Corn and Wheat Prices Outlook 2023: Trading Opportunities Ahead?

Corn and Wheat Prices Outlook 2023: Trading Opportunities Ahead?

Agricultural markets, much like the energy market, experienced unusually high volatility in 2022 as much of the world came out of the Covid pandemic. Meanwhile, the war in Ukraine—another significant cause of volatility—rages on, although its effects on markets have diminished. What do corn and wheat have in store for traders in 2023?

Although demand-side forces affect agricultural prices, corn and wheat are major staples in the world’s food supply chain. Because of that, demand remains consistent from year to year. However, higher interest rates have strained consumers, who may opt to be more conservative in their spending on food items in 2023.

Supply is the major variable that affects prices for these products, and nothing impacts supply more than the weather does.

Corn Market Forecast 2023:

Corn, like other crops, requires adequate weather conditions to grow—precipitation, temperature, and humidity are among the most crucial factors to forecast, albeit difficult ones. Among the most detrimental to crop yields is a lack of rain. The US is the largest corn consumer, producer, and exporter globally.

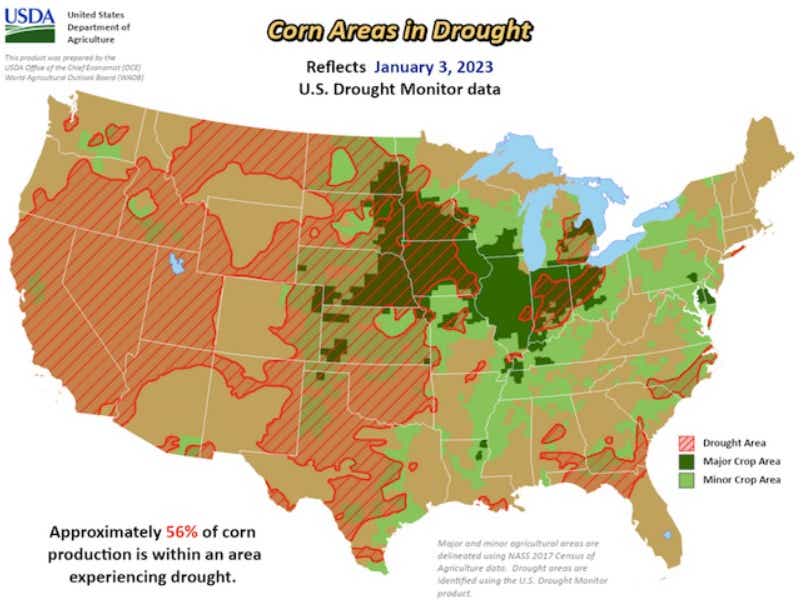

The U.S. corn crop started 2023 off with around 56% of its area in drought, according to the United States Department of Agriculture (USDA). That is higher than general drought conditions were at the start of 2022, around 46%. U.S. corn is planted from April to May and harvested from August to October. Weather conditions during that period, especially in the first half of the season, dictate crop yields.

Corn prices ended 2022 at $6.70 per bushel, increasing around 13% for the year. The World Agricultural Outlook Board (WAOB) expects the 22/23 season-average price (SAP) to drop to around $5.70 per bushel. The lower price estimate is based on an increase in expected harvested acres of 84.1 million, with each acre producing about 5.5% more bushels than the prior year.

Potential Trades on Corn and What to Keep an Eye On

Given the higher production estimates and the impact of interest rates on consumers, a move lower in corn prices for 2023 represents a logical outlook. However, severe weather events can cause volatility in the corn markets, which could present trading opportunities regardless of direction.

Corn is one of the most traded futures contracts in the world, offered as a full-size (/ZC) or mini contract (/XC). Outside of purely directional speculative plays, investors use corn as an inflation or deflation hedge. Remember, because crop conditions are impacted by weather, corn prices are most volatile during the growing season (April to October). Higher liquidity is also a benefit during the planting and harvesting season because producers are hedging in the market.

Since markets expect the Federal Reserve to cut rates later this year, buying corn amid a devaluing US Dollar is one way to play an inflation strategy. A major storm system could cause prices to rise simply due to the uncertainty of how it will impact crop conditions. That could increase volatility, making a strategy to sell premium attractive.

Seasonal factors are also a principal factor to consider for traders. Corn prices typically fall around harvest time, given a large amount of supply hitting the market. Traders should also watch the weekly and monthly reports from the USDA, which cover supply and demand estimates and crop conditions.

Wheat Market Forecast 2023:

Despite a volatile year, wheat finished at around $7.76 per bushel in 2022, which was around 2% higher from the start of the year. Russia’s invasion of Ukraine and resulting Western sanctions caused prices to swing wildly during the year, but an export deal that allowed grain exports from Black Sea ports cooled the uncertainty in the market.

That said, the conflict is ongoing, and the deal securing exports remains fragile until the war ends. Wheat prices are much more vulnerable to that than the price of corn, making it vital for wheat traders to monitor. An escalation from either side could push prices higher, especially if the export corridor in the Black Sea is threatened. Unlike corn, wheat has multiple growing seasons, leaving the potential for more volatility throughout the year.

Like corn prices, the weather is a driving factor for wheat. The USDA forecasts a price of $9.10 per bushel for the 2022/23 season. Currently, prices are around $7.43. While the USDA sees bushels per acre rising to 46.5 million from 44.3 million, the total harvested area is expected to fall to 35.5 million from 37.1 million the year prior. That results in a lower total supply of the crop, helping to explain the price forecast.

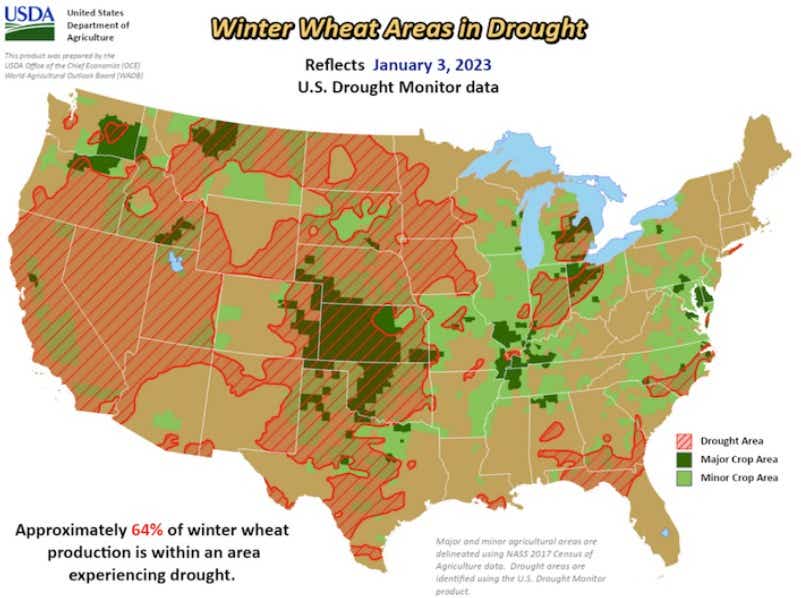

Currently, 64% of the U.S. wheat area is in drought, according to the USDA. If that number stays high come March, when the first planting is typically done, it could spell trouble for crop yields and push prices higher.

Spread Trade the Price Difference Between Wheat and Corn

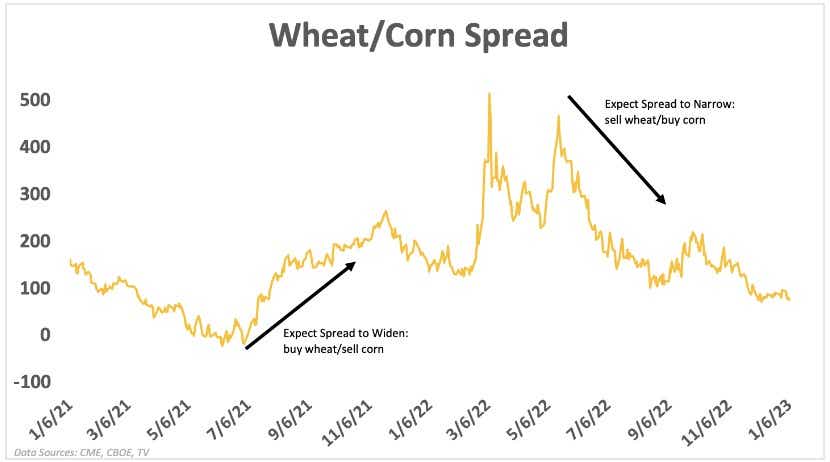

An inter-commodity spread is one way to play the corn and wheat futures markets. Traders play this spread by selling and buying a corn and wheat contract for the same delivery month. While corn and wheat are typically well correlated, seasonal and supply/demand imbalances sometimes cause diverging prices. The chart below highlights this spread and is calculated simply by subtracting the price of corn from wheat.

If the spread is very narrow relative to previous price action, a trader may want to go long the spread and buy wheat while selling corn. Alternatively, if a trader believes the spread is set to narrow, they will sell wheat and buy corn. This trade is possible with full (/ZW) or mini-sized contracts (/XW).

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices