Natural Gas is Trading Lower Despite Israel-Hamas Conflict

Natural Gas is Trading Lower Despite Israel-Hamas Conflict

But technical indicators are still pointing higher

- Natural gas prices drop from multi-week highs.

- The technical outlook remains bullish, for now.

- Seasonal trends may introduce volatility soon.

Natural gas futures (/NGX3) are down about 0.059 to trade at 3.318 per million British thermal units (mmBtu) through Thursday afternoon trading amid broader weakness in the energy sector. The selling pressure comes after November prices hit the highest level since August earlier this week, as geopolitical tensions fueled speculation around the commodity’s flows in the region.

A bullish technical picture, for now

It isn’t surprising to see some selling at these levels, especially after last week’s 14% gain. The question now is: how far will prices drop? The August to September move established a broader range from the previous several months of trading.

Currently, we’ve only retraced about 23.6% of the move off the September lows. However, prices remain above the 200-day simple moving average (SMA), which was overtaken during last week’s move. If bulls can maintain prices above the SMA, we could see some consolidation or an immediate return to higher ground.

Weather and inventory levels might throttle further gains

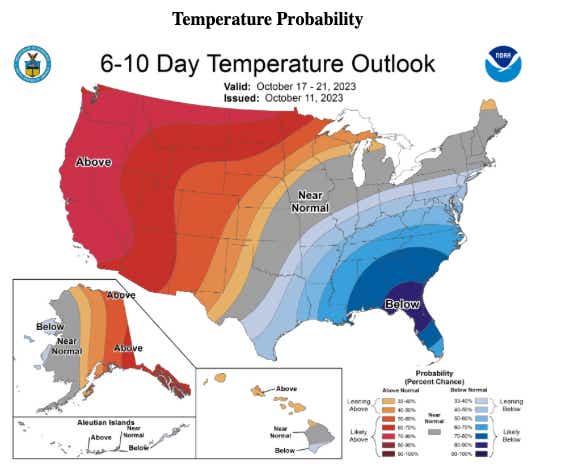

Weather models for the U.S. show above-normal chances for higher-than-average temperatures across the Western U.S., but much of the Midwest and East Coast—where a significant amount of energy demand exists—is due for near-normal to below-normal temperatures. On a net basis, that situation leaves the price outlook in a rather neutral position.

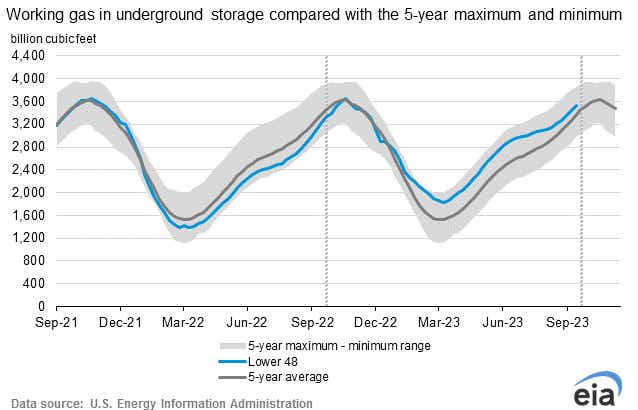

The Energy Information Administration (EIA), on Thursday, reported an 84 billion cubic feet (bcf) inventory build for the week ending Oct. 6. While that was slightly below analysts’ expectations and last week’s +86 bcf figure, total stockpiles are 316 bcf higher than at the same time last year and 163 bcf above the five-year average.

While the outlook in the U.S. remains rather neutral, even during a time when gas demand traditionally rises, regional risks in the Middle East have the potential to spread beyond Europe, should the conflict intensify.

European prices, via Dutch front-month futures, rose to the highest level since March this week. Except for the geopolitical risk premium, European prices are at risk of losing some of its exports after Israel directed Chevron to halt operations at the Tamar gas field. That is impacting Egypt’s ability to export its liquefied natural gas (LNG), which Europe relies upon. This comes after Egypt already reduced its exports due to hotter weather in recent months.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.