Adobe Earnings Preview — $30 Stock Price Move Expected

Adobe Earnings Preview — $30 Stock Price Move Expected

By:Mike Butler

Will the company avoid another disappointment like the sell-off that occurred after last quarter’s strong report?

- Adobe is scheduled to report quarterly earnings after the market closes Thursday.

- The company is expected to announce earnings-per-share of $4.97 on $5.66 billion in revenue.

- Last quarter, its stock crashed over 13% after earnings.

- The executive team will look to right the ship on Thursday, with AI initiatives in focus.

Last quarter, Adobe (ADBE)released a strong earnings report, beating earnings-per-share (EPS) and revenue estimates. But the company’s stock sold off over 13% the following trading day. This quarter, Adobe is expected to announce EPS of $4.97 on $5.66 billion in revenue. If it can post another strong quarter, it will be interesting to see if the market digests it positively or negatively. The stock price opened the year at $447.76, and it currently sits around $418 per share, down over 6% on the year. With that said, the stock has recovered mightily from the low print of $332.01 realized in April.

Many believe the stock sold off last quarter after strong earnings because AI initiatives were slipping and because Adobe may be losing out to competitors. Those sentiments certainly didn’t arise from commentary by the executive team after the earnings announcement in March.

An fact, Adobe CEO Shantanu Narayen praised the company and expressed optimism about its future last quarter: “Adobe’s success over the next decade will be driven by customer-focused innovation and new offerings for creators, marketing professionals, business professionals and consumers ... Adobe is well-positioned to capitalize on the acceleration of the creative economy driven by AI and we are reaffirming our FY2025 financial targets.”

Dan Durn, CFO of Adobe, had similar thoughts: “Our continued innovation and diversified go-to-market strategy drove a record Q1, with new AI-first standalone and add-on innovations exiting the quarter with over $125 million ending ARR book of business...Our customer- focused strategy, leading product portfolio and strong cash flow position us for sustainable long-term growth and increased market share.”

As it stands, ADBE stock is right in the middle of the trading range for the year. It's recovered well from the low, but Adobe has another hill to climb in the earnings report coming out Thursday.

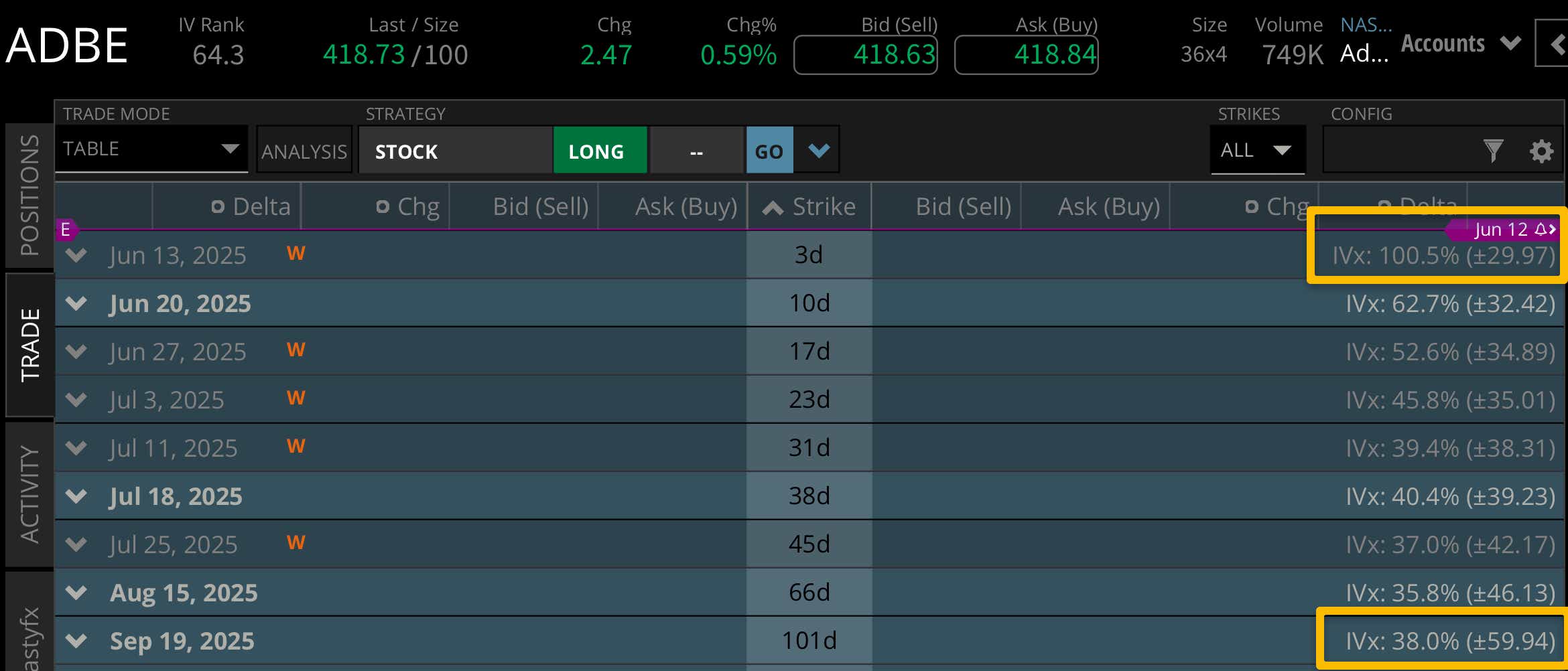

Looking at the implied volatility of the options market can help us put context around this upcoming binary event. We're looking at a +/- $29.97 stock price range based on current implied volatility for this week. This is about 7% of the notional value of the stock price, which is a decent implied volatility level for a tech giant like Adobe.

Looking to the September options cycle over 100 days out, we see a +/-$ 59.94 implied range. This is even more telling because this week's implied range makes up 50% of the expected range for the next 100 days. The market is placing a large weight on this earnings announcement and we should expect to see some choppy moves after the earnings call.

Bullish on Adobe stock for earnings

If you're bullish on Adobe for earnings, you want to see a strong earnings report and strong guidance for the rest of the year. If investors and traders sold Adobe stock after the last earnings call in fear of losing AI traction to competitors, you'll want to hear more positivity in that regard from the executive team this time around.

Bearish on Adobe stock for earnings

If you're bearish on Adobe stock for earnings, you want to see an earnings miss and weak guidance. This could send the stock price back to the lower end of the trading range for the year, especially since it's had such a strong climb back from lows over the past month.

Tune in to Options Trading Concepts Live on Thursday at 11 a.m CDT for a deeper look at Adobe earnings options strategies ahead of the announcement after the close.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices