Nasdaq 100 and the Russell 2000 Lead Rebound Ahead of Powell Testimony

Nasdaq 100 and the Russell 2000 Lead Rebound Ahead of Powell Testimony

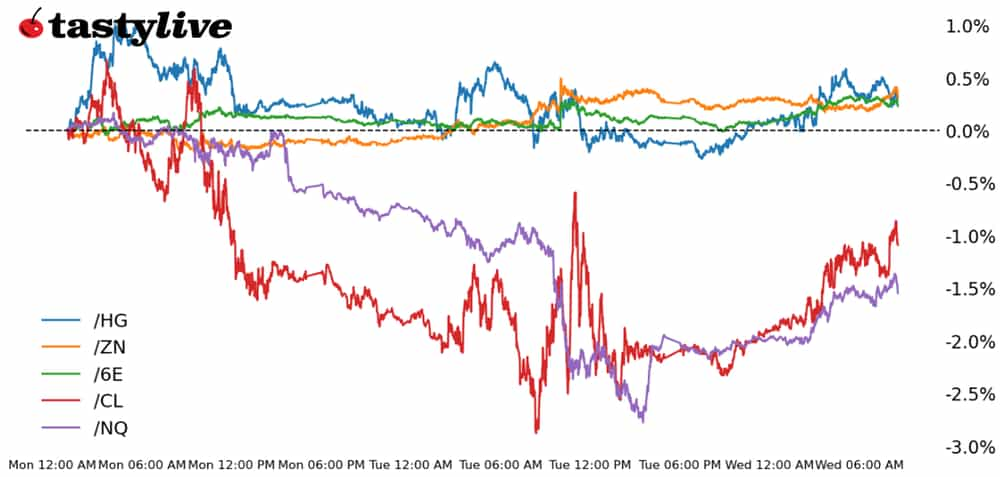

Also 10-year T-note, copper, crude oil and euro futures

- Nasdaq 100 E-mini futures (/NQ): +0.91%

- 10-year T-note futures (/ZN): +0.11%

- Copper futures (/HG): +1.09%

- Crude oil futures (/CL): +1.78%

- Euro futures (/6E): +0.28%

A weaker February U.S. ADP employment report and the release of Federal Reserve Chairman Jerome Powell’s testimony to the House Financial Services Committee did little to upset the overnight rebound in U.S. equity and bond markets. Both the Nasdaq 100 (/NQH4) and Russell 2000 (/RTYH4) were up nearly 1% ahead of the cash equity open. The Fed interest rate cut in June are unchanged after this morning’s data and testimony releases, holding near 72%. While Powell’s testimony has done little to bother traders, the Q&A portion of his testimony may prove more market-moving later this morning.

Symbol: Equities | Daily Change |

/ESH4 | +0.50% |

/NQH4 | +0.91% |

/RTYH4 | +1% |

/YMH4 | +0.48% |

Nasdaq futures (/NQH4) recovered this morning after the biggest daily percentage drop in over a month yesterday. Market mood improved overnight after China suggested a new round of monetary stimulus might come soon. The People’s Bank of China (PBOC) governor, Pan Gongsheng, said there is additional capacity to cut the reserve requirement ratio, a tool that aims to boost lending. Today, Powell is due to address Congress, although the market isn’t expecting his testimony to sway risk sentiment. Still, if Powell comes out swinging against the potential for rate cuts, it may spark some selling in risk assets.

Strategy: (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 17250 p Short 17500 p Short 19000 c Long 19250 c | 22% | +1920 | -3080 |

Short Strangle | Short 17500 p Short 19000 c | 17% | +6390 | x |

Short Put Vertical | Long 17250 p Short 17500 p | 60% | +805 | -4195 |

Symbol: Bonds | Daily Change |

/ZTM4 | +0.03% |

/ZFM4 | +0.07% |

/ZNM4 | +0.11% |

/ZBM4 | +0.13% |

/UBM4 | -0.05% |

Bonds are up for a second day in a row and 10-year T-note futures (/ZNH4) moved to the highest level since February 7, up 0.04% ahead of the Wall Street open. Treasury will auction 17-week bills today, and Powell’s congressional testimony is also in focus for bond traders. After today, bond traders’ focus will shift to Friday’s jobs report.

Strategy (51DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 109 p Short 109.5 p Short 113.5 c Long 114 c | 52% | +203.13 | -296.88 |

Short Strangle | Short 109.5 p Short 113.5 c | 63% | +828.13 | x |

Short Put Vertical | Long 109 p Short 109.5 p | 83% | +109.38 | -390.63 |

Symbol: Metals | Daily Change |

/GCJ4 | +0.15% |

/SIK4 | +0.25% |

/HGK4 | +1.09% |

Copper futures (/HGK4) received a bid overnight that is carrying over into U.S. trading after China pointed toward more policy easing on the horizon. The country’s newly updated 2024 5% growth target would be hard to achieve given the current economic backdrop but hopes for more stimulus were boosted by talk from China’s central bank head overnight. Copper is especially sensitive to Chinese economic growth with the country being the main consumer.

Strategy (50DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 3.75 p Short 3.8 p Short 4 c Long 4.05 c | 39% | +712.50 | -537.50 |

Short Strangle | Short 3.8 p Short 4 c | 58% | +2587.50 | x |

Short Put Vertical | Long 3.75 p Short 3.8 p | 69% | +400 | -850 |

Symbol: Energy | Daily Change |

/CLJ4 | +1.78% |

/HOJ4 | +0.69% |

/NGJ4 | -0.10% |

/RBJ4 | +0.77% |

Crude oil futures (/CLJ4) rose about 1.5% in yesterday morning’s trading as traders shift back to a bullish view on the market, focusing on improvements in inventory numbers and a move by OPEC to extend production cuts into the second quarter. Yesterday’s report from the American Petroleum Institute (API) saw a build of 423,000 barrels for the week ending March 1 vs. expectations for a build of 2.6 million barrels. That may mean the recent pullback in refinery throughput has recovered, allowing greater fuel production that draws from those oil numbers. Today will see the Energy Information Administration (EIA) release its own report.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 74 p Short 74.5 p Short 82.5 c Long 83 c | 41% | +270 | -240 |

Short Strangle | Short 74.5 p Short 82.5 c | 60% | +2720 | x |

Short Put Vertical | Long 74 p Short 74.5 p | 70% | +140 | -370 |

Symbol: FX | Daily Change |

/6AH4 | +0.60% |

/6BH4 | +0.13% |

/6CH4 | +0.22% |

/6EH4 | +0.28% |

/6JH4 | +0.35% |

The Euro (/6EH4) is moving higher ahead of the European Central Bank’s policy decision. Traders started the year with a more dovish view on the ECB, but rate cut expectations have gone from pricing in nearly 160 basis points (bps) of cutting to currently only 90 bps. Progress on inflation has been helpful for policymakers but core measures remain somewhat sticky, which could cause the bank to hesitate to signal some capitulation too soon.

Strategy (30DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.075 p Short 1.08 p Short 1.11 c Long 1.115 c | 61% | +212.50 | -412.50 |

Short Strangle | Short 1.08 p Short 1.11 c | 69% | +562.50 | x |

Short Put Vertical | Long 1.075 p Short 1.08 p | 84% | +125 | -500 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.