S&P 500 Erases Weekly Gain as Oil Jumps and Yen Breaks Down

S&P 500 Erases Weekly Gain as Oil Jumps and Yen Breaks Down

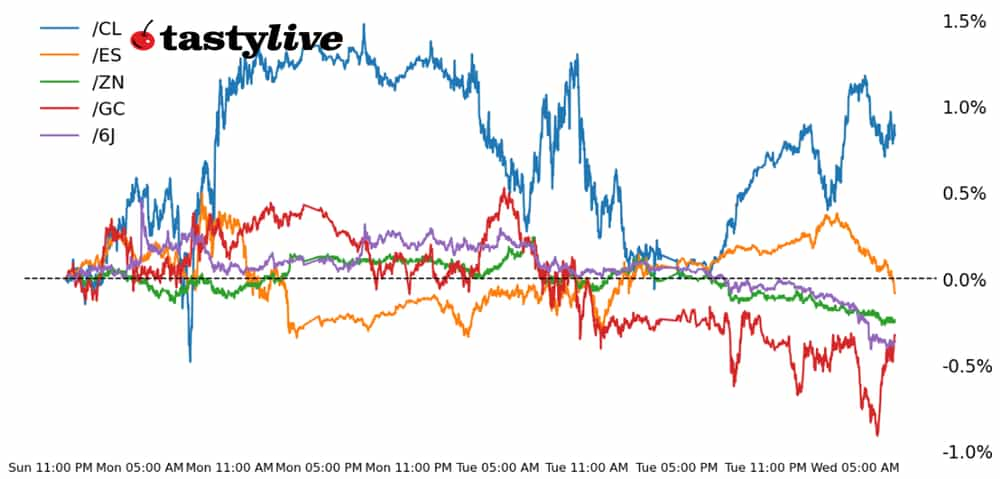

Also, 10-year T-note, gold, crude oil and Japanese yen futures

S&P 500 E-mini futures (/ES): -0.18%

10-year T-note futures (/ZN): -0.3%

Gold futures (/GC): -0.21%

Crude oil futures (/CL): +0.51%

Japanese yen futures (/6J): -0.43%

Pressure is building across markets in the wake of pushback from Federal Reserve officials regarding the timing of the interest rate cut cycle. U.S. equity markets are lower today, influenced by the tick up in bond yields on the back of falling Fed rate cut odds for September. Elsewhere, energy prices continue to chop around near recent highs. Precious metals are still holding critical support for now. In foreign exchange (FX) markets, spot USD/JPY moved above 160; intervention risk would appear to be elevated, but traders seem more than willing to try to break the Bank of Japan.

Symbol: Equities | Daily Change |

/ESU4 | -0.18% |

/NQU4 | -0.12% |

/RTYU4 | -0.45% |

/YMU4 | -0.26% |

S&P 500 contracts traded lower this morning, but there are some bright spots in the equity market. FedEx (FDX) rose nearly 15% in pre-market trading after the shipper announced cost-cutting measures and a beat on earnings. Rivian (RIVN) jumped over 40% after Volkswagen announced a $5 billion investment in the electric vehicle maker. And Whirlpool (WHR) rose nearly 18% as Bosch considers an offer for the appliance company.

Despite the pockets of bullishness, stocks are broadly lower albeit just modestly after European stocks gave up early gains overnight and closed lower. The next couple of days offers plenty of event risks in the way of economic data, including durable goods orders for May and Friday’s inflation data.

Strategy: (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5275 p Short 5300 p Short 5775 c Long 5800 c | 64% | +275 | -980 |

Short Strangle | Short 5300 p Short 5775 c | 70% | +1950 | x |

Short Put Vertical | Long 5275 p Short 5300 p | 83% | +150 | -1100 |

Symbol: Bonds | Daily Change |

/ZTU4 | -0.08% |

/ZFU4 | -0.2% |

/ZNU4 | -0.3% |

/ZBU4 | -0.6% |

/UBU4 | -0.73% |

Treasuries are falling after Fed speakers poured cold water on rate cut bets this week. Fed Governor Michelle Bowman said yesterday she doesn’t think it would be appropriate to cut rates until inflation comes down further. That puts Friday’s inflation report in sharp focus for bond traders and the broader market. The personal consumption expenditures index (PCE) is expected to show prices cooling to a +2.6% pace on a year-over-year basis for the core measure, which is the Fed’s preferred reading. That would be down from 2.8% in April. Today the Treasury will auction off five-year notes.

Strategy (58DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 107 p Short 107.5 p Short 112.5 c Long 113 c | 60% | +140.63 | -359.38 |

Short Strangle | Short 107.5 p Short 112.5 c | 67% | +578.13 | x |

Short Put Vertical | Long 107 p Short 107.5 p | 90% | +62.50 | -437.50 |

Symbol: Metals | Daily Change |

/GCQ4 | -0.21% |

/SIN4 | +0.25% |

/HGN4 | -0.29% |

Gold prices (/GCQ4) were down 0.18% ahead of the New York open, adding to yesterday’s losses. However, the selling isn’t too bad considering a higher dollar and rising Treasury yields. The metal appears to be offering some safe haven ahead of this week’s economic data, which could sway the sentiment around rate cut bets. Traders also have tomorrow night’s U.S. Presidential debate in focus, although any impact from the debate will likely quickly fade once Friday’s inflation report crosses the wires.

Strategy (29DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2215 p Short 2230 p Short 2395 c Long 2410 c | 65% | +420 | -1080 |

Short Strangle | Short 2230 p Short 2395 c | 72% | +1670 | x |

Short Put Vertical | Long 2215 p Short 2230 p | 84% | +210 | -1290 |

Symbol: Energy | Daily Change |

/CLQ4 | +0.51% |

/HON4 | +0.8% |

/NGN4 | -1.89% |

/RBN4 | +0.49% |

Crude oil prices (/CLQ4) are modestly higher but the commodity seems to be carving out a range of consolidation around the 81 level after the past few days of trading. A private report showed crude inventories rose 914,000 barrels last week, which surprised expectations calling for a 3 million barrel draw. Gasoline stocks rose sharply, about 3.8 million barrels, while distillates fell 1.2 million barrels. The Energy Information Administration (EIA) will release its own report today.

Active investors will have total products supplied in focus—a proxy for demand. That measure jumped last week, although actual fuel demand is still below levels that appear supportive for the oil market. Meanwhile, the prompt spread, the difference between the front-month and next month’s contract remains firm, indicating strong physical demand.

Strategy (50DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 72 p Short 73 p Short 87 c Long 87 c | 63% | +240 | -760 |

Short Strangle | Short 73 p Short 87 c | 71% | +1390 | x |

Short Put Vertical | Long 72 p Short 73 p | 84% | +120 | -880 |

Symbol: FX | Daily Change |

/6AU4 | +0.15% |

/6BU4 | -0.32% |

/6CU4 | -0.24% |

/6EU4 | -0.32% |

/6JU4 | -0.43% |

Japanese yen futures (/6JU4) fell 0.4% and the exchange rate vs. the dollar is at the weakest level since 1986. Traders continue to press bearish bets even as Japanese officials warn the markets that they are closely monitoring the currency’s movement, bringing back the risk of an intervention. The Ministry of Finance hasn’t signaled a clear level that they would be uncomfortable with, but it is likely somewhere between the 160 to 165 exchange rate. The yen may experience heightened volatility trading within these levels.

Strategy (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.00605 p Short 0.0061 p Short 0.0065 c Long 0.00655 c | 63% | +162.50 | -462.50 |

Short Strangle | Short 0.0061 p Short 0.0065 c | 70% | +587.50 | x |

Short Put Vertical | Long 0.00605 p Short 0.0061 p | 87% | +75 | -550 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.