Stocks Face Perfect Storm of Macro Risk on FOMC, ECB and BOE Meetings: Macro Week Ahead

Stocks Face Perfect Storm of Macro Risk on FOMC, ECB and BOE Meetings: Macro Week Ahead

By:Ilya Spivak

Stock markets are at risk and the U.S. dollar may continue to recover against the euro and the British pound as the Federal Reserve, the European Central Bank and the Bank of England deliver policy updates.

- U.S. CPI inflation data may stir volatility, but key moves will likely wait for the Fed.

- Stocks may fall as the U.S. dollar gains if the FOMC sticks to the familiar policy script.

- Euro, British pound at risk if the ECB and BOE leave dovish policy bets unchallenged.

A mixed performance left financial markets without much progress last week.

Wall Street continued to idle, with the bellwether S&P 500 and the high-flying Nasdaq stock indices little changed. Treasury yields recovered a bit of lost ground after blistering losses in the previous week. Gold prices were similarly in correction mode, clocking in a loss.

The U.S. dollar scored a notable gain of 1%, building on the prior week’s advance. Crude oil prices fell for a seventh week in a row, dropping to a four-month low.

Here are the key macro waypoints for traders in the week ahead:

U.S. consumer price index data

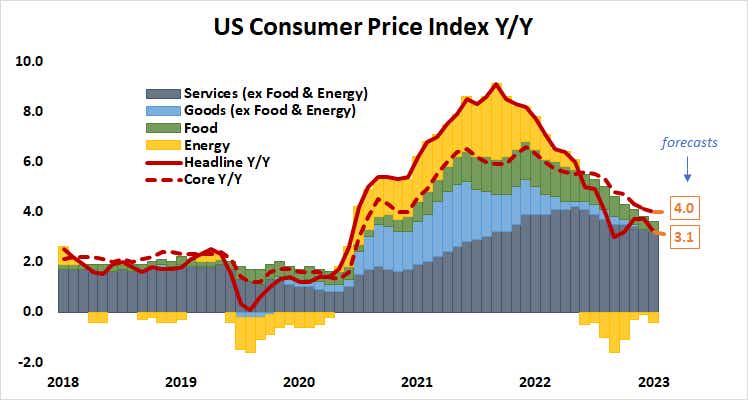

Inflation is expected to have edged a bit lower in November. The headline price growth rate is expected to be 3.1% year over year, the lowest since March 2021. Analysts expect the core measure excluding volatile food and energy prices—the focus for Federal Reserve policy makers whose main target are sticky service-sector prices–to hold steady at 4%.

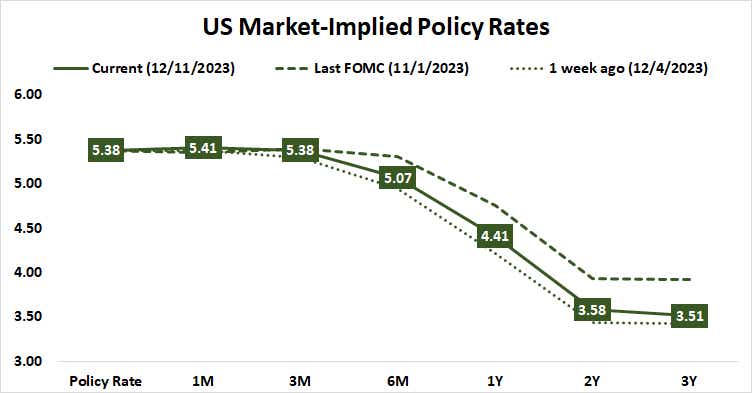

November was marked by a sharply dovish shift in monetary policy expectations. Investors now have the first 25-basis-point (bps) interest rate cut fully priced in for May and envision at least four of them by year-end. The implied probability of a fifth one—bringing the easing tally to 125bps—is at a hefty 45%. October’s soft CPI print helped bring this on.

Any deviation from established forecasts interpreted as endorsing or countering this shift is likely to generate volatility across financial markets. Follow-through and trend development may be limited however, with traders reluctant to show conviction before hearing from the U.S. central bank itself just one day later.

Federal Reserve monetary policy announcement

This week, the U.S. central bank’s policy-setting Federal Open Market Committee (FOMC) will deliver its final policy decision of 2023. The markets are thoroughly convinced that the target lending rate will remain unchanged. Fed Funds futures price in the probability of a change at this meeting at a mere 1.2%.

This puts the spotlight on updated economic and interest rate forecasts as well as the post-meeting press conference with Fed Chair Jerome Powell. Officials have showed with great effect how communicating through these channels can push markets to deliver on policy outcomes without interest changes in September and November.

Markets have shown that they’ve started to look through policymakers’ familiar disclaimers about the primacy of containing inflation and readiness to resume tightening if need be. Such rhetoric now seems baseline, with traders focusing on any marginal tone adjustment that might hint at the scope and timeline for incoming rate cuts.

Opting against changes in the forecasts or the commentary may be seen as a signal by itself, suggesting that markets have somewhat overreached. That could hurt stocks, bonds, and gold prices while nudging up the U.S. dollar.

European Central Bank (ECB) and Bank of England (BOE) meetings

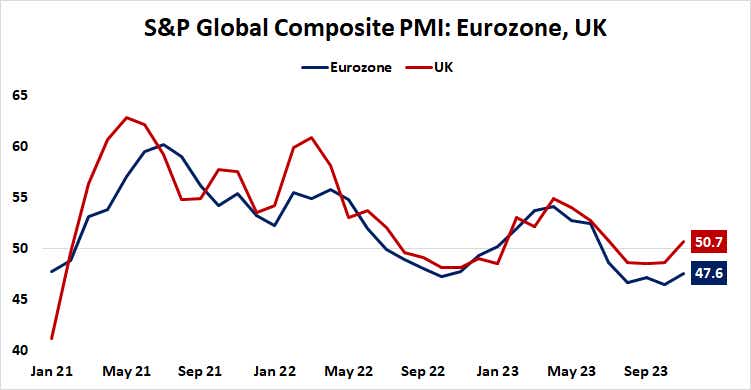

Policy announcements from Europe’s top central banks follow right on the heels of the FOMC. Both are expected to remain on hold while official communications set the stage for the start of an easing cycle. The markets see the ECB starting to deliver rate cuts by April. The BOE looks likely to join the fray in June, and no later than August.

Growth is anemic in both economies, though leading purchasing manager index (PMI) data suggests the UK managed to return to growth in November after three months of shrinking economic activity. The Eurozone remained in contraction mode for a fifth consecutive month in the meanwhile.

Against this backdrop, disinflation has picked up pace on both sides of the English Channel. The markets have repriced accordingly, with notable dovish adjustments in the priced-in policy path for the ECB and the BOE playing since each central bank’s last meeting.

The key consideration now is whether either of them is prepared to push back. Inflation expectations priced into the bond market – so-called “breakeven rates” – fell in October and November even as more rate cuts were being priced in. This means the ECB and BOE need not turn the screws on investors. That may hurt the euro and the British pound.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.