Copper and Yuan Flash Recession Signal to Global Markets

Copper and Yuan Flash Recession Signal to Global Markets

Copper prices fall to a multi-month low. Yuan weakness is a clue.

- Copper prices fall to the lowest level since June.

- China's weakening yuan underscores lower demand for the red metal.

- Technicals turn bearish.

Copper prices (/HG) fell about 6 cents, or 1.61%, to trade around 3.6655 per pound on Tuesday, trading to the lowest level since early June and deepening a three-week selloff.

The current weakness is part of a broader unwinding in the red metal from January. The move's strength is also notable; the month-to-date performance is -8.5%. That is the biggest monthly decline since June 2022.

What's with copper's weakness?

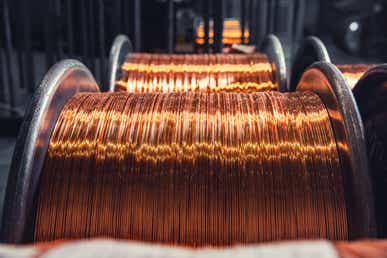

Several things are driving down the price of copper. The metal is typically seen as a proxy for global economic health, explaining its nickname as Dr. Copper. That is due to copper’s heavy use in industry while not being used as a traditional store of value, such as gold or silver.

So, what is up with copper? We need only look to China to tell us part of the story. The world’s second-largest economic engine has fueled its growth via construction and urbanization over the past decade, which requires a lot of copper. Now, many believe that China’s growth will continue to slow.

The central authorities are fighting to stimulate the lackluster activity to counter the slowdown. Earlier this week, the People’s Bank of China (PBOC), which is like the Chinese version of the Federal Reserve, cut its key lending rates. Those rate cuts aim to spur credit growth, although loosening the credit supply doesn’t do much if the demand isn’t there.

The Chinese yuan is one indicator we can look at besides copper to see that the market isn’t really buying the Chinese revival story. The yuan ($CNH) weakened past 7.3231 on Tuesday, putting it at the weakest since late last year. At the same time, Chinese officials have moved to limit economic data that has traditionally been readily available to markets. That isn’t really something you do to inspire confidence. The yuan’s surrender to the dollar over the past several weeks reinforces the signal copper is sending.

Speaking of the dollar, the U.S. currency has pivoted higher over the last few weeks following a broader decline that was driven by markets anticipating the Federal Reserve was done hiking rates. The broad-based DXY Index—which measures the currency against a basket of peers, including the euro and Swiss franc—rose over 3% over the last five weeks.

That greenback's strength makes copper more expensive for buyers outside the United States, and China is a big buyer. Should investors apply the same signal to the global economy? That much isn’t clear, as other major economies, like the U.S., are heavily service-based and still performing well. Altogether, however, it doesn’t bode well for the economic outlook.

What to watch in the week ahead for copper traders

- Euro Area Q2 GDP Growth Rate

- U.S. building permits (July)

- U.S. FOMC minutes

- Japan inflation rate (July)

Copper technical outlook

Prices are testing the 78.6% Fibonacci retracement level from the May to July move. A breakdown could leave the recent selling uninterrupted. The metal is also trading below all its key moving averages, including the 200-day simple moving average (SMA) shown on the chart. There is currently little confidence for bulls to step into the ring.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.