Unlock Lower Fees with Smart Options Trading

Unlock Lower Fees with Smart Options Trading

By:Kai Zeng

The seemingly small investment costs for mutual funds and ETFs can mount up over time

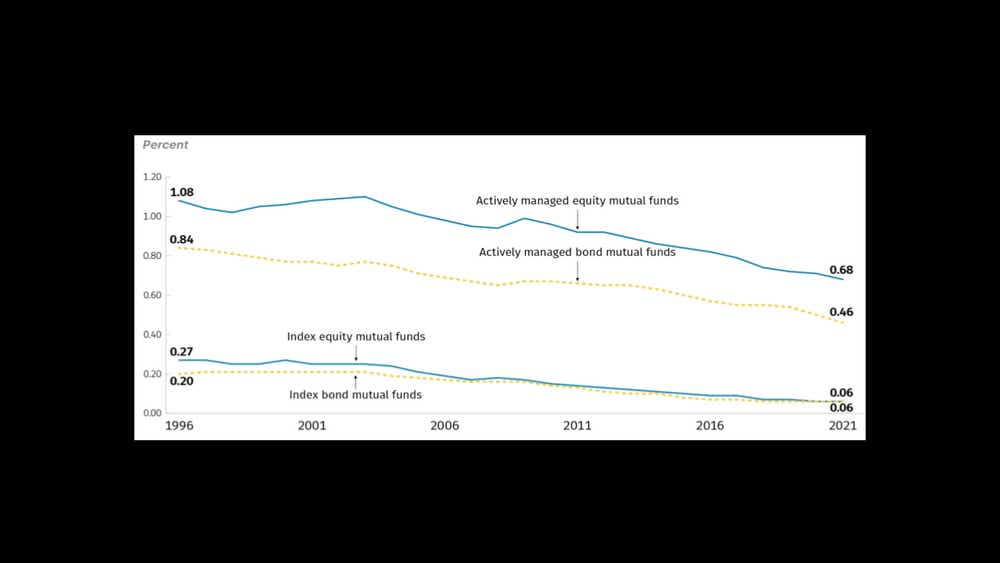

When considering investment strategies, understanding the costs associated with each option is pivotal. With the financial landscape offering a plethora of investment vehicles—from options to mutual funds and exchange-traded funds (ETFs)—making informed decisions requires a grasp of the associated expenses.

On the surface, investment costs for mutual funds and ETFs appear relatively low, with averages around 0.5% and 0.16% respectively. These numbers, though seemingly insignificant at first glance, can accumulate over time, influencing your overall investment returns. For instance, an investor placing $10,000 in a mutual fund with a 0.5% expense ratio will pay $50 annually in fees, while the same investment in an ETF with a 0.16% ratio costs only $16 per year, showcasing a notable difference in expense.

Diving deeper, the active management of investments through options trading presents an interesting alternative. Consider the strategy of selling S&P 500 ETF (SPY) 30-day puts over a 45-day cycle. Taking into account market conditions such as a volatility index (VIX) near the 15% average, this method yields intriguing results. When compared to the traditional buy-and-hold strategy, selling puts not only incurs lower costs than mutual funds but also competes closely with the low expenses of ETFs.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

In scenarios where large account traders utilize capped rates—say, $10 per leg—the cost benefits become even more apparent. Analyzing various account sizes and assuming full capital allocation to these puts, the consistent lower costs against the average ETF expenses highlight the efficiency of options trading in controlling investment expenses.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Focusing on long-term performance, allocating a portion of capital to strategic options trading, such as 25% into SPY puts, has historically outperformed the standard buy-and-hold approach in an SPY ETF, even with its low expense ratio of 0.0945%. This insight is backed by analysis over a 20-year period in a simulated $1 million account, revealing that the annualized expense ratio for a portfolio managed through options trading is, in fact, lower than that of a purely passive SPY strategy.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

In essence, while passive investment strategies are touted for their simplicity and lower upfront costs, the long-term analysis tells a different story. Active management, particularly through options trading, provides a viable pathway to reducing expenses and potentially enhancing overall returns. Whether you’re managing a substantial portfolio or just starting, understanding the impact of expense ratios and exploring efficient trading strategies could be key to maximizing your investment potential.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.