Automakers Seeing Some Volatility

Automakers Seeing Some Volatility

And ... August inflation report and The tastylive NYC Master class

- On Sept. 9, Tom Sosnoff and Jermal Chandler delivered an intense two-hour event covering eight strategic investment topics.

- This week's August CPI may show that economic fears have turned from inflationary to recessionary.

- The potential United Auto Workers strike could lead to some volatility and movement in auto manufacturers.

There is no city on earth with the electricity and the buzz that New York city offers. The boroughs, the pizza, Times Square, Lady Liberty—the Big Apple has it all.

There was even an extra special energy in the city last week with so many big events occurring. New York Fashion Week was apparent all over the city with several models taking alfresco photographs. There also were lots of sports as the NFL kicked off and The U.S. Open concluded with Coco Gauff and Novak Djokovic taking home the top prizes. Spoiler alert: I was rooting for both players.

Another incredible event occurring in New York last week was the third installment of the collaborative effort between tastylive and Cboe Global Markets. Tom Sosnoff and I performed at The Racket NYC to deliver The Master Class for the Unlucky Investor to a sold-out crowd. The content for this educational event is nothing short of difficult to digest. It was purposefully created that way. Many in the crowd might have left with more questions than they arrived with, but I believe that's a good thing.

The Master Class attempts to arm the listener with all the background behind why options are so powerful. If you come to the next one in Los Angeles, you will see what I mean. Often, new traders are trying to figure out how they can turn their idea into a trade. However, it never occurs to them that they could have the right idea and the right trade but can still be wrong. That's the beauty of the event. Keep that in mind the next time you're looking to make a trade on Fed day.

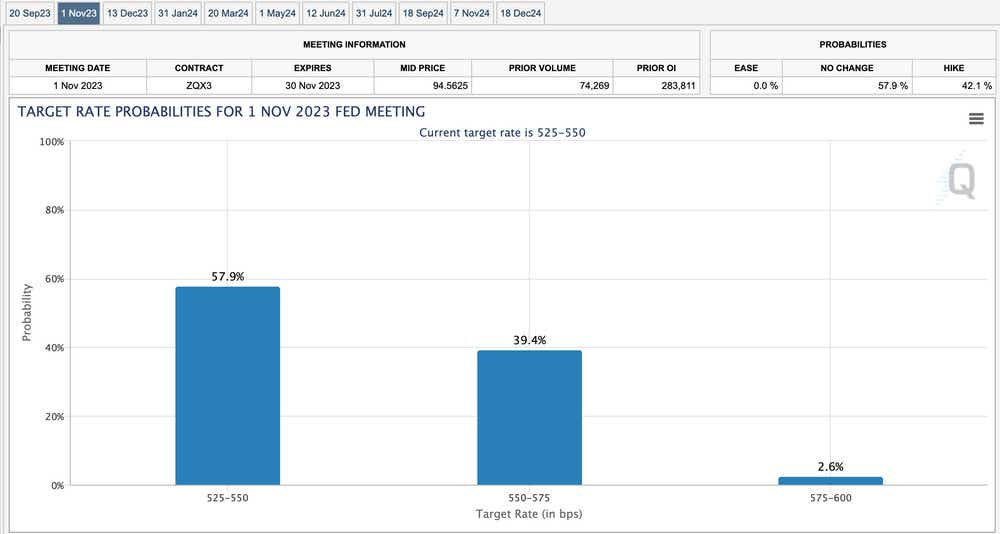

Speaking of macro events, this week will provide a major one as Wednesday's August consumer price index report will is likely to show that after a summer of better news on inflation, consumer prices are back on the rise. Traders expect the Fed to stay on hold at next week's meeting and calculate a roughly 42% chance that the central bank will deliver a hike in November.

Finally, keep an eye on General Motors (GM), Ford (F) and Stellantis NV (STLA) as they are facing a contract deadline just before midnight on Sept. 14 for nearly 150,000 U.S. hourly workers. We are already seeing near-term volatility expectations rise and if things don't go as planned, we could witness a market-moving economic event.

Jermal Chandler, tastylive head of options strategy, has been in the market and trading for 20 years. He hosts Engineering the Trade, airing Monday, Tuesday, Thursday and Friday. @jermalchandler

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.