Homebuilders are Running Hot as Interest Rates Peak

Homebuilders are Running Hot as Interest Rates Peak

Prices should persist despite higher mortgage rates

- The decline in U.S. Treasury yields proves to be a tailwind for U.S. homebuilders.

- ITB is up 4.88% this week.

- Low housing inventory and elevated U.S. mortgage rates mean the supply issue is unlikely to be solved anytime soon.

The bond sell-off in August proved disruptive for many segments of financial markets, especially for new homebuyers, which saw U.S. mortgage rates jump above 7% for the first time in over two decades. But now that there is evidence coming together that U.S. Treasury yields may have reached a near-term peak, interest rate-sensitive assets are shaking off the rust and surging higher.

Before we get to the increasingly bullish technical setup in U.S. homebuilders, it’s worth a review of the housing market situation (building on a recent note from head of global macro, Ilya Spivak).

Will the housing supply improve soon? Unlikely

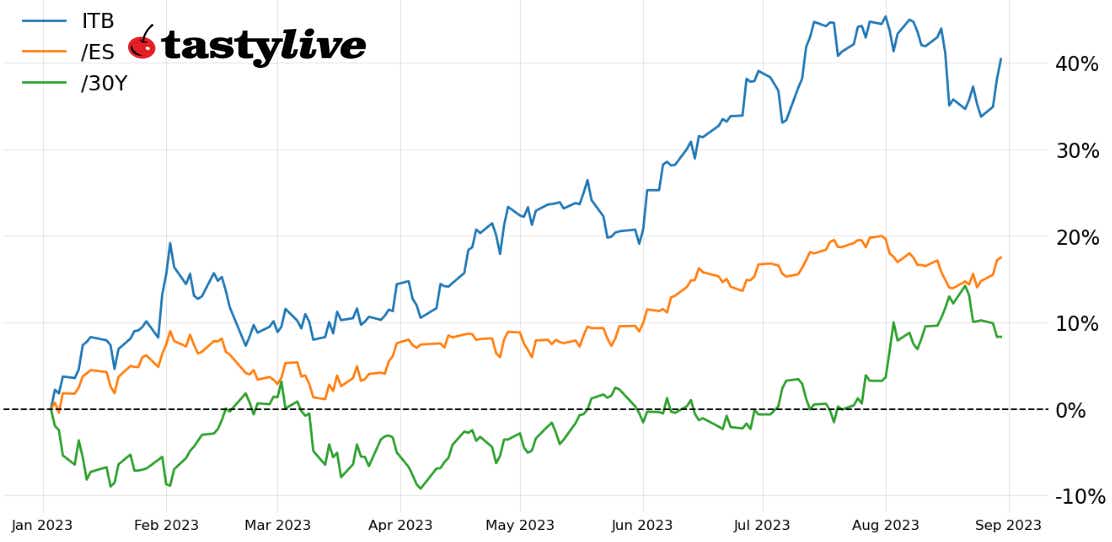

One of the main reasons the iShares U.S. Home Construction ETF (ITB) and homebuilders have had so much success in 2023–outpacing the S&P 500 (/ES) by +21.30% year-to-date, even as the U.S. Treasury 30-year bond yield rose from 3.938% to 4.234% and U.S. 30-year fixed mortgage rates rose from 6.48% to 7.23%—is a severe lack of housing supply.

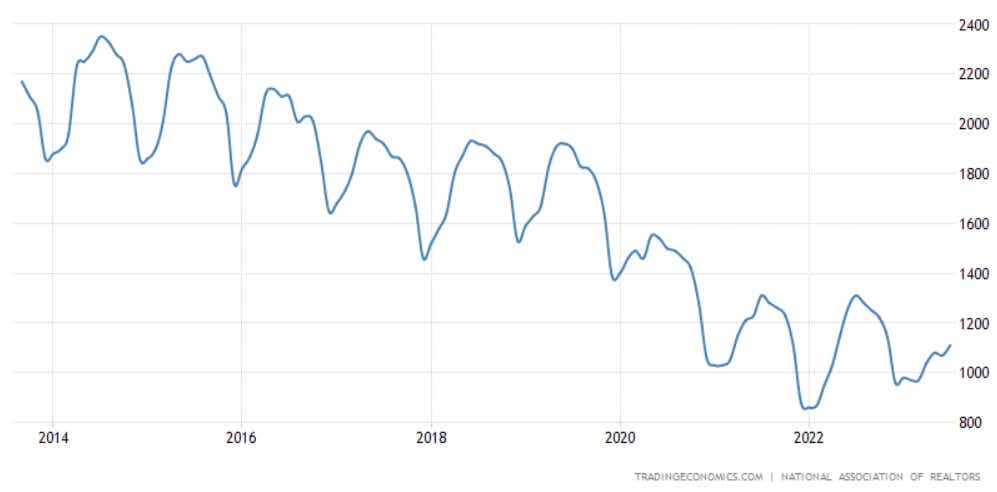

Total housing inventory in the United States is barely off multi-decade lows, according to the National Association of Realtors (via TradingEconomics).

And thanks to the wide divergence between the effective interest rate on outstanding mortgage debt and the 30-year fixed mortgage rate–3.60% versus 7.23%, respectively—active listing levels remain near historical lows as well, according to Realtor.com (via FRED).

Supply is constrained, and it’s highly unlikely that enough dwelling units will be constructed over the next few years to fix the supply/demand imbalance.

Back to the trade. Look no further than the price action in homebuilders this week.

ITB technical analysis: daily chart (October 2022 to August 2023)

ITB has added 4.88% this week alone, at the time this note was written. In doing so, it has maintained its uptrend off the October 2022, April 2023, May 2023, and June 2023 swing lows. ITB is trading above its daily 21-EMA (one month moving average) for the first time since Aug. 16. Momentum has started to firm up, with MACD nearing a bullish crossover (albeit below its signal line) and slow stochastics jumping out of oversold territory.

The yearly high at 89.65–and beyond–is very much in reach, assuming bonds continue to bottom; the rolling one-month correlation between ITB and /ZB has been greater than +0.50 since Aug. 18.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.