Copper Prices May Rise as Speculators go Long

Copper Prices May Rise as Speculators go Long

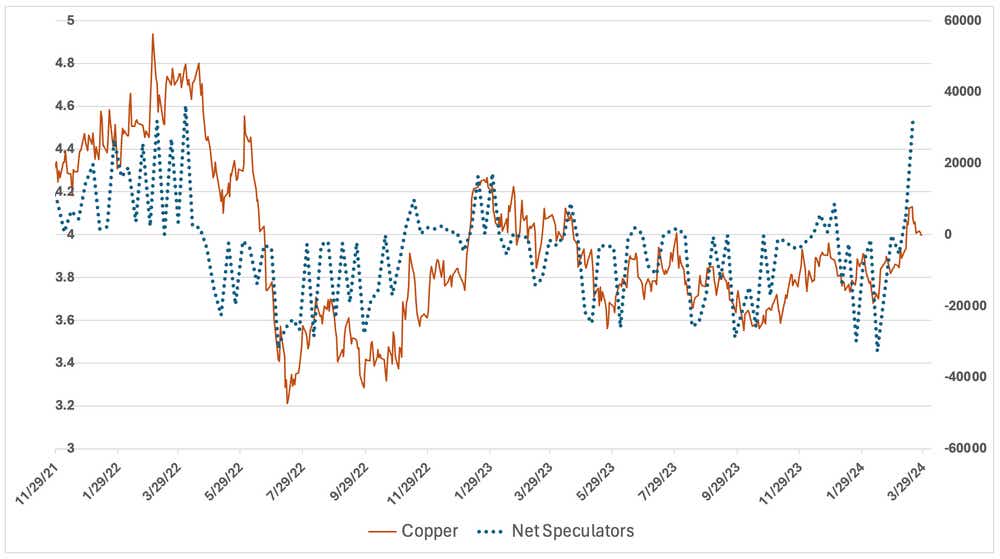

The Commodity Futures Trading Commission is showing the highest net long position among non-commercial traders since April 2022

- Copper prices trimmed their losses today.

- Speculator positioning points to a bullish bias.

- Copper inventory remains seasonally high but relief is in sight.

Copper prices recovered from losses this morning to make small gains in afternoon trading, indicating a potential easing of selling pressures witnessed since last week when prices hit the highest levels since April. With prices now at the December swing high, traders will have to sort out a direction for the metal amid conflicting fundamental forces.

Speculators pile into copper long positions

The positioning among copper traders points to a growing bullish bet in the market, with the Commodity Futures Trading Commission (CFTC) showing the highest net long position among non-commercial traders, otherwise known as speculators, since April 2022.

Breaking down the numbers in the commitments of traders report (COT) shows 124,000 longs against 92,000 shorts. Both longs and shorts increased their positions for the week ending March 19, although longs went heavier, adding 36,877 contracts vs. 10,379 short contracts—a ratio of more than 3-to-1 longs to shorts.

The changes in positioning data bode well for longs, especially because there isn’t an elevated short position in the market, which could sometimes cause squeezes when there are upward price movements. Long positioning is the highest since May 2021, but short positioning is only at levels from just February.

Another way to look at the data is the fact that last time speculators were this net long, copper prices were nearly 20% higher than today’s levels. While there are endless ways to interpret positioning data, breaking it down at basic levels that we’ve considered appears to point to a bullish bias.

Inventory remains high on seasonal basis

Copper that sits in warehouse in China fell for the first time of the year last week, although stockpiles remain at the highest levels since 2020 for this time of the year at 285,000 tons. The inventory drop could mark a turning point in supply because Chinese smelters have agreed to cut production, which should see less refined copper hitting warehouses. That, combined with incoming rate cuts amid an already resilient global economy, especially in the United States, could help copper resume its earlier upward trend.

Trading copper

Given that bulls have defended the psychologically important 4 level on Wednesday, which also coincides with the January swing high, traders might want to get long by selling a put spread, given the relatively high implied volatility (IV) marked by an implied volatility rank (IVR) of 68.2.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices