S&P 500 Points Lower After Moody’s Credit Outlook Downgrade

S&P 500 Points Lower After Moody’s Credit Outlook Downgrade

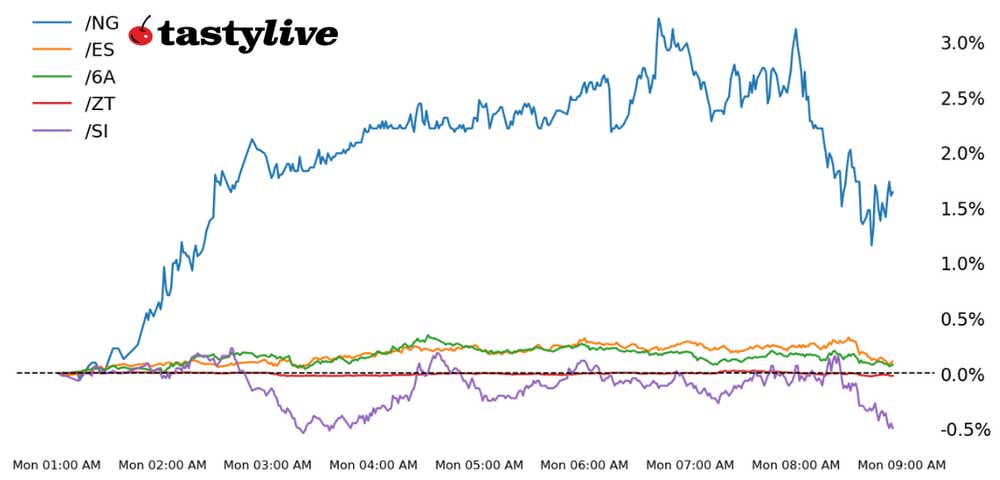

Also two-year T-note, gold, natural gas and Australian dollar futures

- S&P 500 E-mini futures (/ES): -0.34%

- Two-year T-note futures (/ZT): -0.02%

- Gold futures (/GC): +0.11%

- Natural gas futures (/NG): +4.45%

- Australian dollar futures (/6A): +0.17%

Ahead of key U.S. economic releases the coming days, notably the October U.S. consumer price index and retail sales reports, global markets are fading moves seen over the course of the past week. A push higher by U.S. bond yields across the curve may be weighing on stock futures, all of which are slightly underwater this morning. Meanwhile, volatility in energy markets continues, with natural gas (/NGZ3) higher by nearly 4.5% to start the week.

Symbol: Equities | Daily Change |

/ESZ3 | -0.34% |

/NQZ3 | -0.42% |

/RTYZ3 | -0.43% |

/YMZ3 | -0.24% |

Moody’s credit rating outlook downgrade of the U.S. on Friday (from “stable” to “negative”) may be helping to set a weaker tone this morning. All four U.S. equity index futures are pointing lower, led by the Russell 2000 (/RTYZ3) and Nasdaq 100 (/NQZ3). With earnings from Home Depot (HD), TJX Cos. (TJX), Walmart (WMT), and BJ’s Wholesale Club (BJ) in the coming days, the health of the U.S. consumer is squarely in focus.

Strategy: (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4410 p Short 4420 p Short 4500 c Long 4510 c | 15% | +400 | -100 |

Long Strangle | Long 4410 p Long 4510 c | 50% | x | -5900 |

Short Put Vertical | Long 4410 p Short 4420 p | 61% | +162.50 | -337.50 |

Symbol: Bonds | Daily Change |

/ZTZ3 | -0.02% |

/ZFZ3 | -0.13% |

/ZNZ3 | -0.22% |

/ZBZ3 | -0.55% |

/UBZ3 | -0.77% |

The credit outlook downgrade from Moody’s may be helping to push up U.S. Treasury yields at the start of the week. Bonds are lower across the curve, once again led by price action in the 30s (/ZBZ3) and ultras (/UBZ3). However, with the October U.S. inflation report due tomorrow, eyes are on the two-year note (/ZTZ3), given its close relationship to Federal Reserve rate hike expectations.

Strategy (39DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 101 p Short 101.125 p Short 101.875 c Long 102 c | 29% | +125 | -125 |

Long Strangle | Long 101 p Long 102 c | 51% | x | -531.25 |

Short Put Vertical | Long 101 p Short 101.125 p | 88% | +62.50 | -187.50 |

Symbol: Metals | Daily Change |

/GCZ3 | +0.11% |

/SIZ3 | -1.08% |

/HGZ3 | +1.30% |

Silver prices (/SIZ3) are tracking lower this morning as recent comments from Federal Reserve Chair Jerome Powell’s speech last week, which threatened further rate hikes if needed, continue to weigh on precious metals. Traders are now shifting their focus to tomorrow’s inflation data. If the numbers for October come in below expectations—currently at 3.3% year-over-year—that could allow some upside for silver.

Strategy (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1920 p Short 1925 p Short 1995 c Long 2000 c | 33% | +310 | -190 |

Long Strangle | Long 1920 p Long 2000 c | 41% | x | -3310 |

Short Put Vertical | Long 1920 p Short 1925 p | 70% | +170 | -330 |

Symbol: Energy | Daily Change |

/CLZ3 | -0.12% |

/HOZ3 | +0.87% |

/NGZ3 | +4.45% |

/RBZ3 | -0.19% |

Natural gas futures (/NGZ3) are on the rise after commodity analysts at Kpler, reported by Reuters, forecasted an increase in demand for liquified natural gas (LNG) for Asia, rising to 22.67 million metric tons in November, up from 21.18 in October. That said, milder-than-usual weather in the United States, specifically across the East Coast, should keep prices from surging.

Strategy (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 3.1 p Short 3.15 p Short 3.65 c Long 3.7 c | 26% | +370 | -130 |

Long Strangle | Long 3.1 p Long 3.7 c | 41% | x | -3990 |

Short Put Vertical | Long 3.1 p Short 3.15 p | 59% | +220 | -280 |

Symbol: FX | Daily Change |

/6AZ3 | +0.17% |

/6BZ3 | +0.22% |

/6CZ3 | -0.10% |

/6EZ3 | -0.08% |

/6JZ3 | -0.17% |

Australian dollar futures (/6AZ3) are benefiting from recent data from China showing improving credit conditions, with new Yuan loans for October increasing to $101.3 billion in October, according to the People’s Bank of China (PBOC). That was below September, but it exceeded analysts’ expectations. Australia’s currency benefits from improved sentiment in China because of the country’s outsized trade. Recent comments from Reserve Bank of Australia (RBA) members have also helped firm up the currency. However, the risk-off tone in equity markets will keep a cap on the upside in the risk-sensitive currency.

Strategy (25DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.62 p Short 0.6225 p Short 0.6525 c Long 0.655 c | 64% | +80 | -170 |

Long Strangle | Long 0.62 p Long 0.655 c | 25% | x | -260 |

Short Put Vertical | Long 0.62 p Short 0.6225 p | 85% | +40 | -210 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.