Macro Week Ahead: U.S. Retail Sales, RBA and BOE Rate Decisions, Global PMI Data

Macro Week Ahead: U.S. Retail Sales, RBA and BOE Rate Decisions, Global PMI Data

By:Ilya Spivak

Do stocks markets have anything left to celebrate after U.S. inflation data and the Federal Reserve policy update?

- Stocks may lose a key speculative tailwind as market pricing and Fed rate cut bets align.

- Central banks in Australia and the UK may signal diverging paths on interest rate policy.

- Traders may be looking for signs of global economic slowdown in June’s flash PMI surveys.

Financial markets were left with mixed cues from May’s U.S. inflation data.

The consumer retail (CPI) and wholesale (PPI) metrics came in softer than expected and a Federal Reserve policy update that shifted officials’ rate cut baseline through the end of next year to a less dovish setting by 20 basis points (bps).

Nevertheless, the markets opted for a mostly benign interpretation. Stocks and bonds tellingly rose as Treasury yields fell, though the U.S. dollar held its ground against major currencies and precious metals were notably muted. Cyclical crude oil and copper struggled for headway and bitcoin slipped to the bottom of a three-week range.

Here are the macro waypoints that are likely to shape price action in the week ahead.

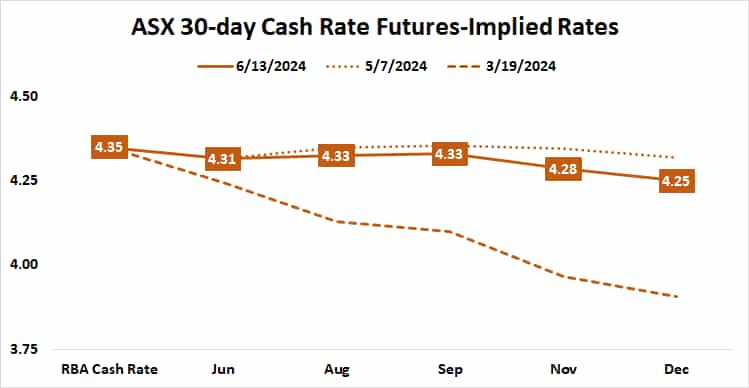

Reserve Bank of Australia (RBA) policy meeting

Australia’s central bank is expected to hold its target cash rate unchanged at 4.35% at June’s policy meeting. Interest rate futures markets have erased expectations for stimulus this year, pricing in just 10 bps of easing. That implies a less-than-even 40% probability of a standard-sized 25 bps reduction before the calendar turns to 2025.

Analytics from Citigroup show that Australian economic data has deteriorated relative to baseline forecasts in recent weeks and leading purchasing managers index (PMI) data suggested that the pace of economic activity growth ticked down in May to the slowest since February.

Nevertheless, the monthly and quarterly consumer price index (CPI) inflation figures have overshot analysts’ expectations since the beginning of the year even as disinflation has continued, arguing against a dovish rethink or still more rate hikes. This much is already priced in however and is unlikely to be especially market moving.

On balance, this means that an unexpectedly dovish turn in the language of the policy statement, anticipating slower growth ahead and setting the stage for the sooner onset of stimulus, is the most potent surprise risk at play. The Australian dollar is likely to drop if such a scenario plays out.

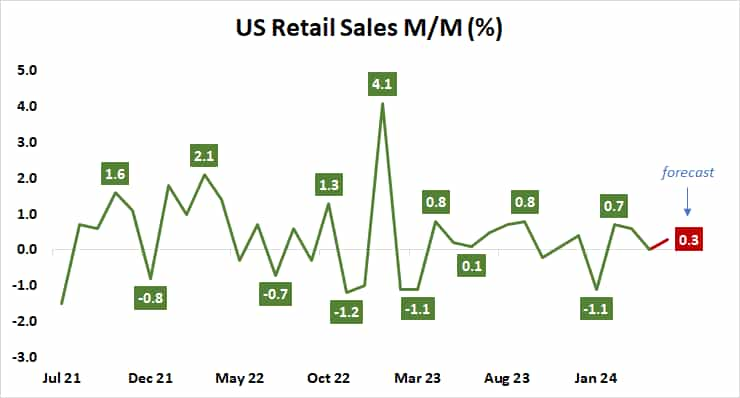

U.S. retail sales data

Receipts are seen rising 0.3% month-on-month in May, rebounding after a flat result in April and landing toward the middle of the range of outcomes seen over the past 12 months. Citigroup analytics put U.S. economic data outcomes on an improving path over the past three weeks, which may set the stage for an upside surprise.

The key question for the markets is whether such an outcome can drive active speculation on the path of Federal Reserve monetary policy. The priced-in outlook reflected in Fed Funds futures and June’s updated Summary of Economic Projections from central bank officials are now broadly in line, calling for five 25 bps cuts by the end of 2025.

On balance, an improbably sharp deviation from the baseline is needed to dislodge consensus in earnest. This might mean that stock markets’ most potent tailwind since mid-April–a dovish shift in the expected 2025 policy path–fizzled. That might set the stage for a downdraft on Wall Street after the numbers cross the wires.

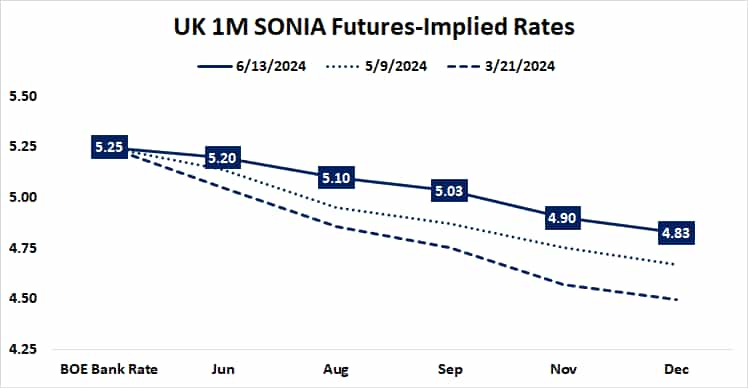

Bank of England (BOE) policy meeting

Analysts expect U.K. central bank officials to hold rates unchanged in June. The cumulative stimulus tally priced into interest rate futures calls for 42 bps in cuts, implying at least one 25 bps reduction and a 68% probability of a second one before year-end.

Incoming consumer price index (CPI) inflation data is expected to show price growth slowed to 1.9% year-on-year in May, the lowest since April 2021. However, sticky costs locked in the recreation and hospitality sectors–the biggest contributors to price growth in April–might take longer to work down than the markets anticipate.

Citigroup analytics show that U.K. economic data has markedly improved relative to forecasts recently. Warmer economic growth might mean that cyclical forces are tougher to squeeze out of the inflation calculus. If that makes for a BOE that is more reticent to cut than the markets anticipate, the British pound may rise as local stocks (ETF: EWU) decline.

Global purchasing managers index (PMI) data

The first look at June’s roundup of S&P Global PMI data will offer a sense of where the global business cycle is heading, and how major central banks might need to adjust rate cut plans in response.

Global economic data has been cooling relative to median forecasts since mid-April, according to Citigroup. Weakness is more pronounced in emerging markets versus the G10 space and centered on the Asia Pacific region. This means the area of greatest concern is also the global hub for the value-add middle step in the global supply chain.

This may be an early sign of a global economic downturn. If confirmation begins to appear in G10 PMI data, risk appetite may cool even as the case for stimulus grows amid recession fears. The Eurozone is a case in point: local stocks (ETF: EZU) have dropped since the European Central Bank (ECB) cut rates for the first time in five years earlier this month.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.