Trans Mountain Pipeline: Canada's Oil Gamechanger?

Trans Mountain Pipeline: Canada's Oil Gamechanger?

A brief overview of the Trans Mountain expansion project

- The Trans Mountain oil pipeline project is nearly operational.

- Increased Canadian oil flow to the Pacific should bolster Canada’s oil revenues.

- U.S. refiners face slightly tighter margins as Western Canada Select discount tightens.

An expansion project over a decade in the making is finally nearing completion, and it could change the way the North American oil market operates.

The Trans Mountain Pipeline expansion will increase the system’s capacity from 300,000 barrels per day (bpd) to 890,000 bpd.

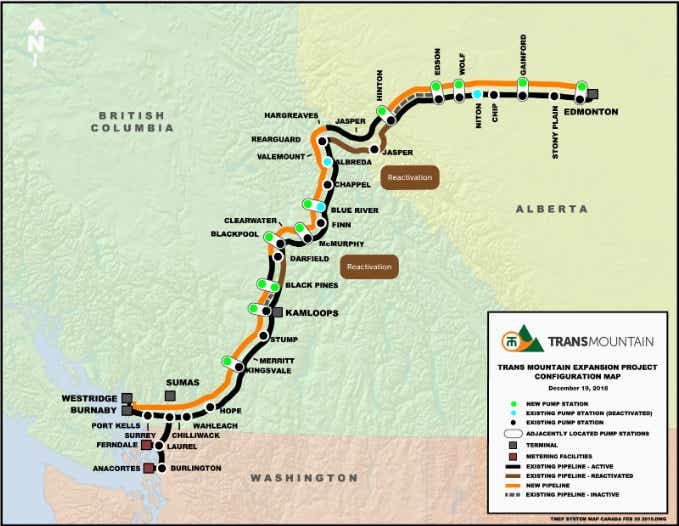

In late March, the Trans Mountain Corp. announced it would begin line fill—a final process to bring a pipeline into operation—which appears to be underway as of March 28. The new pipeline carries heavy crude oils from Alberta’s oil sand fields to British Columbia’s Burrard Inlet. The existing pipeline runs alongside the new one and carries refined products and light crude oil.

The expanded pipeline project, or TMX, has been in the making for over a decade and hit several roadblocks along the way. In 2018, the Canadian government bought the pipeline from Kinder Morgan (KMI). While costs soared during the pipeline’s buildout, Canadian politicians have remained supportive of the project because of benefits it creates both in the short term and long term, including jobs, increased taxes and making Canada more competitive on the global energy stage.

What the expansion means for the North American oil market

Canada has historically sold most of its oil to the United States, specifically moving it into the U.S. Midwest by rail and truck.

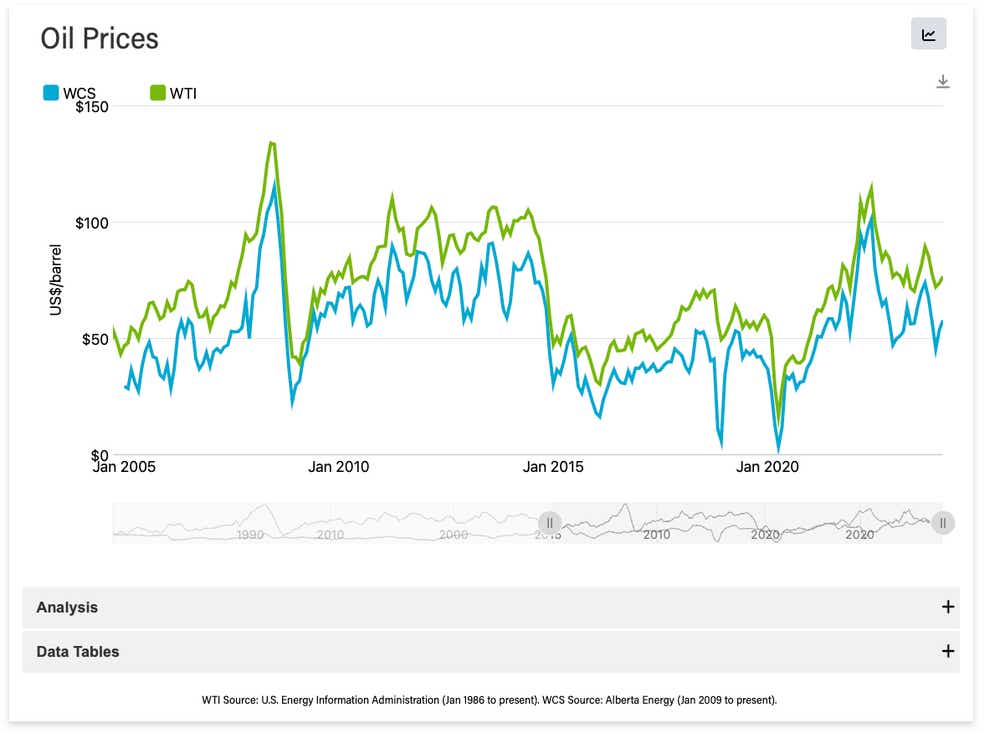

The inability to move oil produced in Alberta to the Pacific seaboard forced this dynamic and because of it, Canada’s oil has regularly been sold at a discount to global benchmarks. The relationship between West Texas Intermediate (WTI) and oil from Alberta, otherwise referred to as Western Canada Select (WCS), can be seen in the chart below.

With the new pipeline, Canada will be able to demand better prices for its oil, which will be shipped via the Pacific Tidewater terminal in the Burrard Inlet. That will improve margins for Canadian refiners and allow the additional 590 thousand barrels per day (k/bpd) to fetch a price more aligned with global benchmarks.

Possible new customers

Observers expected new customers for those seabound exports were seen to be Asian Pacific countries initially, but some of that oil will likely continue going to the United States. The oil from Vancouver to Los Angeles surged to four-year highs in March, according to a Bloomberg report citing data from Vortexa.

Canada having a more efficient system to export its crude oil means more potential customers, which brings increased competition for its oil. That said, the discount Canada sells its oil to WTI should tighten once the pipeline is fully operational. And that could mean reduced margins for U.S. refiners, all else equal. Midstream Canadian oil companies—firms that store and transport oil--such as Cenovus Energy (CVE) should benefit. In the end though, increased options are usually always a good thing for markets.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.