S&P 500 and Nasdaq 100 Futures are Lower at the Start of December

S&P 500 and Nasdaq 100 Futures are Lower at the Start of December

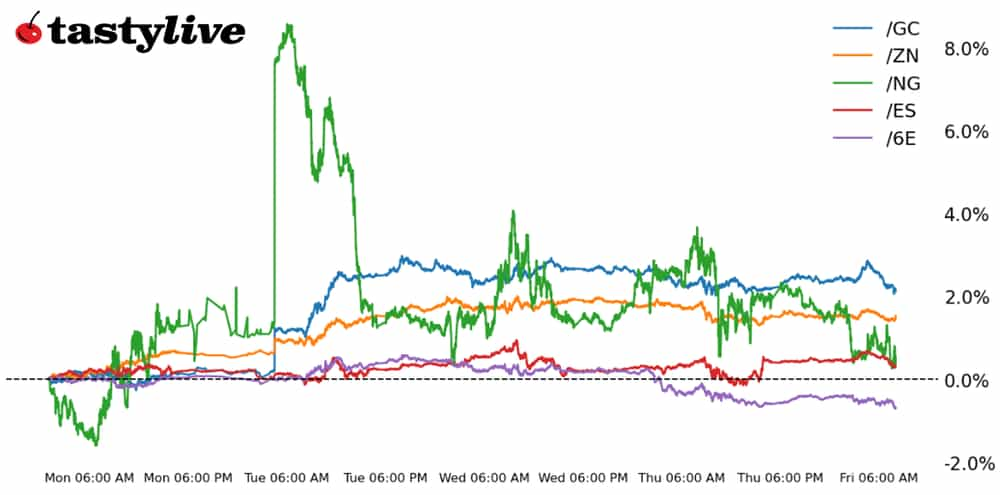

Also 10-year T-bond, gold, natural gas and euro futures

- S&P 500 E-mini futures (/ES): -0.21%

- 10-year T-note futures (/ZN): +0.16%

- Gold futures (/GC): -0.03%

- Natural gas futures (/NG): -3.15%

- Euro futures (/6E): -0.13%

A new month beckons, following one of the best months over the past decade for U.S. equity markets and the best month for U.S. Treasury bonds since at least December 2008. (Also note that it was the best month for the Bloomberg U.S. Aggregate Bond Index since May 1985). Stocks are modestly lower this morning amid a rebound in bond prices, though the shifts are immaterial ahead of a key speech by Federal Reserve Chair Jerome Powell at 11 a..m ES T/10 a.m. CST today. Elsewhere, energy markets continue to reel in the wake of the disappointing results from the OPEC+ meeting yesterday.

Symbol: Equities | Daily Change |

/ESZ3 | -0.21% |

/NQZ3 | -0.33% |

/RTYZ3 | -0.21% |

/YMZ3 | -0.04% |

The best month for the S&P 500 (/ESZ3) since July 2022, and the fourth best month over the past 10 years, is being followed by modest selling this morning as December trading begins. Continued struggles in semiconductor stocks, mainly Nvidia (NVDA), are weighing down the tech-heavy Nasdaq 100 (/NQZ3). Note that December historically has not been a friendly month for equities, as volatility tends to rise meaningfully at the end of the year.

Strategy: (50DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4550 p Short 4560 p Short 4670 c Long 4680 c | 21% | +362.50 | -137.50 |

Long Strangle | Long 4550 p Long 4680 c | 50% | x | -4837.50 |

Short Put Vertical | Long 4550 p Short 4560 p | 65% | +150 | -350 |

Symbol: Bonds | Daily Change |

/ZTZ3 | +0.05% |

/ZFZ3 | +0.10% |

/ZNZ3 | +0.16% |

/ZBZ3 | +0.05% |

/UBZ3 | +0.28% |

Ahead of Fed Chair Powell’s speech today, U.S. Treasury bonds are modestly higher across the curve. The belly of the curve is perking up, which is usually tied to expectations around the duration of a Fed rate hike/cut cycle. After what appears to be end-of-month profit taking yesterday, the 10-year note (/ZNZ3) is moving higher, with the 10-year yield sitting at 4.322% - well off the high of 4.512% set on Monday.

Strategy (56DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 107 p Short 107.5 p Short 112 c Long 112.5 c | 51% | +203.13 | -296.88 |

Long Strangle | Long 107 p Long 112.5 c | 33% | x | -671.88 |

Short Put Vertical | Long 107 p Short 107.5 p | 85% | +93.75 | -406.25 |

Symbol: Metals | Daily Change |

/GCG4 | -0.03% |

/SIH4 | -0.49% |

/HGZ3 | +0.71% |

Precious metals have taken a step backwards this morning following a mixed performance to wrap up November. Nevertheless, silver prices (/SIH4) hit their highest level since Aug. 31 earlier in today’s session before pulling back, while gold prices (/GCG4) remain near their highest level since the first week of June. Elsewhere, copper prices (/HGZ3) are at their highest level since Sept. 1, after gaining more than 10% from their low in October.

Strategy (55DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2025 p Short 2030 p Short 2080 c Long 2085 c | 20% | +390 | -110 |

Long Strangle | Long 2025 p Long 2085 c | 45% | x | -5380 |

Short Put Vertical | Long 2025 p Short 2030 p | 65% | +220 | -280 |

Symbol: Energy | Daily Change |

/CLF4 | -0.28% |

/HOZ3 | -2.01% |

/NGF4 | -3.15% |

/RBZ3 | -3.67% |

The OPEC+ meeting yesterday proved highly disappointing, with changes in production quotas and limited, voluntary production cuts through 1Q’ 24 failing to meet high expectations of greater clarity (particularly from Saudi Arabia) on production cuts through the entirety of next year. Crude oil prices (/CLF4) are rebounding modestly, but the pain continues elsewhere, especially for natural gas prices (/NGF4), which have cratered by over 27% since Nov. 1, thanks to building inventories and a warmer-than-usual early winter across much of North America and Europe.

Strategy (48DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2.5 p Short 2.55 p Short 2.9 c Long 2.95 c | 23% | +390 | -110 |

Long Strangle | Long 2.5 p Long 2.95 c | 42% | x | -3540 |

Short Put Vertical | Long 2.5 p Short 2.55 p | 57% | +230 | -270 |

Symbol: FX | Daily Change |

/6AZ3 | +0.08% |

/6BZ3 | +0.13% |

/6CZ3 | +0.13% |

/6EZ3 | -0.13% |

/6JZ3 | +0.04% |

A sharp decline in Eurozone inflation rates in November may prove to be a significant turning point for the euro (/6EZ3). European Central Bank rate cut odds have been pulled forward, with a 25-basis -point (bps) rate cut priced in for April 2024, ahead of when the Fed’s first hike is discounted (May 2024). In the coming days, traders should keep an eye on the Australian dollar (/6AZ3) and the Canadian dollar (/6CZ3) in the wake of a softer Australian inflation report and a shockingly bad Canadian gross domestic product (GDP) report: both the Reserve Bank of Australia and Bank of Canada will hold their December policy meetings next week.

Strategy (35DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.06 p Short 1.065 p Short 1.115 c Long 1.12 c | 71% | +137.50 | -487.50 |

Long Strangle | Long 1.06 p Long 1.12 c | 19% | x | -262.50 |

Short Put Vertical | Long 1.06 p Short 1.065 p | 93% | +56.25 | -568.75 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.