Crude Oil Prices May Fall if Ukraine and Gaza Wars Concerns Deflate

Crude Oil Prices May Fall if Ukraine and Gaza Wars Concerns Deflate

By:Ilya Spivak

Crude oil prices seem to depend on geopolitical fear for support, making them vulnerable to headline risk

- Crude oil prices mounted a steady recovery to retake $80/bbl in June.

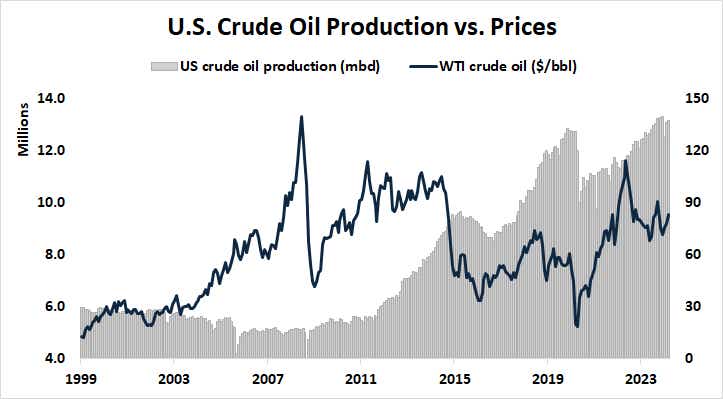

- Surging U.S. crude oil output is seemingly at odds with price behavior.

- Anything appearing to deflate geopolitical risk may shock the market.

Crude oil prices inched steadily higher in June. The U.S.-based West Texas Intermediate (WTI) benchmark contract rose 13% from the low above $72 per barrel (bbl) at the start of the month to a high just below $82/bbl. That peak put prices at the strongest level in two months.

A weekly update on inventory flows from the U.S. Energy Information Administration (EIA) is expected to show stockpiles fell for a second consecutive week, shedding 3 million barrels. Downstream, gasoline and distillate stocks are expected to follow suit, losing 1.1 and 1.5 million barrels, respectively. That may help keep prices supported.

Crude oil prices rose despite a sea of supply

Nevertheless, a broader view suggests the U.S. is awash in crude oil. EIA data shows production bottomed out in March 2021 having plunged amid COVID-19 lockdowns. Then it started to rebuild rapidly. By December 2023, the U.S. was producing 13.3 million barrels per day (mbd), the most on record. It was a touch lower at 13.1 mbd in March.

What’s more, production efficiency seems to have improved by leaps and bounds. Baker Hughes reports the number of operational U.S. oil rigs has trended lower since peaking just shy of 1,600 in September 2015. The tally fell to a pandemic low of 183 in August 2020, rebuilt to 627 by December 2022, and has since fallen to 485 this month.

Energy consultancy Primary Vision reveals that the number of crews actively engaged in hydraulic fracturing of shale oil deposits – so-called “fracking”, the innovative extraction method at the heart of surging U.S. output over the past decade – has halved from close to 500 in mid-2018 to just 246 now.

That crude oil prices are tracking upward while output remains so robust seems somewhat counterintuitive. One might have expected that growing production would pressure WTI lower. The lingering presence of a speculative geopolitical risk premium embedded in prices might explain the disconnect.

Oil markets: beware of headline risk

Fighting between Russia and Ukraine continues, with both sides targeting each other’s energy infrastructure. The conflict kicked off when terrorist group Hamas attacked Israel in October is also ongoing. It has fed fears about supply disruptions if a large regional power like Iran is pulled into the fray, and as Yemen’s Houthis strike tankers in the Red Sea.

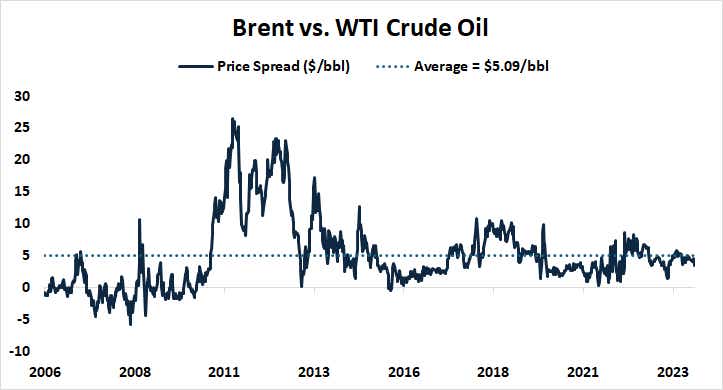

Interestingly, this has not shown up in the price spread between WTI and Brent, the European crude oil benchmark where the impact of supply disruption stemming from the crises in Ukraine and Israel ought to be outsized. The premium on Brent over WTI has oscillated in a narrow range centered around $5/bbl for years, and that’s where it remains.

This suggests that if it is truly geopolitical risk that accounts for crude oil’s resilience, then it is concern about the increased probability of a supply shock that is at play, rather than actual disruption. This likely makes for outsized sensitivity to news-flow. A stray headline or two deflating risk perception may be enough to give prices a potent downward jolt.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices