Central Bank Bonanza: Updates Loom from BOJ, RBA, Fed and BOE

Central Bank Bonanza: Updates Loom from BOJ, RBA, Fed and BOE

By:Ilya Spivak

Stocks may trade lower while the U.S. dollar and Japanese yen advance amid a flurry of major central bank activity

- Stocks may struggle if the Fed endorses newly-set expectations for two cuts in 2024.

- The Japanese yen may rebound if the BOJ limits tightening to a modest rate hike.

- A dovish turn in RBA and BOE rhetoric may hurt the Australian dollar and British pound.

Stocks fell for a second week while non-yielding gold and the Japanese yen pulled back as Treasury bond rates surged last week. Bitcoin took a step backward also, while the U.S. dollar inched upward. Crude oil prices have continued to march to the beat of their own drum, gaining ground amid swelling fears of geopolitical risk.

Here are the macro waypoints likely to shape price action in the week ahead.

Bank of Japan

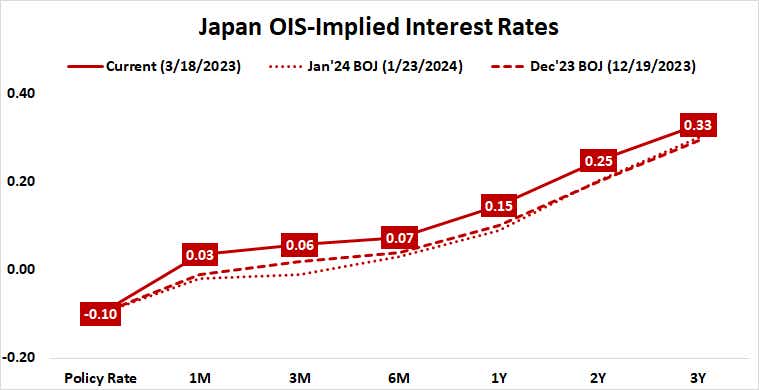

The Bank of Japan (BOJ) is widely expected to exit negative interest rate policy this month, raising its target interest rate by 10 basis points (bps). It has been expected for over a year that this change would be coming in 2024. Its timing has been made more immediate by the conclusion of annual pay negotiations at local firms, which locked in strong wage gains.

With the move already priced in, the key question now is whether the BOJ will take the added steps of sunsetting yield curve control (YCC), the policy of capping the 10-year Japanese government bond (JGB) yield at 0%, reducing asset purchases or some combination thereof.

Anything other than a surprise hold at -0.10% for the benchmark lending rate seems likely to stabilize the Japanese yen after last week’s selloff. Going beyond the rate hike to dilute stimulus further may offer the currency a lift.

Reserve Bank of Australia

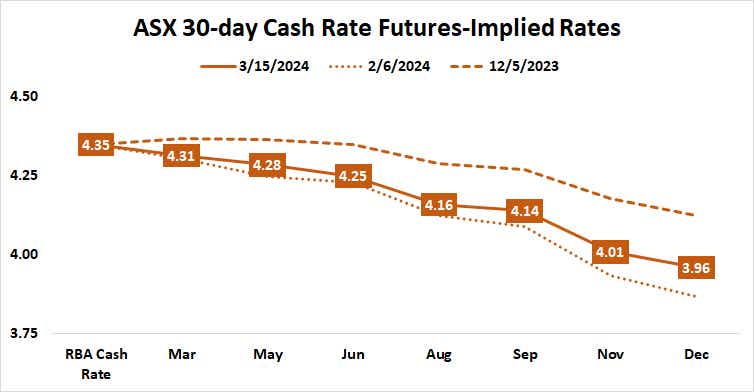

Australia’s central bank is seen holding its target bank rate unchanged at 4.35% at this week’s policy meeting. As it stands, the first 25bps rate cut is priced in by November. Just 36bps in cuts are baked into rate futures for the year, implying a 56% probability of a further 25bps before the calendar turns to 2025.

A run of disappointing economic data—including the monthly consumer price index (CPI) inflation gauge—may see Gov. Michele Bullock ease back on hawkish rhetoric in the policy statement accompanying meeting. That might boost the expected likelihood of a second cut, weighing on the Australian dollar.

U.S. Federal Reserve

With no rate change in the cards from the policy-steering Federal Open Market Committee (FOMC), all eyes will be trained on the updated set of economic and interest rate forecasts as well as the post-meeting press conference with Chair Jerome Powell. The priced-in probability of an on-hold outcome is a commanding 99%.

Officials called for 80bps in rate cuts in their December forecast update. Since then, a steady stream of hotter-than-expected economic data, including various measures of inflation, has trimmed priced-in expectations from 150bps to just 61bps, meaning the markets now see two cuts as narrowly likelier than three this year.

Not surprisingly, stock markets buoyed by the prospect of cheaper money than the central bank acknowledged earlier in the year have stalled as traders’ outlook has flipped to a more hawkish setting than December’s baseline. Wall Street may retreat while the U.S. dollar rises if the Fed endorses the markets’ repositioning.

Bank of England

Another on-hold rate decision is expected from the Bank of England (BOE), with the target bank rate left unchanged at 5.25%. The first cut is currently on the menu by August. A total of 53bps in easing is priced into rate futures, putting the likelihood of a third reduction at less than 0.5%.

CPI data published ahead of the rate decision is expected to put the headline year-on-year inflation rate at 3.5%, the slowest since September 2021. Meanwhile, job vacancies continue to fall—standing at the lowest since May 2021 as of January—and wage growth has eased back to the weakest since July 2022.

Data from Citigroup reveals U.K. economic data has tended to undershoot baseline forecasts even after the economy bounced back from a shallow late-2023 recession since the beginning of this year. Meanwhile, a BOE survey showed inflation expectations are easing.

Taken together, this might make room for a bit of cautious optimism from BOE officials and help set the stage for easing later in the year. If this moves the voting tally on the nine-member monetary policy committee (MPC), trimming the number of votes for a hike from 2 to 1 or 0, the British Pound may face selling pressure.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.