Bonds Struggle to Rally as Odds of an Interest Rate Cut Erode

Bonds Struggle to Rally as Odds of an Interest Rate Cut Erode

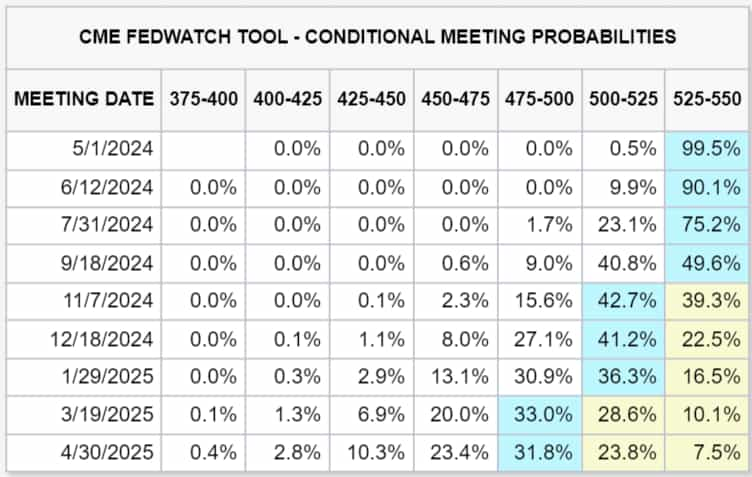

In just the last week, the chance of a 25-bps rate cut in June have plunged to 9.9% from 18.8% a week ago

- U.S. Treasury notes and bonds are meandering just off their yearly lows.

- Rate cut odds for 2024 are continuing to fall, with the odds of a 25-bps rate cut in June down to 9.9% from 18.8% a week ago.

- Bond volatility has contracted over the past week after a modest expansion through most of April.

Market Update: U.S. 10-year Yield up to 4.661%

Still-elevated commodity prices and three successive months of inflation data trending in the wrong direction have been a significant problem for U.S. Treasuries. At the start of April, there was north of a 60% chance of a 25 basis-point (bps) rate cut in June. That has been decimated in recent weeks:

Only one full 25-bps rate cut is discounted through the end of 2024, with a 21.8% chance of a second 25-bps rate cut before the year ends. And while that may mean a floor of sorts is coming into focus—unless, of course, the Federal Reserve shifts the conversation even farther toward no cuts or even a rate hike—it does mean bonds still have the problem of all the remaining odds of a cut lingering before the November and December 2024 meetings.

It's a reasonable assumption the Federal Open Market Committee (FOMC) won’t cut rates until at least after the November elections. Recall that at the January FOMC meeting, Fed Chair Jerome Powell noted that six months of good inflation data weren’t enough to convince policymakers that it was time to start the rate cut cycle.

Now, after three months of bad inflation data, the clock has effectively been reset; we’ll need at least three months of good inflation data to bring us back to where we were in January, a place where policymakers still weren’t comfortable with rate cuts.

Following that logic, it would hold that the odds for June, July and September need to be zeroed out. To this end, that means additional weakness is in store for the /SR3M4 and /SR3U4 contracts, both of which have held near perfect positive one-month rolling correlations with bonds across the curve (with 2s (/ZTM4) having a higher correlation than 30s (/ZBM4), but both still robust at +0.99 vs. +0.94).

The deterioration of Fed rate cut odds for June, July and September may prove to be an albatross around bonds’ proverbial necks that prevents any meaningful rally from taking shape, particularly as energy prices remain elevated.

/ZN US 10-year Note Price Technical Analysis: Daily Chart (October 2023 to April 2024)

The series of lower highs and lower lows remains in 10s (/ZNM4). /ZNM4 remains below its daily 5-, 13- and 21-EMA (exponential moving average) cloud, which is in bearish sequential order. Slow stochastics are barely floating out of oversold territory, while MACD (moving average convergence/divergence) is flat well below its signal line. Without a clear sign that momentum has turned the corner, the downtrend from the yearly highs remains very much in place. And in a low volatility environment (IVR: 27.2), it makes little sense right now to try to “call a bottom” by selling put spreads or buying call spreads.

/ZB US 30-year Bond Price Technical Analysis: Daily Chart (October 2023 to April 2024)

As was the case in /ZNM4, the technical picture for 30s (/ZBM4) remains bearish. Similarly, lower highs and lower lowers continue to prevail. Even with slow stochastics poking their head out of oversold territory, the momentum profile remains by and large bearish with /ZBM4 beneath its daily 5-, 13- and 21-EMA cloud and MACD flatlining deep below its signal line. No discernible bottoming pattern or shift in momentum has been observed, leaving /ZBM4 in the same position as /ZNM4: getting long right now is akin to catching a falling knife. Or from another angle, it's a bet that markets are underpricing Fed rate cut odds for June, July and September.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.