China is Weaker Than Local Stock Markets Show. Here is How to Trade It.

China is Weaker Than Local Stock Markets Show. Here is How to Trade It.

By:Ilya Spivak

Stock markets in China have rebounded but the world’s second-largest economy still looks weak.

China’s economy remains weak despite a rebound on local stock markets.

Beijing’s monetary and fiscal stimulus efforts are failing to revive momentum.

The Australian dollar offers a trading outlet as May PMI reports approach.

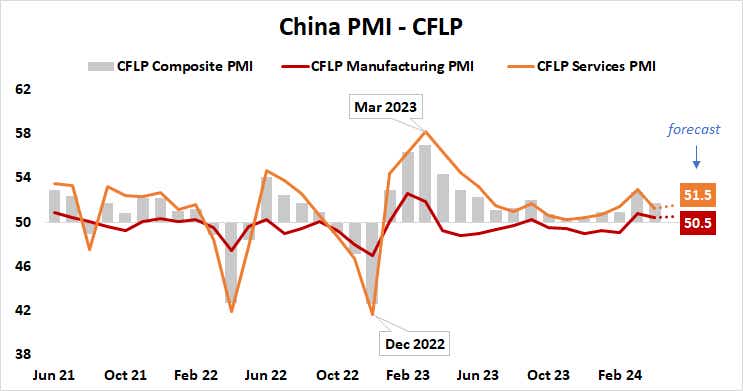

Economic activity in China accelerated this month, according to baseline forecasts for the May edition of official purchasing managers index (PMI) data from the China Federation of Logistics and Purchasing (CFLP) due this week.

Analysts expect growth to tick higher in both the manufacturing and the services sectors. Nevertheless, the pace of expansion is penciled in at barely-there levels.

An upswell of service-sector activity and a return to expansion mode for manufacturing in March looked promising, but momentum seemed to fizzle in April. In May, the world’s second-largest economy looks set to continue limping along without much of a tailwind.

Analytics from Citigroup warn that–despite a mixed bag of releases in recent weeks–the overall trend in China’s economic data outcomes has been toward deceleration relative to consensus forecasts since mid-April. That may set the stage for still softer results than market-watchers are already anticipating.

China’s economy is still struggling

Prospects for a lasting pickup appear dim as stimulus efforts falter. Data from the People’s Bank of China (PBOC) shows that credit growth cratered in April. Total financing fell nearly 106% year-over-year, marking the biggest decline since 2005. That’s echoed in loan growth of just 9.6% year over year, also the lowest in 19 years.

China’s quarterly gross domestic product (GDP) data doesn’t easily isolate the contribution of direct government spending to economic growth, but weakness in the overall data speaks to a lackluster fiscal effort. Real GDP growth has outpaced nominal expansion for four consecutive quarters, with a gap of about one percentage point on average.

This points to a negative coefficient on the inflation input into the GDP calculation, which implies near-absent demand. Normally, a healthy economic appetite bids up prices as would-be consumers compete for a limited supply of goods and services. By contrast, falling prices hint at discounting to entice uptake and clear inventories.

The response from global investors seems unmistakably negative. Data from the Ministry of Commerce (MOFCOM) shows that foreign direct investment fell 27.8% year-on-year last month, marking the largest monthly drop since at least 2015. Local stocks have risen since February, but cross-border stock connect volumes are stuck in a three-year range.

Looking past stocks to trade China’s troubles

Against this backdrop, the rise on Chinese bourses in recent months may be the work of the so-called “home team."

Beijing directed the investment arm of the sovereign wealth fund to load up on domestic shares early in the year. For most (if not all) traders, fighting an official buying program seems like a losing battle.

Trading the Australian dollar

The Australian dollar offers an alternative trading vehicle to express a view on Chinese economic weakness outside the politburo’s purview. It may be carving out a bearish head and shoulders (H&S) pattern having failed to hold after an attempted break above four-month range resistance.

Completing the pattern would call for establishing a foothold below the 0.66 figure. If that transpires, the measured move objective on the downside implied by the H&S structure targets a decline below the 0.65 mark. Invalidating the downside bias probably demands retaking the 0.67 level.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.