0DTE Tactics: Opening vs. Closing Trades

0DTE Tactics: Opening vs. Closing Trades

Tom Sosnoff reveals the "red flag" you need to be on the lookout for to successfully trade zero-DTE options

When you have just hours to execute, the setup and execution of a trading strategy is more vital than usual.

On the May 14 edition of Money Measures on the tastylive network, hosts Tom Sosnoff and Tony Battista discussed a study that examined the first 90 minutes and last 30 minutes of the trading day for traders diving into zero-days-to-expiry (0DTE) options.

View a brief summary of the discussion here and the entire Market Measures segment here.

0DTE options, as the name suggests, are options set to expire by the end of the trading day. That makes 0DTE options the most rapid and dynamic trading instruments in the financial markets. For instance, traders might buy 0DTE options in the morning, allowing them to take advantage of the early trading day's price movements and a more predictable market.

The brief time to expiration gives 0DTE options inherently higher gamma—which means their prices change more dramatically with movements in the underlying asset. This makes the options attractive for short-term strategies but extremely risky if one isn't cautious. The key to mastering 0DTE strategies lies in understanding the optimal times for trading and the potential pitfalls.

First 90 minutes vs. last 30 minutes

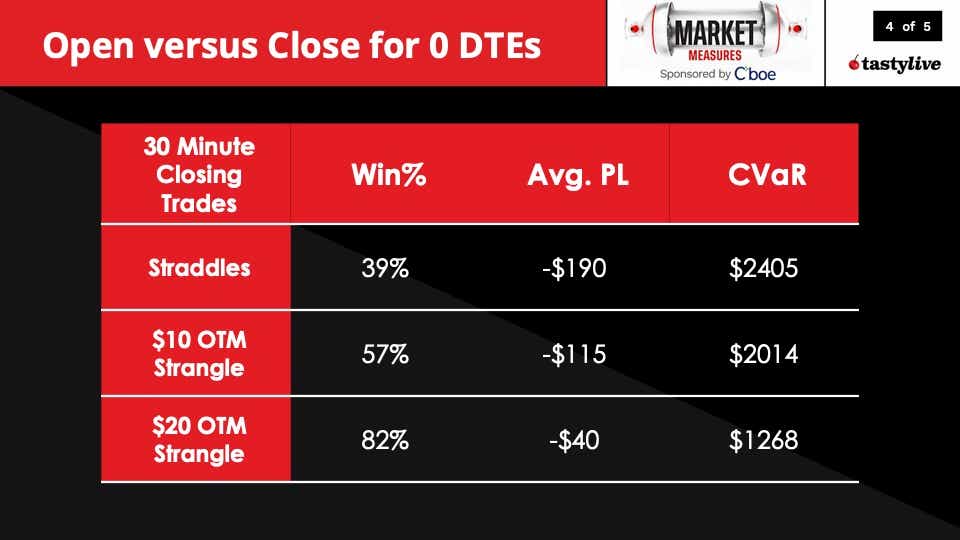

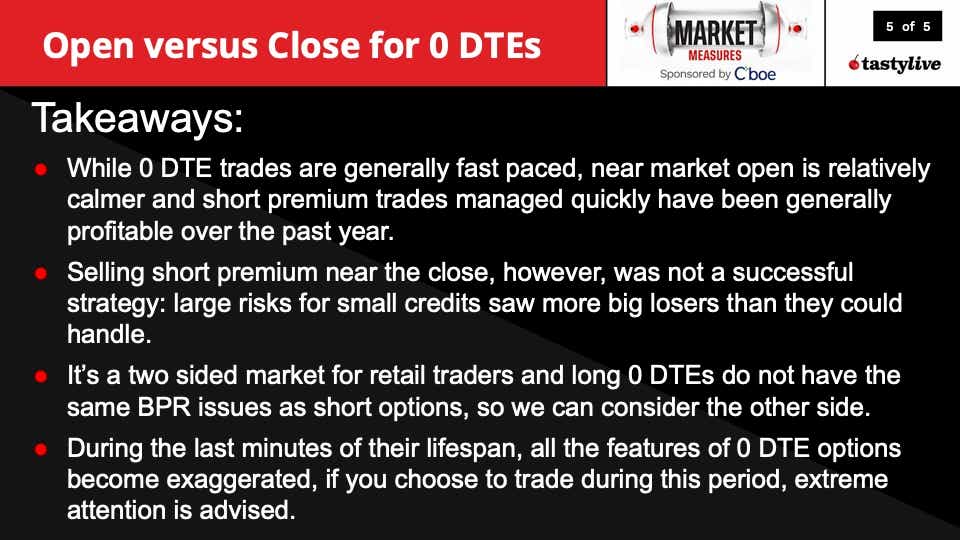

Selling 0DTE short strangles at market opening and closing them after 90 minutes generally results in profitable trades, while selling short premium in the last 30 minutes often leads to losses because of market volatility, a tastylive study shows.

"There’s a very important red flag here," Sosnoff said. "Don’t sell zero DT premium with a half hour to go."

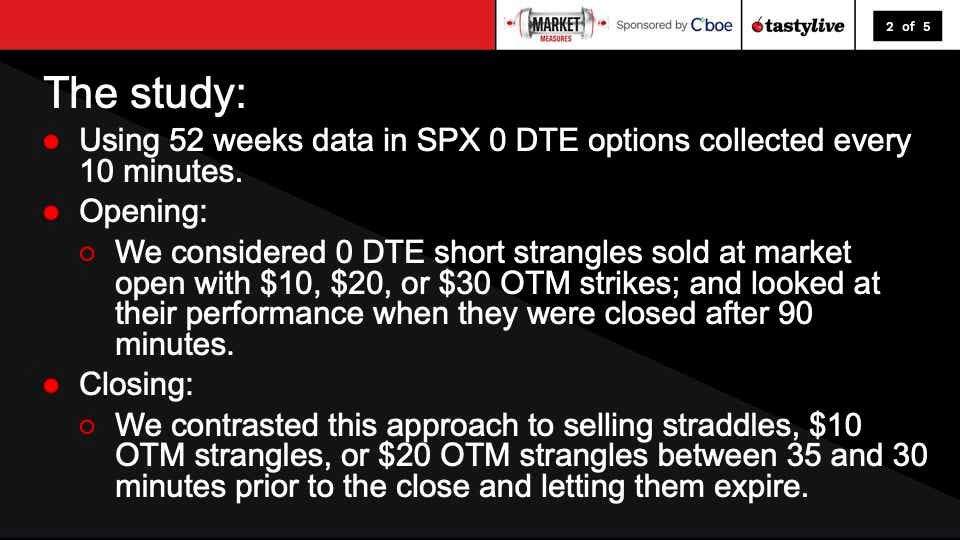

The study, spanning 52 weeks, assessed the performance of different trading strategies. Below are takeaways for early morning and late-afternoon trades.

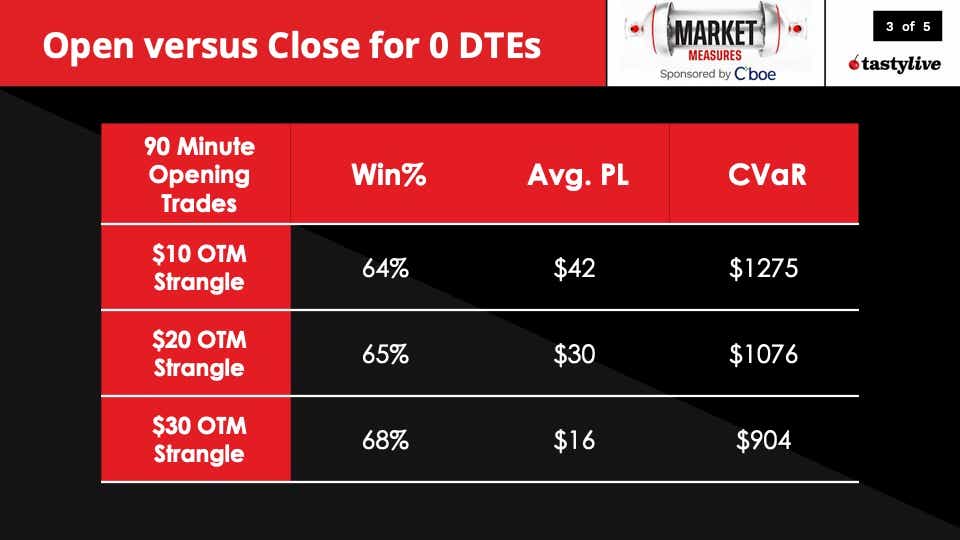

During the early morning, selling $10 out-of-the-money (OTM) strangles had a win rate of 64%, $20 OTM at 65% and $30 OTM at 68%. Also, average profit and loss and conditional value at risk (CVaR), also known as the expected shortfall, were relatively stable, making this a somewhat profitable strategy with controlled risk. CVarR is a risk assessment measure that quantifies an investment portfolio’s tail risk.

In the late afternoon, selling straddles showed a win rate of 40%, $10 OTM had a win rate of 57%a nd $20 OTM outperformed with a win rate of 82%. And, despite the win rates, all strategies resulted in net losses, primarily because of outlier moves that produced significant losses, as evidenced by higher CVaR values.

More on conditional value at risk (CVaR)

While trading 0DTE options, CVaR is particularly useful because of the inherent high risk and potential for large, unexpected spikes in price movement as these options near expiration. Monitoring CVaR helps traders understand and prepare for extreme losses, which is crucial for maintaining a balanced risk-reward profile in such a volatile trading environment.

CVaR provides an estimate of the potential losses in an investment portfolio or position under extreme market conditions. Unlike value at risk (VaR)—which evaluates threshold loss level that is not expected to be exceeded with a given confidence level—CVaR goes further by estimating the average of losses that occur beyond the VaR threshold.

Final thoughts

In summary, trading zero-DTE options requires good timing and a keen understanding of market behavior. Stick to early trades for more stable results, and tread cautiously in the turbulent waters of the closing minutes.

View a brief summary of the discussion here and the entire Market Measures segment here.

Disclaimer: The above content is for informational purposes only and does not constitute trading or investment advice. Trading in financial markets involves substantial risk and may not be suitable for all investors. Always conduct your own due diligence and consult with a licensed financial advisor.

Jacob Perlman is a tastylive mathematician and quantitative researcher.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices