BOE Preview: End of Rate Hikes May Lift U.K. Stocks, British Pound

BOE Preview: End of Rate Hikes May Lift U.K. Stocks, British Pound

By:Ilya Spivak

The Bank of England appears likely to keep rates unchanged and signal the end of its hiking cycle this month. That may support U.K. stocks and the British pound.

- The Bank of England is keeping rates on hold and follow the European Central Bank’s signal of the end of the hiking cycle.

- Sticky inflation is ebbing amid a U.K. growth slump, and some see cuts by September 2024.

- U.K. stocks and the British pound might benefit as risk-seeking capital rotates.

The Bank of England (BoE) looks set to follow the European Central Bank (ECB) into the end of interest rate hikes.

The U.K. central bank is expected to keep its target rate on hold this month, as will its cousin on the Continent. A deep economic downturn appears to give cover to Gov. Andrew Bailey and company to end the fight against inflation and refocus on growth.

The probability of a rate increase at November’s conclave is just 4.6%. The likelihood of another hike in this tightening cycle tops out in February 2024 at 36%, implying that investors assign better than even odds to rates having already peaked. The first cut is priced in by September but could arrive as soon as August. The chance of that outcome is penciled in at over 63%.

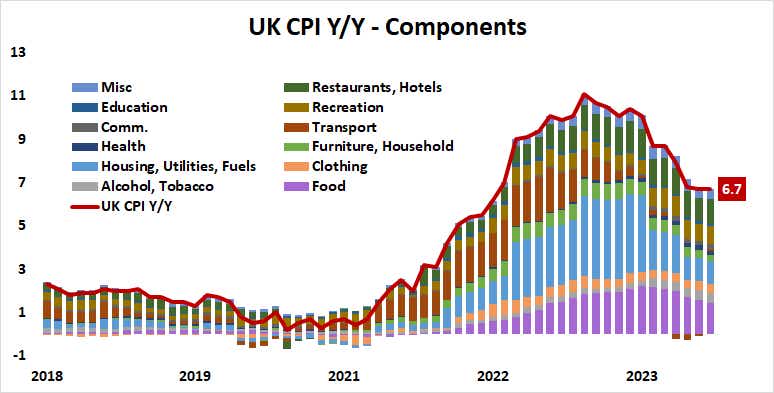

U.K. inflation: pressure continues to ease

October’s round of leading purchasing managers’ index (PMI) data showed the economy shrank for a third consecutive month. Meanwhile, food prices remain the biggest contributor to consumer price index (CPI) inflation. Monetary policy can’t do much about that. Base effects ought to keep driving fuel cost disinflation, however while a deepening economic downturn breaks down the uplift from discretionary spending.

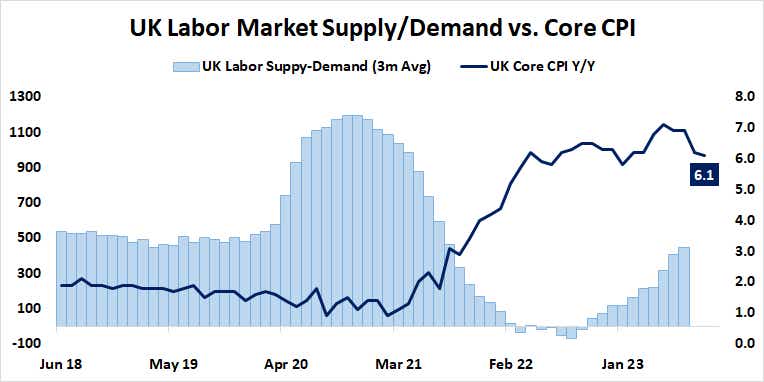

At the same time, progress is being made on the sticky component of inflation locked up in the labor market. The supply-demand balance there continues to unwind a shortage of workers. The shortfall peaked in August 2022 and a surplus has been building thereafter. It registered a two-year high in July, the latest month of data.

U.K. stocks and British pound may benefit from dovish BoE turn

The policy statement and the press conference with Mr. Bailey thereafter will probably stress officials’ intent to hold rates at the cycle high for now to anchor expectations. At the same time, they are likely to hint that the bias has shifted to timing the next rate cut, as opposed to the next hike.

U.K. stocks will probably like that, cheering the prospect that monetary authorities are turning a corner and relief is coming closer into view. The British pound may find a way higher as well, shrugging off the dovish adjustment as capital flows search for bargains in battered corners of the markets where a policy pivot seems closest to delivering a lifeline.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices