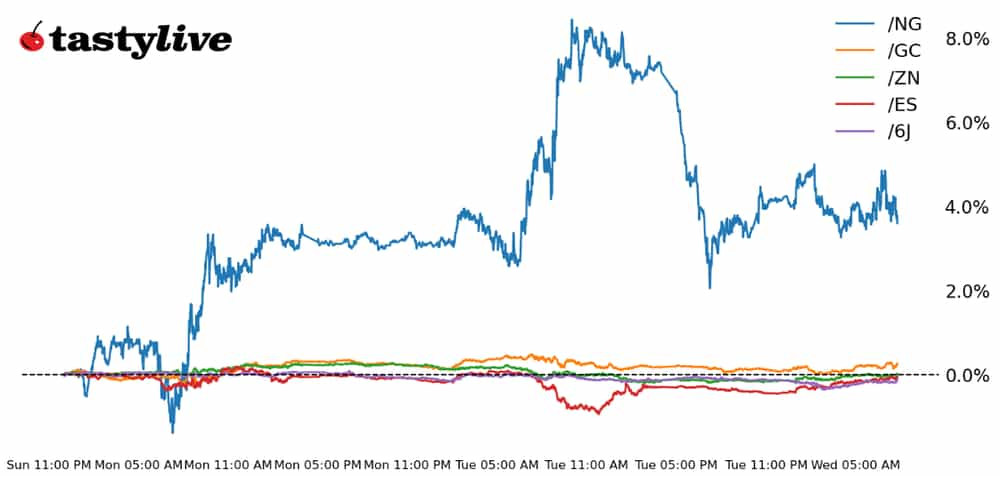

S&P 500, 10-year T-Note, Gold, Natural Gas, and Japanese Yen Futures

S&P 500, 10-year T-Note, Gold, Natural Gas, and Japanese Yen Futures

This Morning’s Five Futures in Focus

- S&P 500 e-mini futures (/ES): +0.30%

- 10-year T-note futures (/ZN): +0.19%

- gold futures (/GC): -0.02%

- Natural gas futures (/NG): +2.60%

- Japanese yen futures (/6J): +0.01%

While the typical pre-FOMC quiet period in markets was anything but that yesterday, assets across the board (sans energy) are mostly quiet on Wednesday in the hours before the next Fed rate decision. Softness in U.S. Treasury yields, which ticked up to fresh cycle highs in parts of the curve, may be helping provide some relief in U.S. equity markets and in foreign exchange rates.

Symbol: Equities | Daily Change |

/ESZ3 | +0.30% |

/NQZ3 | +0.28% |

/RTYZ3 | +0.47% |

/YMZ3 | +0.31% |

Another day, another relatively contained overnight session for the four U.S. equity index futures. None are trading with greater than a +/-0.50% move. Could the Fed inject additional volatility today? Traders continue to expect little from the September Federal Open Market Committee meeting. Today, options markets are pricing in less than a +/-1% move, through the close for the S&P 500 (/ESZ3), just over a +/-1% move in the Nasdaq 100 (/NQZ3), and around a +/-1.5% move in the Russell 2000 (/RTYZ3).

Strategy: (41DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4450 p Short 4460 p Short 4530 c Long 4540 c | 16% | +412.50 | -87.50 |

Long Strangle | Long 4450 p Long 4540 c | 49% | x | -5225 |

Short Put Vertical | Long 4450 p Short 4460 p | 62% | +157.50 | -342.50 |

Symbol: Bonds | Daily Change |

/ZTZ3 | +0.08% |

/ZFZ3 | +0.16% |

/ZNZ3 | +0.19% |

/ZBZ3 | +0.24% |

/UBZ3 | +0.28% |

For the first time in a week, bonds are rallying across the curve. Like during the four-day downswing, it’s the long end of the curve that’s leading, this time to the upside. It’s hard not to draw a line between price action in energy prices and bonds these days, whereby the first meaningful downturn in crude oil prices (/CLZ3) is coinciding with the pullback in U.S. Treasury yields. Intuitively, then, the price action makes sense, insofar as inflation expectations are embedded in the long end of the curve.

Strategy (37DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 107.5 p Short 108 p Short 111 c Long 111.5 c | 52% | +218.75 | -281.25 |

Long Strangle | Long 107.5 p Long 111.5 c | 30% | x | -515.63 |

Short Put Vertical | Long 107.5 p Short 108 p | 80% | +125 | -375 |

Symbol: Metals | Daily Change |

/GCZ3 | -0.02% |

/SIZ3 | +0.59% |

/HGZ3 | +0.48% |

All eyes are on the Fed’s interest-rate decision and accompanying economic projections for gold (/GCZ3) and silver (/SIZ3) traders today. While gold prices are steady this morning, silver is moving higher. Still, big bets on the metals are likely to wait until after today’s announcement, which could dictate direction. If the Fed meeting isn’t enough, we still have rate decisions from the Bank of England and the Bank of Japan, due Thursday and Friday.

Strategy (36DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1930 p Short 1940 p Short 1980 c Long 1990 c | 31% | +670 | -330 |

Long Strangle | Long 1930 p Long 1990 c | 41% | x | -2,510 |

Short Put Vertical | Long 1930 p Short 1940 p | 65% | +400 | -600 |

Symbol: Energy | Daily Change |

/CLZ3 | -0.99% |

/NGZ3 | -2.60% |

U.S. natural gas prices (/NGZ3) are retreating this morning as the broader energy sector, including oil, declines. The commodity remains on track to record its best weekly gain since August, which may be dissuading traders from bidding prices higher, especially at a time when the weather is starting to cool across the country, reducing energy demand.

Strategy (36DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2.77 p Short 2.8 p Short 3.13 c Long 3.15 c | 25% | +190 | -110 |

Long Strangle | Long 2.77 p Long 3.15 c | 42% | x | -2,710 |

Short Put Vertical | Long 2.77 p Short 2.8 p | 59% | +120 | -180 |

Symbol: FX | Daily Change |

/6AZ3 | +0.46% |

/6BZ3 | -0.08% |

/6CZ3 | +0.08% |

/6EZ3 | +0.20% |

/6JZ3 | +0.01% |

Central banks are in focus for the next 48 hours—starting with the Fed this afternoon—which will impact all FX futures. Attention will then quickly shift across the pond tomorrow morning to the British pound (/6BZ3) and the Bank of England, which could levy a final rate hike this cycle. Friday morning in Japan, all eyes will turn to the Japanese yen (/6JZ3) and the Bank of Japan, where it is possible it will lay the groundwork for an exit of the central bank’s extraordinarily loose monetary policy.

Strategy (16DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0067 p Short 0.00675 p Short 0.00705 c Long 0.0071 c | 75% | +125.00 | -500 |

Long Strangle | Long 0.0067 p Long 0.0071 c | 13% | x | -137.50 |

Short Put Vertical | Long 0.0067 p Short 0.00675 p | 84% | +87.50 | -537.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.