Nasdaq 100 Steps Back as Equity Rally Cools

Nasdaq 100 Steps Back as Equity Rally Cools

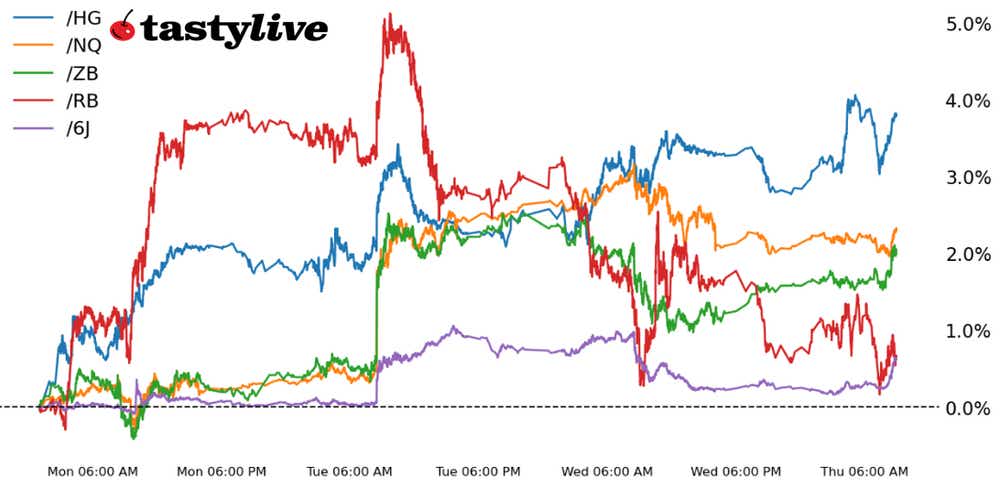

Also 30-year T-bond, copper, gasoline and Japanese yen futures

- Nasdaq 100 e-mini futures (/NQ): -0.20%

- 30-year T-bond futures (/ZB): +0.63%

- Copper futures (/HG): -0.30%

- Gasoline futures (/RB): -1.55%

- Japanese yen futures (/6J): +0.39%

Absent significant economic data releases or earnings reports, global financial markets are treading water once again on Thursday.

Equity index futures are modestly lower following Wednesday’s mixed session, although U.S. Treasury bonds are bouncing back. Perhaps the biggest catalyst for the rest of the week will be news from the Asia-Pacific Economic Cooperation (APEC) summit, where U.S. President Joe Biden and Chinese President Xi Jingping have been holding bilateral meetings to ensure the world’s foremost economic and military superpowers avoid confrontation across multiple arenas.

Symbol: Equities | Daily Change |

/ESZ3 | -0.07% |

/NQZ3 | -0.20% |

/RTYZ3 | -0.28% |

/YMZ3 | -0.16% |

Russell 2000 down the most

U.S. equity index futures are trading slightly lower on Thursday following a sideways, choppy session yesterday. After outperforming most of the day on Wednesday, the Russell 2000 (/RTYZ3) is leading to the downside. Earnings releases predicated around the health of the U.S. consumer have offered mixed views as well, with Macy’s (M) charging higher while Walmart (WMT) has slumped meaningfully.

Strategy: (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 15600 p Short 15700 p Short 16500 c Long 16600 c | 35% | +1150 | -850 |

Long Strangle | Long 15600 p Long 16600 c | 42% | x | -6480 |

Short Put Vertical | Long 15600 p Short 15700 p | 68% | +550 | -1450 |

Symbol: Bonds | Daily Change |

/ZTZ3 | +0.14% |

/ZFZ3 | +0.33% |

/ZNZ3 | +0.48% |

/ZBZ3 | +0.63% |

/UBZ3 | +0.79% |

Weaker jobs market

Weaker U.S. jobless claims are aligning neatly with the Federal Reserve’s desire to see a softer labor market, which further reduces the need of another rate hike this cycle. That said, Fed rate hike odds were zeroed out ahead of today. The focus is now on whether traders think a rate cut is necessary by March. The long end of the curve continues to be the biggest mover, with 30s (/ZBZ3) and ultras (/UBZ3) leading the way higher.

Strategy (36DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 110 p Short 111 p Short 119 c Long 120 c | 56% | +390.63 | -609.39 |

Long Strangle | Long 110 p Long 120 c | 28% | x | -1062.50 |

Short Put Vertical | Long 110 p Short 111 p | 81% | +203.13 | -796.88 |

Symbol: Metals | Daily Change |

/GCZ3 | +0.58% |

/SIZ3 | +1.98% |

/HGZ3 | +0.30% |

Copper futures rise

Copper futures (/HGZ3) rose for the fourth day this morning and are now on track to record the best weekly percentage gain since March after rate traders started to price in rate cuts as early as March. Protests at one of the world’s largest copper mines is also helping to support prices, with the Cobre Panama mine reducing output, according to First Quantum Minerals. The mine accounts for around 1% of global copper production.

Strategy (40DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 3.71 p Short 3.72 p Short 3.8 c Long 3.81 c | 16% | +212.50 | -37.50 |

Long Strangle | Long 3.71 p Long 3.81 c | 49% | x | -2950 |

Short Put Vertical | Long 3.71 p Short 3.72 p | 61% | +112.50 | -137.50 |

Symbol: Energy | Daily Change |

/CLZ3 | -1.57% |

/HOZ3 | -0.96% |

/NGZ3 | -0.88% |

/RBZ3 | -1.55% |

Gasoline prices (/RBZ3) fell alongside oil this morning as traders continued to digest yesterday’s inventory numbers that showed a 3.6-million-barrel build in oil stocks for the week ending Nov. 10, and +13.9 million for the week ending Nov. 3.

While it showed that gasoline inventory decreased for the prior two periods. A recent change in the way the Energy Information Administration (EIA) accounts for products has left traders unsure if that is due to increased demand. Usually, at this time of year, gas stations stock up their tanks to prepare for holiday driving demand, which likely accounts for part of the draw.

Strategy (xDTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | x | x | x | x |

Long Strangle | x | x | x | x |

Short Put Vertical | x | x | x | x |

Symbol: FX | Daily Change |

/6AZ3 | -0.20% |

/6BZ3 | +0.12% |

/6CZ3 | -0.27% |

/6EZ3 | +0.28% |

/6JZ3 | +0.39% |

The Japanese Yen (/6JZ3) rose again as trader remained cautious about a possible intervention from the Bank of Japan. While that was suspected earlier this week when a sharp rally occurred, it appears driven more by options traders than by a move from Japan. For now, it appears that the BoJ has gained credibility and that short speculators aren’t willing to challenge the bank, which has seemingly created an artificial floor for the currency. However, with a large volume of options expiring next week, this may not be a long-lasting phenomenon.

Strategy (22DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.00645 p Short 0.0065 p Short 0.0068 c Long 0.00685 c | 77% | +87.50 | -537.50 |

Long Strangle | Long 0.00645 p Long 0.00685 c | 11% | x | -112.50 |

Short Put Vertical | Long 0.00645 p Short 0.0065 p | 94% | +31.25 | -593.75 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices