S&P 500: How Will Markets Absorb New Geopolitical Pressures?

S&P 500: How Will Markets Absorb New Geopolitical Pressures?

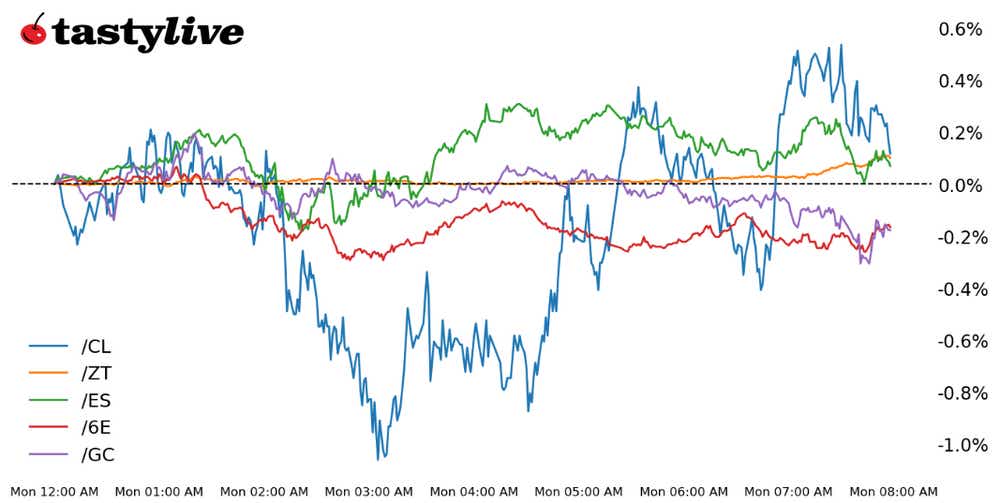

Also, the two-year T-Note, gold, crude oil and euro futures

This Morning’s Five Futures in Focus:

- S&P 500 e-mini futures (/ES): -0.53%

- 2-year T-note futures (/ZT): +0.20%

- Gold futures (/GC): +0.79%

- Crude oil futures (/CL): +3.26%

- Euro futures (/6E): -0.48%

Shocking news from Israel over the weekend sparked opening price gaps at the start of the week, although there hasn’t been much follow-through beyond the initial gaps. Markets are positioning in a classic risk-off defensive posture, with the Japanese yen and U.S. dollar leading the way, followed by strength in both precious metals and bonds. Energy markets remain a ground zero of sorts, whereby concerns that a protracted regional conflict spanning from Jerusalem to Tehran could disrupt global oil supplies.

Symbol: Equities | Daily Change |

/ESZ3 | -0.53% |

/NQZ3 | -0.64% |

/RTYZ3 | -0.87% |

/YMZ3 | -0.48% |

The enthusiasm experienced by U.S. equity markets on Friday has quickly soured at the start of the week, given the news out of Israel. However, after initially gapping open to the downside, each of the four major U.S. equity index futures are showing signs of relative stability around the start of trading in New York. The Russell 2000 (/RTYZ3) and the Nasdaq 100 (/NQZ3) are the leaders to the downside; neither has lost more than 1% thus far.

Strategy: (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4270 p Short 4280 p Short 4350 c Long 4360 c | 53% | +345 | -155 |

Long Strangle | Long 4270 p Long 4360 c | 46% | x | -7850 |

Short Put Vertical | Long 4270 p Short 4280 p | 59% | +175 | -325 |

Symbol: Bonds | Daily Change |

/ZTZ3 | +0.20% |

/ZFZ3 | +0.48% |

/ZNZ3 | +0.63% |

/ZBZ3 | +0.59% |

/UBZ3 | +0.41% |

The safe haven trade is in full effect in U.S. Treasury bonds, with the 10-year note (/ZNZ3) seeing the biggest price improvement relative to the close on Friday. However, Federal Reserve officials are starting to lay the groundwork for no additional rate hikes: San Francisco Fed President Mary Daly said last week the recent bump in yields may diminish the need for another hike; and Dallas Fed President Lorie Logan said the same thing today.

Strategy (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 101 p Short 101.125 p Short 101.75 c Long 101.875 c | 24% | +171.88 | -78.13 |

Long Strangle | Long 101 p Long 101.875 | 53% | x | -781.25 |

Short Put Vertical | Short 101.125 p Long 101 p | 86% | +78.13 | -171.88 |

Symbol: Metals | Daily Change |

/GCZ3 | +0.79% |

/SIZ3 | +0.75% |

/HGZ3 | +0.55% |

Gold prices (/GCZ3) are advancing higher despite a stronger dollar. The fighting between Israel and Hamas is boosting safe-haven bids. Military analysts already expect to see a drawn out and bloody conflict that may forever alter the Middle East. Gold may have more room to run this week, especially if the conflict intensifies. Today, traders will have their eyes on several Federal Reserve members who are set to speak, including Fed Vice Chair Michael Barr.

Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1810 p Short 1815 p Short 1855 c Long 1860 c | 18% | +390 | -120 |

Long Strangle | Long 1810 p Long 1860 c | 47% | x | -4,190 |

Short Put Vertical | Short 1815 p Long 1810 p | 74% | +130 | -360 |

Symbol: Energy | Daily Change |

/CLZ3 | +3.26% |

/NGZ3 | -0.66% |

Energy markets are advancing as the conflict between Israel and Hamas stoke geopolitical tensions in the Middle East. Crude oil prices (/CLZ3) are up nearly 4% this morning, which already puts the daily gain at the largest since May. Natural gas prices (/NGZ3) are also moving higher, with Chevron closing a gas platform in the Eastern Mediterranean at the direction of the Israel government.

Strategy (37DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 82 p Short 82.5 p Short 87.5 c Long 88 c | 19% | +390 | -120 |

Long Strangle | Long 82 p Long 88 c | 47% | x | -5,520 |

Short Put Vertical | Short 82.5 p Long 82 p | 56% | +210 | -280 |

Symbol: FX | Daily Change |

/6AZ3 | -0.39% |

/6BZ3 | -0.41% |

/6CZ3 | +0.11% |

/6EZ3 | -0.48% |

/6JZ3 | +0.21% |

Both the Japanese yen and the U.S. dollar are benefiting from their status as liquid safe havens at a time when markets are staring down increased uncertainty. The Canadian dollar (/6CZ3) is also faring well, at least relative to some of its peers, given the jump in energy prices seen since the close on Friday. German inflation figures due later this week will keep attention focused on the euro (/6EZ3) as well.

Strategy (60DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.045 p Short 1.05 p Short 1.065 c Long 1.07 c | 25% | +462.50 | -162.50 |

Long Strangle | Long 1.045 p Long 1.07 c | 43% | x | -1,950 |

Short Put Vertical | Short 1.05 p Long 1.045 p | 70% | +225 | -400 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices