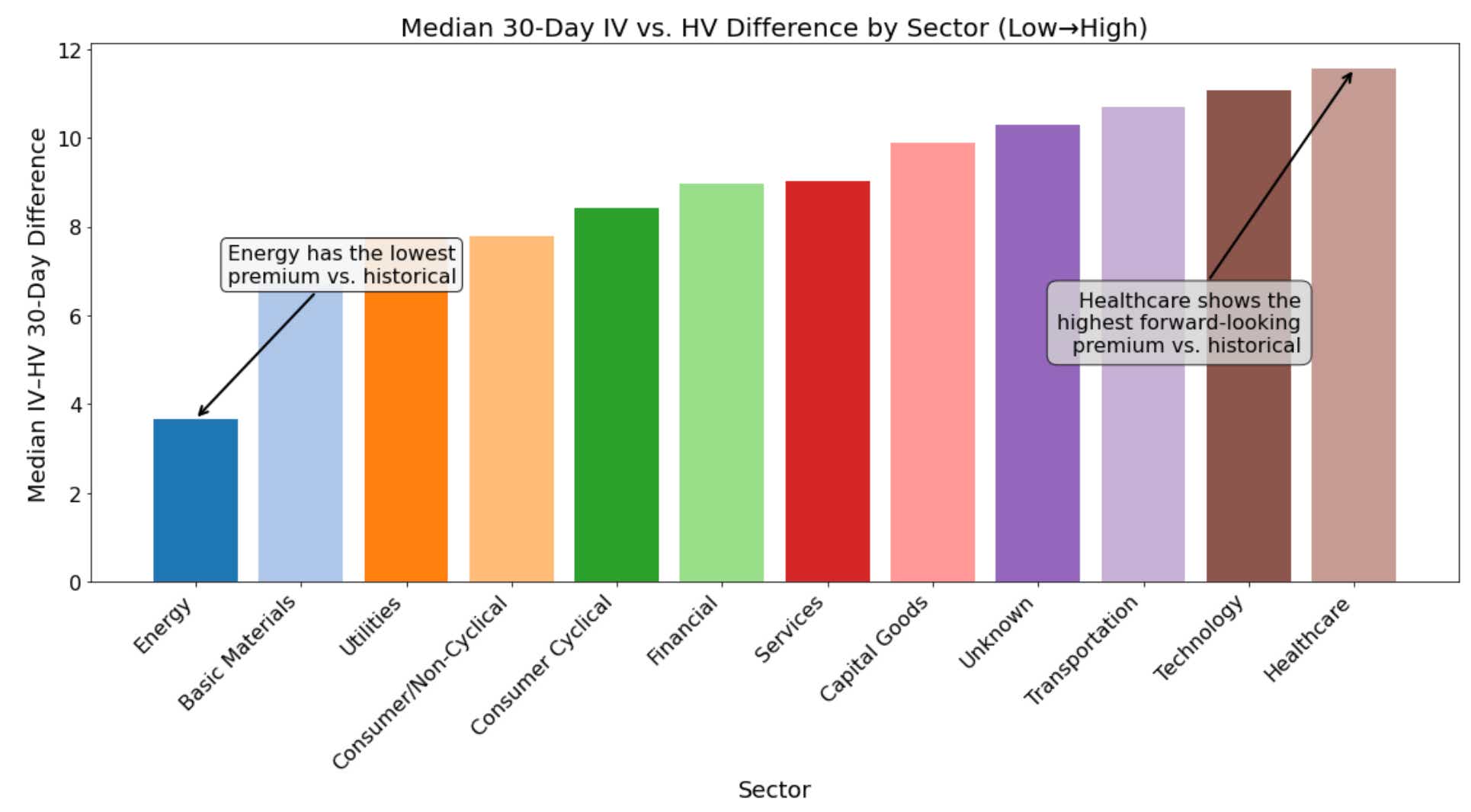

Our analysis reveals that Energy currently offers minimal "edge" with forward-looking volatility nearly matching historical movement. In contrast, technology and healthcare display the widest spreads. Their options premiums are significantly elevated relative to actual historical volatility.

For Healthcare specifically, this means traders are paying substantial premiums for protection against moves that haven't materialized in recent history.

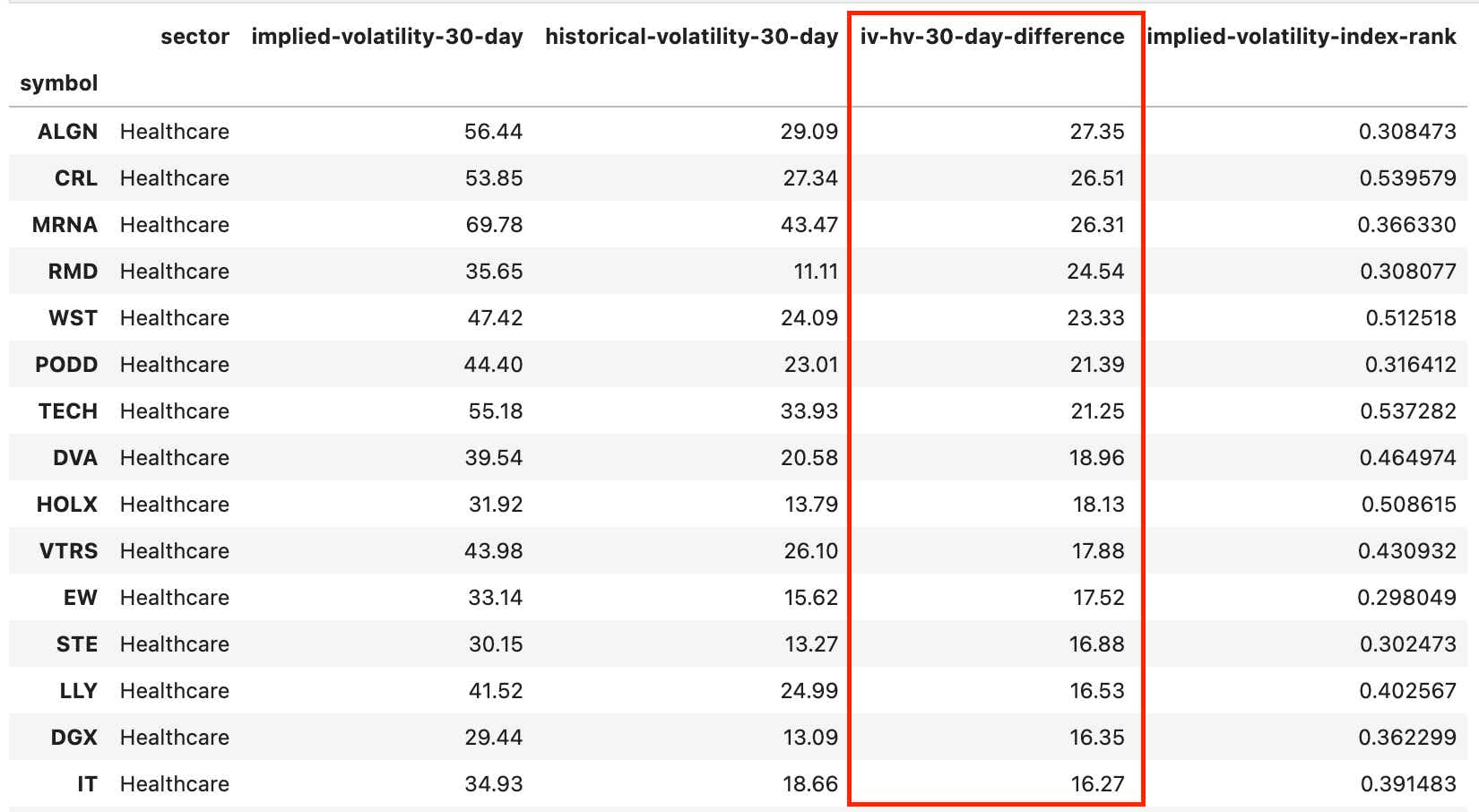

Digging into healthcare, the list below shows some interesting candidates for selling premium.

Crypto SOL/USD has room to run?

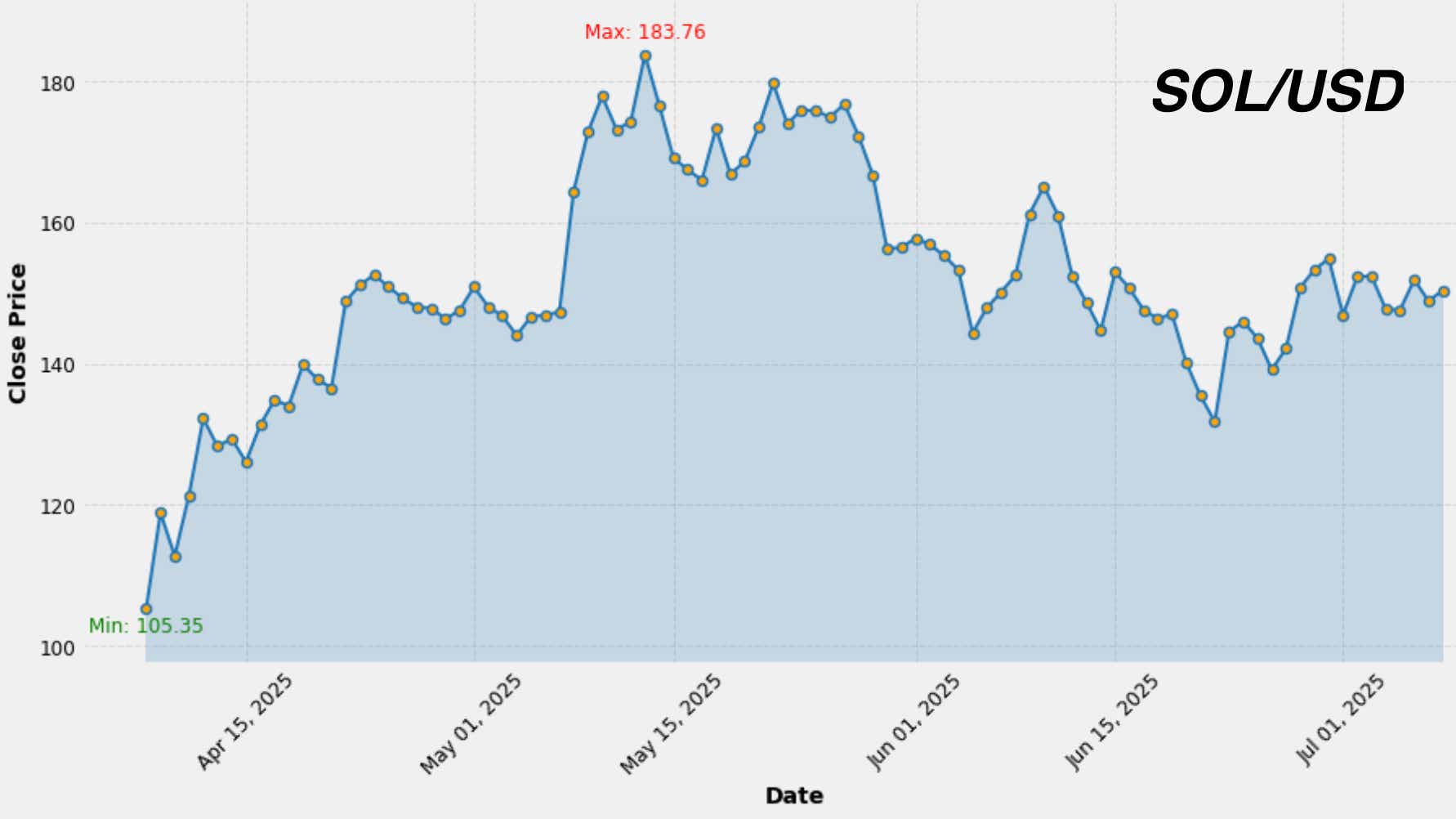

Though Ripple (XRP) dominated last year with a 349.5% return from June 2024 to July 2025 vs. the bitcoin (BTC) 59.6% benchmark — and delivered twice the volatility of BTC — crypto markets have entered a summer lull. During the same period, Litecoin (LTC) returned 2.9% and Solana (SOL) declined 9.5%, underscoring SOL’s position as last year’s weakest performer despite XRP’s outsized swings.

However, when we focus on the last three months (April 2025–June 2025), SOL has led the field with 40% returns, outpacing BTC’s 37% and overtaking XRP (23%) and LTC (21%). Based on this shift — from SOL’s annual underperformance to quarterly leadership — and given Solana’s active user base and network growth, we believe SOL is best--positioned to outperform as volatility re-emerges. Meanwhile, we expect XRP may warrant profit-taking or hedging to manage its elevated risk profile.

Want more crypto insights? Signup for the tastycrypto newsletter - https://www.tastycrypto.com/newsletter-sign-up/

Two trade ideas

PLTR ($136.02) short strangle (AUG) $4.62 credit

Palantir (PLTR), one of the recent tech darlings, is up close to 400% in just the span of a year. Volatility remains high, with tons of upside skew to the options. If you think the stock might chop around this range into earnings, a short strangle 105p/175c trades at a hefty $4.62 credit and uses only $1,300 in BP, with downside risk near $100 and upside risk at nearly $180.

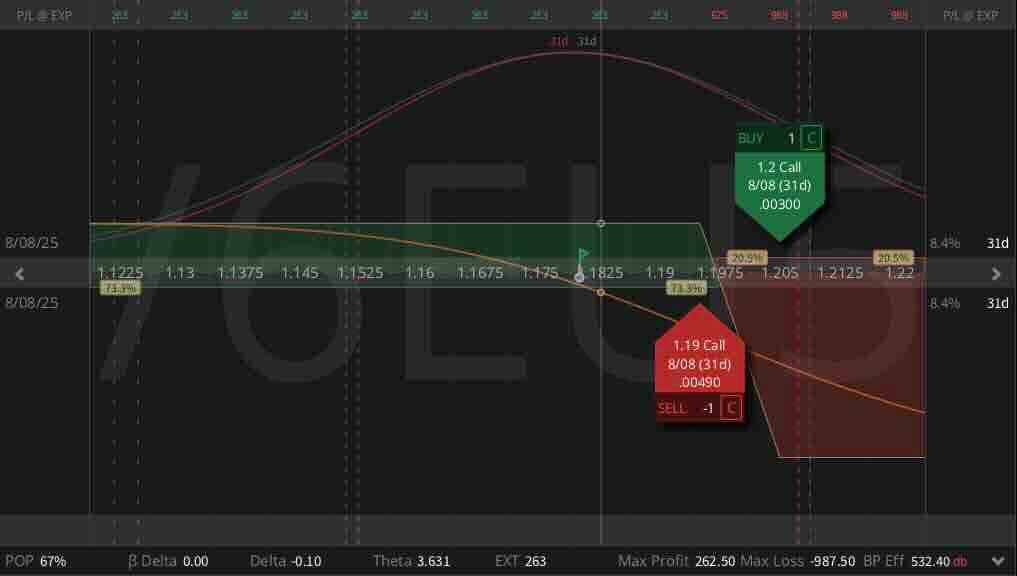

/6EU5 ($1.17480) short call spread (AUG8) $0.00210 credit

The US dollar has lost 10%-15% of its value in just the last six months, $DXY is the symbol for the dollar index, which is a non-tradable index tracking the dollar vs. a basket of international currencies, of which the euro is a large portion. Being short the dollar has become a consensus trade. If you lean contrarian, a short call spread in /6E is a defined risk way to play it. Short the 1.19 and long the 1.20 gives a breakeven near recent highs.

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He’s known best for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex and macro.

Trade with a better broker. Open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.