Natural Gas Volatility Possible as Winter Nears

Natural Gas Volatility Possible as Winter Nears

Natural gas prices rise from multi-month lows

- Natural gas prices are set for big weekly gain.

- Volatility risks present themselves heading into winter.

- The technical outlook is improving but the downtrend remains.

Prices are pulling back today, but U.S. natural gas futures are on track to record the best weekly percentage gain since June after hitting a 2023 low earlier this week. The November contract (/NGX3) started trading yesterday as the prompt-month contract, which is trading down 1.20% to 2.910 per million British thermal units (mmBtu).

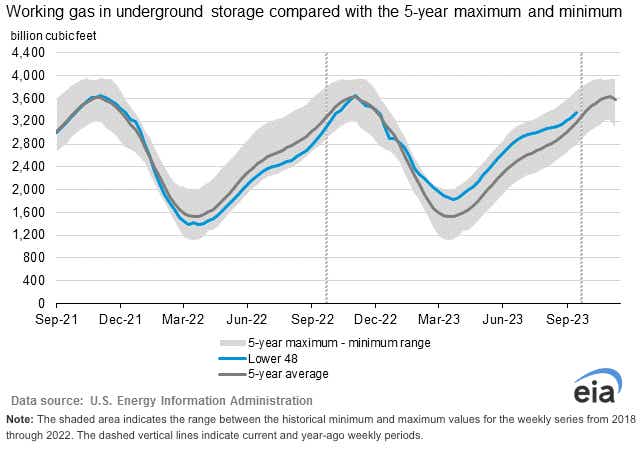

The U.S. Energy Information Administration (EIA) reported yesterday that the natural gas inventory rose by 90 billion cubic feet (Bcf) for the week ending Sept. 22, putting total working gas in storage at 3,359 Bcf. Compared with the same time last year, stocks are 397 Bcf higher—a strong bearish factor at this time of the year.

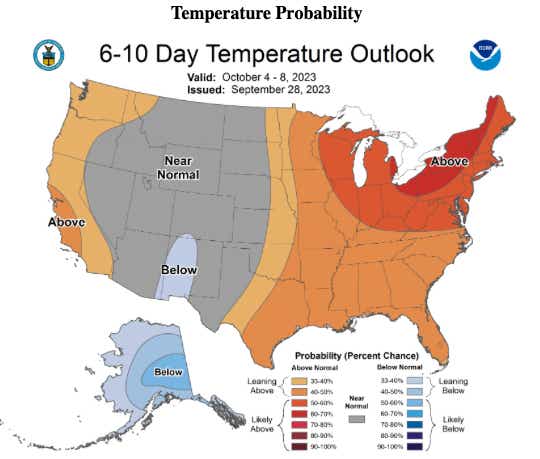

The U.S. weather outlook via the National Weather Service’s 6-10 day temperature outlook calls for above-average temps across the eastern half of the country, particularly the Northeast. That would typically be a tailwind for prices by raising demand, but at this time of the year the weather is much milder so it shouldn’t cause a big spike in energy demand even with above-average seasonal mercury readings.

As the U.S. enters its seasonal withdrawal period when stockpiles typically fall as heating demand rises, the above-average inventory levels should keep prices from making dramatic moves higher. With winter approaching, traders should remain cautious if weather models shift to colder temperatures, which would bolster the demand outlook.

Factors abroad pose risks to U.S. prices

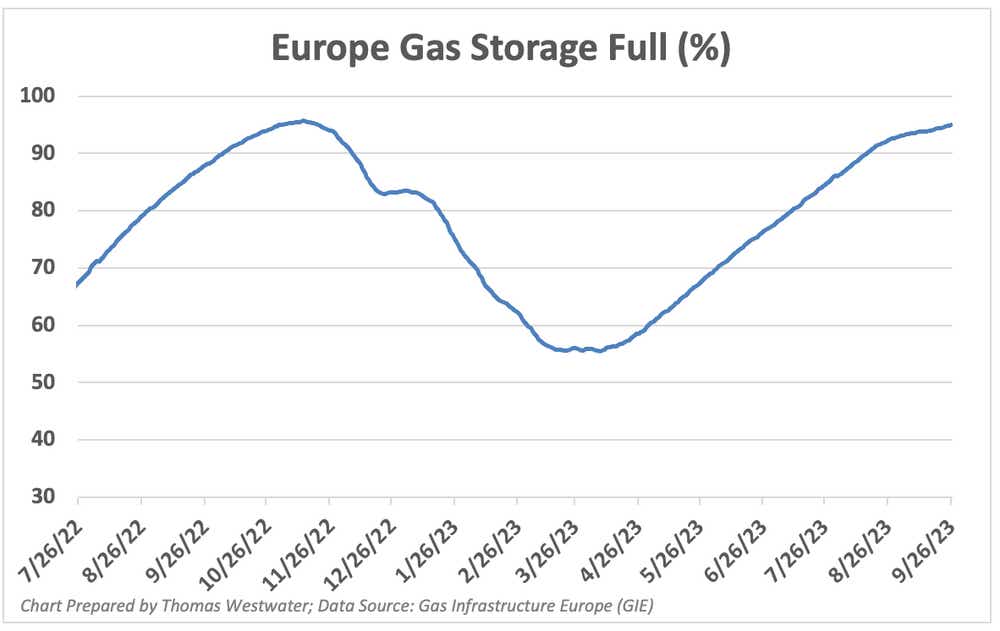

While the risks from Australia's LNG supply have been mitigated, factors abroad, including a precarious situation in Europe amid the Ukrainian war, leaves the chance for unexpected volatility on the U.S. benchmark because a major supply shock would send European prices higher and compete for U.S. liquefied natural gas cargoes.

Norway has replaced much of Europe’s lost gas from Russia, and the bloc is on much better ground going into this winter compared with last year. According to data from Gas Infrastructure Europe (GIE), total inventory is 95.03% full as of Sept. 26. If problems arise in Norway’s production, such as unscheduled maintenance, it could spark a new round of volatility.

Natural gas technical outlook

Natural gas prices are attempting to clear the 23.6% Fibonacci retracement level, measured by the August high to this week’s low. While the MACD is showing a bullish move above its signal line and oriented higher, the downtrend remains in effect. If bulls manage to clear the 23.6% fib, it may help to establish a floor of support into next week.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.