Expect a Weak Dollar in 2024 Unless Stocks Drop, Says an Economic Model

Expect a Weak Dollar in 2024 Unless Stocks Drop, Says an Economic Model

By:Ilya Spivak

The U.S. dollar will be weak in 2024 according to a famous economic model, but its fortunes might quickly change if volatility spikes and stocks retreat

- Unrivaled liquidity makes the U.S. dollar different from other currencies.

- Middling U.S. growth relative to G7 peers may spell trouble for the dollar in 2024.

- The strength of the dollar may explode if Fed rate hikes trigger a spike in volatility.

The U.S. dollar occupies a special place in the global financial system. Data from the Bank of International Settlements (BIS)—the so-called “central bank for central banks”—reveals in its tri-annual survey of foreign exchange markets that as of 2022, the currency accounted for 88% of the total average daily turnover of $7.5 trillion.

That makes the greenback uniquely liquid, even when compared to broadly traded counterparts like the euro or the Japanese yen. For traders, this makes for price action dynamics unlike most other currencies. They have been famously illustrated by a model developed by economists Stephen Jen and Fatih Yilmaz called the “dollar smile.”

Thriving on extremes: The dollar-smile model

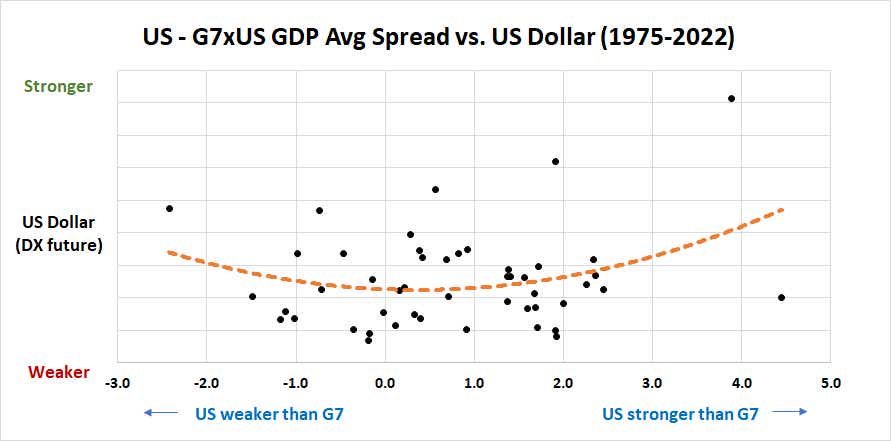

This framework ties the dollar’s performance to the relative strength of the U.S. economy against that of its peers. It reveals the currency tends to rise when U.S. growth either significantly leads or lags compared with average growth in the G7 economies (excluding the U.S. itself).

The right side of the chart tells a familiar story. When the U.S. economy is outperforming, brisk growth is bidding up inflation and pushing the Federal Reserve to raise interest rates. That expands the dollar’s yield advantage against its lagging counterparts and pushes it upward. This is the way most currencies tend to work.

The left side is where the dollar’s unique properties shine. The U.S. is the world’s largest economy. If growth there is lagging in a meaningful way, the knock-on effect on global growth at large is understandably damaging. It isn’t difficult to imagine that markets might turn defensive in such a scenario, with money flowing away from risky assets and toward safety.

It likewise follows that much of this “cashing out” tends to pour into the greenback. Its unrivaled liquidity means that it can absorb large-scale capital inflows with less volatility than the alternatives, which is a clear advantage at a time when investors are in flight mode. Its ubiquity also means that redeploying capital is easier after whatever scare subsides.

Either the dollar is in trouble, or stock markets are

Using this framework to map out where the dollar may be heading in 2024 produces ominous results. A Bloomberg survey of economists gives the U.S. an expected gross domestic product (GDP) growth premium of 0.78%. This lands squarely in the middling part of the smile chart, an area consistent with a weaker currency.

The lurking risk of a market shakeout may yet change this verdict.

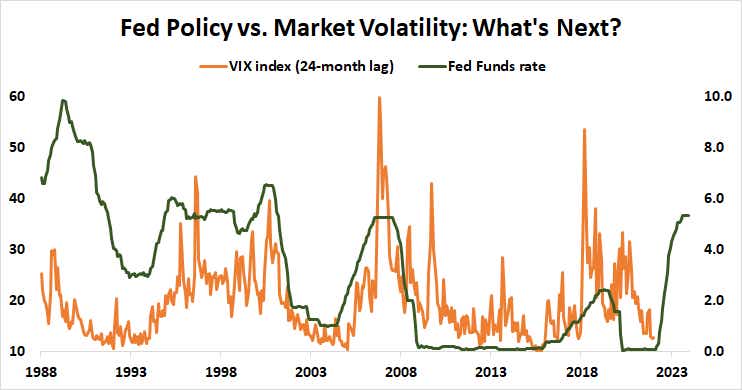

The modern financial and economic order has existed for just about four decades, emerging after the major currencies were untethered from gold convertibility. The VIX index of implied S&P 500 option volatility—investors’ so-called “fear gauge”—was launched in 1993.

Over the subsequent three decades, a sharp spike in the VIX has followed about two years after the start of a Fed tightening cycle. This echoes the central bank’s own estimate of 12-18 months for the economy to absorb a single hike. The latest rate hike cycle started in March 2022, putting the markets squarely in the danger zone as 2024 begins.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.