Stocks in China are Sailing Higher, But the Economy is Still in Trouble

Stocks in China are Sailing Higher, But the Economy is Still in Trouble

By:Ilya Spivak

China’s stocks are rebounding and some positive signs of post-COVID progress have truly emerged, but the economy still looks woefully anemic.

- China’s stock market is racing to recover from February’s five-year lows

- Some post-COVID progress is truly on display and risk appetite is firming

- Incoming data likely to warn that the economy remains woefully anemic

The stock market in China seems to be coming back to life. The CSI 300 benchmark index tracking the top names on the country’s bourses in Shanghai and Shenzhen has rallied 16% since hitting a five-year low on Feb. 2.

February marked the largest monthly increase November 2022 with a gain of 9.35%. Another 2.3% has been added so far in March.

China’s markets have vastly underperformed since global stocks began to recover in late 2022 after suffering broad-based losses against a backdrop of rapid interest rate hikes that year as global central banks battled runaway inflation.

The ETF tracking the MSCI All-Country World Index (ACWI) is up 40% since October 2022. The one following CSI 300 (ASHR) is down 8% over the same period.

China’s stock market: signs of life

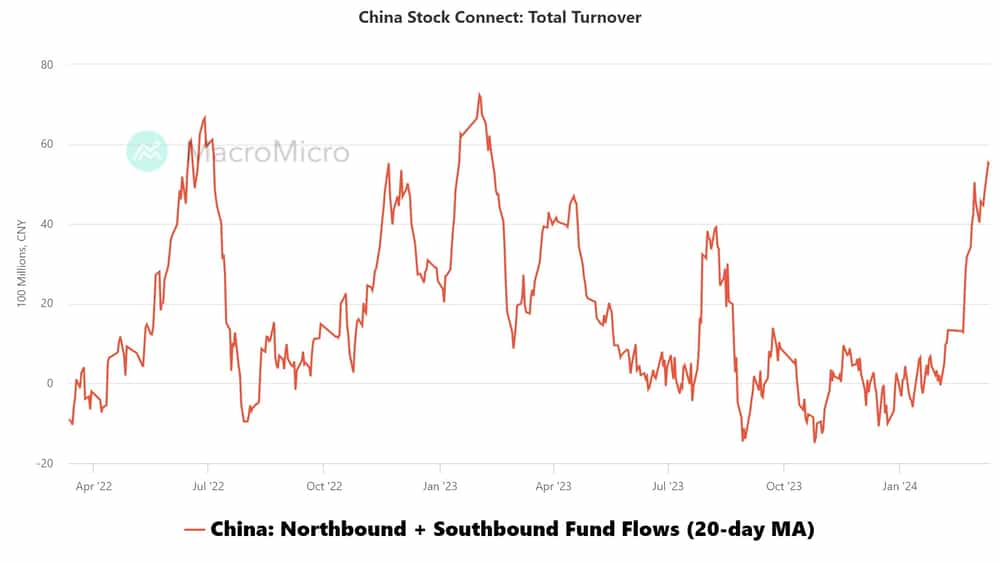

Surging trade turnover on China’s stock connect – a system linking mainland markets with that of Hong Kong and allowing investors on one end to trade directly on the other – underpins the appearance of returning risk appetite.

Hong Kong Exchanges and Clearing Limited (HKEX), the owner of Hong Kong’s stock exchange, reports that average monthly flows have jumped to the highest in a year.

Tepid signs of economic progress have emerged in earnest. The latest set of official purchasing managers index (PMI) data suggests the pace of contraction in the manufacturing sector has steadied while growth in services is cautiously accelerating, hitting a five-month high in February.

House prices fell for a seventh consecutive month in January, but the pace of decline is showing signs of anchoring. Value-add industrial activity has picked up.

Nevertheless, economic data due to cross the wires in the days ahead may cool optimism. Credit growth, industrial production and retail sales are all expected to have slowed last month.

Analytics from Citigroup suggest Chinese economic data outcomes have converged on forecasts, implying results broadly in line with soggy expectations are likely.

China’s economy: still struggling

Meanwhile, real gross domestic product (GDP) growth has outpaced the nominal side for three quarters straight, implying an eye-watering deflationary gap of about 1.5%.

Evaporating pricing power speaks to the anemic demand, suggesting the world’s second-largest economy remains in dire straits.

In early February, Central Huijin, the investment unit of China Investment Corp, the country’s sovereign wealth fund, said it plans to expand purchases of locally listed ETFs.

Shortly thereafter, official media outlets reported that China Securities Regulatory Commission chair Yi Huiman was removed from his post, as if to signal regime change.

This hints that at least some of the recent buoyancy in Chinese markets owes to government-directed buying. A run of sluggish economic data outcomes may not necessarily upend progress if the so-called “home team” keeps prices marching higher, but it would highlight a pointed concern about the move’s sustainability. Buyer beware.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit

tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account, today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.