Top 10 Stocks to Watch: February 2024

Top 10 Stocks to Watch: February 2024

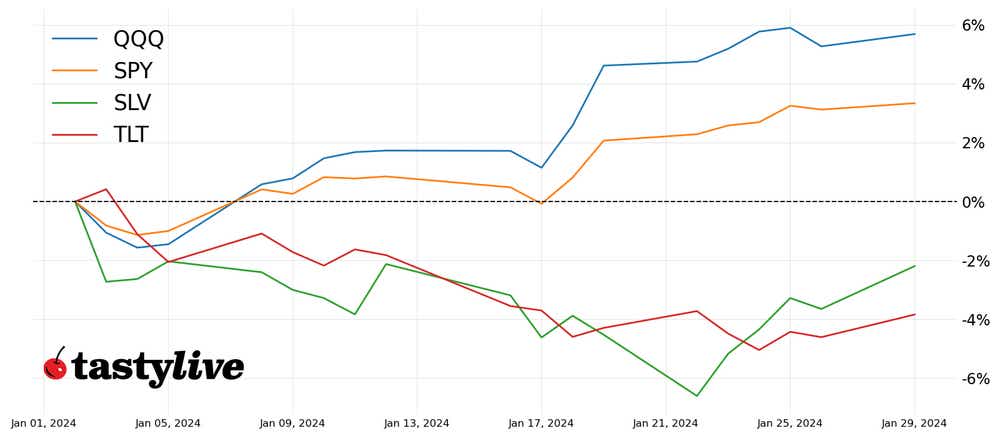

S&P 500 e-mini futures are up 2.23% for the year so far

- The market began 2024 with a decline to the 4,700 level but has since rallied to all-time highs around 4,925, indicating buyer dominance and positive market direction.

- With the market currently at all-time highs and the 5,000 level now a potential target, buyers continue to exert strong buying pressure seen since late 2023.

- Today's focus is on major stocks, predominantly in the tech sector, emphasizing the importance of individual company evaluation and diversification across varied sectors.

Last month, we were looking forward to the first two weeks of trading in 2024 because they would give us an indication of market direction. Then, 2024 started with a down move to the 4,700 level but has subsequently rallied to all-time highs around 4,925.

Bullish tendencies

We continue to sit at all-time highs now, which tells us buyers remain in control in the near term, and they continued to follow through with the buying pressure that dominated the end of 2023. The 5,000 level is now within striking distance and may be a target for many buyers.

Price action continues to indicate bullish tendencies. It’s likely that we will see continued movement upward. If sellers find an opportunity to test the downside again, look for 4,790 as a price target, followed by 4,750.

Today’s list is full of big-name stocks, as well as being tech sector heavy, so evaluate each company individually and remember to diversify your positions across a variety of uncorrelated sectors.

A note on earnings trades

To capture the bulk of the volatility of earnings announcements, earnings trades are often executed either the day before or on the day of the earnings announcement. However, earnings trades can also be placed days or weeks before an earnings event, which could lead to early profit taking.

Alternatively, placing a trade shortly after an earnings announcement can be a strategic choice to circumvent the binary nature of the event. Evaluate each trade in a way that allows you to execute the position that matches your strategy.

If you're considering a trade going into an earnings event, one approach is to initiate the position in the monthly options contract that follows the earnings event.

This strategy offers flexibility. Should you need to defend your position – perhaps due to unexpected market movements—you can "roll" it out to the subsequent monthly options contract. Rolling out the position in this way allows you to extend its duration and potentially collect more premium, providing a buffer against market volatility.

Top 10 stocks to watch in February 2024

- Amazon.com (AMZN) – 2/1 - After the close

- Apple (AAPL) – 2/1 - After the close

- Meta Platforms (META) – 2/1 - After the close

- Enphase Energy (ENPH) – 2/6 - After the close

- PayPal Holdings (PYPL) – 2/7 - After the close

- Walt Disney (DIS) – 2/7 - After the close

- DraftKings (DKNG) – 2/15 - After the close

- NVIDIA (NVDA) – 2/21 - After the close

- Square (SQ) – 2/22 - After the close

- Snowflake (SNOW) – 2/28 - After the close

1. Amazon.com

Amazon (AMZN) is currently trading at $160.30, up 5.78% from its opening price of 2024 at $151.54. The current IVR on the tastytrade platform is 49.1. The implied volatility (IV) in February's contract is 29.1 and March's contract is 32. AMZN has reported positive net income in four of its last five quarterly reports.

AMZN’s options markets are extremely liquid and make for a good environment to get in and out of your trades efficiently. If you have a larger account and want to take on the risk of an undefined position in AMZN, it is reasonable to do so. In this instance a 16-delta strangle sets up well with a decent premium to buying-power-used ratio. 35-delta short direction spreads and 20-delta short iron condors also set up well.

2. Apple (AAPL)

Apple (AAPL) currently trades at $191.11, up 2.12% from its opening price of 2024 at $187.15. The current implied volatility rank (IVR) on the tastytrade platform is 50.1. The IV in February's contract is 28.3 and March's contract is 24.3. AAPL has reported positive net income in its last five quarterly reports.

AAPL has an extremely liquid and tight options market, with markets often one penny wide. Most single expiration options strategies can be set up for the strategy of your preference. The premium to buying-power-used for undefined risk positions is slightly less appealing than AMZN, but still reasonable. 20-delta short iron condors also set up well.

3. Meta Platforms

Meta (META), formerly Facebook, currently trades at $400.3, up 14.1% from its opening price of 2024 at $351.32. The current IVR on the tastytrade platform is 50.9. The IV in February's contract is 47.6 and March's contract is 38.1. META has reported positive net income in its last five quarterly reports.

META is an expensive stock to trade, and most accounts will want to stick with defined risk positions. A 20-delta, ten-dollar wide short iron condors set up well. 30-delta, ten-dollar wide directional spreads also set up well. February’s contract volatility is ten points higher than March, so calendarized spreads may be in play as well.

4. Enphase Energy

Enphase Energy—which produces solar micro-inverters, battery storage, and electric vehicle charging systems—currently trades at $107.27, down 17.9% from its opening price of 2024 at $130.66. The current IVR on the tastytrade platform is 77.9. The IV in February's contract is 93.3 and March's contract is 74.6. ENPH has reported positive net income in its last five quarterly reports.

At the time of writing, ENPH’s IVR is high, which means premium is extremely expensive right now. This is beneficial for those looking to sell premium because strikes that are far away from the current price (sometimes beyond one standard deviation) still have enough premium to sell with a good chance of profiting.

For example, a 13-delta strangle currently sets up very well with a good premium to buying-power-used ratio in ENPH. However, as the earnings announcement approaches, IVR could fall. That may mean you want to put the position on soon rather than later, which you can do, and then take the position off before earnings. If that strategy doesn’t work out as the earnings announcement approaches, you can leave it on expose the position to the earnings event.

On top of that, almost any defined risk spread can be set up in ENPH currently. From directional spreads to calendarized spreads, you should be able to find a position that matches your strategy and provides a decent probability of profit (PoP).

5. PayPal

PayPal (PYPL) currently trades at $62.87, up 2.7% from its opening price of 2024 at $61.22. The current IVR on the tastytrade platform is 68.6. The IV in February's contract is 56.6 and March's contract is 45.5. PYPL has reported positive net income its last five quarterly reports.

PYPL is very liquid, and its options markets are tight. A one standard deviation short strangle sets up well. With PYPL at $62, an undefined risk strategy may be suitable for medium-sized accounts. 35-delta, five-dollar wide short directional spreads also set up well.

6. Walt Disney

Disney (DIS) currently trades at $96.41, up 7% from its opening price of 2024 at $90.10. The current IVR on the tastytrade platform is 72.

The IV in February's contract is 40 and March's contract is 32.5. DIS has reported positive net income in four of its last five quarterly reports.

7. DraftKings

DraftKings (DKNG)—digital sports entertainment and gaming company—currently trades at $38.94, up 12.48% from its opening price of 2024 at $34.62. The current IVR on the tastytrade platform is 44.1. The IV in February's contract is 71.2 and March's contract is 56.4. DKNG has reported positive net income in none of its last five quarterly reports.

DKNG is cheap enough that small to medium sized accounts could consider placing an undefined risk position. An 18-delta short strangle sets up well in DKNG. 24-delta, short iron condors set up decently. Also consider calendarized spreads since the front month volatility is about 15 points higher than the next month.

8. Nvidia (NVDA)

Nvidia (NVDA) currently trades at $616, up 25.09% from its opening price of 2024 at $494.4. The current IVR on the tastytrade platform is 40. The IV in February's contract is 39.3 and March's contract is 44.7. NVDA has reported positive net income in its last five quarterly reports.

NVDA is an expensive stock to trade, but it is also very liquid. Most accounts will want to execute defined risk positions in NVDA. A 19-delta short iron condor sets up well. Directional spreads also set up well with your preferred PoP. It will be necessary to place NVDA earnings trades in contracts that expire following the earnings announcement.

9. Square

Square (SQ), a financial services and mobile payment company. currently trades at $67.85, down 10.13% from its opening price of 2024 at $75.5. The current IVR on the tastytrade platform is 55.7. The IV in February's contract is 53.2 and March's contract is 58.8. SQ has reported positive net income in none of its last five quarterly reports.

SQ earnings trades must be placed in contracts that expire following the earnings announcement. SQ is very liquid. An 18-delta short strangle sets up well with a slightly less than desirable premium to buying-power-used ratio. SQ is cheap enough for medium-sized accounts to consider undefined risk positions.

10. Snowflake

Snowflake (SNOW) provides cloud-based data warehousing services. It currently trades at $207.2, up 6.26% from its opening price of 2024 at $195. The current IVR on the tastytrade platform is 46.4. The IV in February's contract is 49 and March's contract is 53.5. SNOW has reported positive net income in none of its last five quarterly reports.

SNOW is an expensive stock to trade in and undefined risk positions require a large amount of buying power to maintain. For that reason, almost all accounts should only consider defined risk trades for SNOW. A ten-dollar wide, 20-delta short iron condor sets up well. 25-delta, five-dollar wide directional spreads also set up with a decent premium to buying-power-used ratio.

Ryan Sullivan is an active options and forex trader and programming producer for the tastylive network.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices