Crack Spread Trading | What You Need To Know About Crack Spreads

What Is A Crack Spread?

The Crack Spread is the spread between the price of crude oil and the petroleum products that are refined from the crude oil.

Refiners need to buy crude oil (the raw material) which they then refine into various petroleum products such as gas and diesel (the finished product). The crack spread represents the profit margin that oil refiners can expect to make by “cracking” crude oil and refining it into gasoline or diesel fuel.

Trading Opportunities In The Oil Industry

If you’ve been paying any attention to what’s been going on in the commodity space over the past year (2014-2015), you’re likely aware that crude oil prices have realized some significant volatility. The price of a barrel of oil in the futures market has declined from around $108 in June to less than $50 a barrel level in July 2015. This decline in price has attracted the attention of traders, investment analysts, and market commentators alike, all with an opinion on where potential opportunities in the energy sector exist. As traders, we love this volatility, but the price of crude oil itself isn’t the only number we should be paying attention to when looking for a trade.

Understanding The Refinery Process Is Important To Crack Spread Traders

Even if you’re only trading energy stocks or just outright crude oil futures such as the WTI (West Texas Intermediate) crude contract, it’s very important to understand some of the drivers and outputs of the energy market.

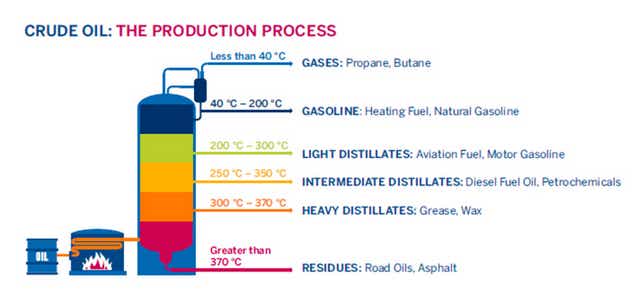

Oil companies sell their crude oil to refineries who then ‘crack’ the oil into refined products, such as gas or diesel. Crude oil is refined by heating and compressing the crude oil at various temperatures. Various petroleum products are the result of this process depending on the temperature at which the crude oil is heated. You can see which products are created at which temperatures in the diagram below.

It’s important for traders to pay attention to the prices of refined products because these values (primarily gasoline and diesel fuel) drive demand for crude oil by the refiners and subsequently, impact the price of crude oil.

Additionally, the profit margin for an oil refiner can be impacted significantly by various fundamental drivers of the price of both the input (crude) and the output (refined products). The prices of the refined products can also move separately from one another, or at times, inversely. When this happens, it can significantly impact the crack spread, causing the refiner to shift its demand for crude oil.

For example, when the price of oil increases while the prices of the refined products stay flat, we will typically see the spread narrow. In turn, the refiner may reduce its output, causing the spread to widen again. Or, if the price of oil decreases and the prices of refined products stay flat or even increase, we might expect the spread to widen.

Let’s take a look at this spread using prices for Crude Oil, Heating Oil, and Gasoline from June 10, 2015 (these prices are displayed in the chart below).

Understanding Crude Oil Specs

In the chart above we can see the contract, symbol, and the amount of physical product represented on a per contract basis (i.e. 1 WTI contract represents 1,000 barrels of oil). The price (on 6/10/15) of the contract is represented in the quote column and the tick size, tick value, and notional value of each contract can be seen as well.

/CL Tick Size

The tick size represents the minimum dollar amount the price of the contract will move up or down. So, if a trader buys 1 /CL futures contract for $59.95 and the price of the contract increases to $59.96 in the market, then it would have increased by 1 tick. Each tick of /CL represents $10. Therefore, when the market increased by a tick, the trader would have a profit of $10.00.

/CL Notional Value

The notional value of the /CL futures contract can also be determined by taking the current price of the contract, $59.00* and multiplying this value by the number of barrels the contract represents, which is 1,000. The notional value in this instance would be $59,000.

Simple 1 To 1 Crack Spread

Now that we have an understanding of what’s represented by each of these futures contracts, let’s take a look at the spread on a 1:1 basis, either 1 /RB (unleaded gasoline) or 1 /HO (heating oil) contract to 1 /CL contract. This is commonly referred to as a simple 1:1 crack spread.

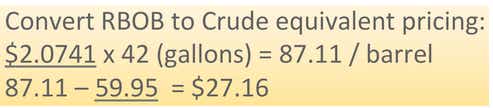

To create a 1:1 crack spread, the first step is to convert the price of the refined product which is quoted in dollars per gallon, to the price of crude which is quoted in dollars per barrel.

It’s easy to do this because there are 42 gallons of oil in a barrel. Therefore, we can take the per gallon price of the refined product (either /RB or /HO) and multiply it by 42. This gives us a per barrel price that we can then use to compare to the per barrel price of crude oil.

Once we’ve done this calculation using the current price of $2.0741* for gasoline, we get a per barrel price of $87.11.

We can then subtract the current per barrel price of crude oil from the per barrel price of the refined product, in this case gasoline, and this gives us a crack spread of $27.16 ($87.11 - 59.95). This calculation can also be viewed in the image below.

Because the crack spread represents the refiner margin, a positive spread means the refinery is making money and a negative spread means the refinery is losing money.

* A positive spread (meaning: refined product price - crude oil price = X, where X >0), indicates that the refinery is making money.

* A negative spread (meaning: refined product price - crude oil price = -X, where X >0), indicates that the refinery is losing money.

This is important because as we’ve mentioned previously, it impacts the demand for crude oil from the refinery. If the spread is negative, meaning the refinery does not have a positive profit margin, refineries are typically not going to be buyers of crude oil and this should be reflected by an overall decrease in demand for physical crude from the refiner.

When the spread is wide it can also impact crude prices as there is the potential for increased demand from to refiner to take advantage of the large margin. As traders, we can use this information to get an indication of where oil might trade in the short term, but we also need to track where the spread is currently relative to where it’s been over time.

Understanding where the spread is currently, relative to a historical basis, and knowing that there’s a strong correlation between the price of crude oil and the refined products, presents us with potential trading opportunities.

In the last 5 years, the crack spread has traded between $0 and right around $40. A 3-year chart of the relationship between crude oil (yellow) and gasoline prices (purple) is illustrated in the crack spread chart below.

Crack Spread Chart

Since the crack spread is sometimes a driver of WTI Crude Oil prices, the relationship between the two is very important to understand.

Crack Spread Widening

When the crack spread widens, we tend to see that there’s an increase in demand for refined products, and therefore it’s likely that crude oil prices will increase to catch up to the demand for gasoline or heating oil. We can also develop the assumption that when the spread has widened out, one of the products has overextended itself and may be due for a reversal in price (meaning the spread will tighten back up).

By looking at the current spread from our example, the crack spread is at $27.16 (which is relatively high on a historical basis), and understanding current market fundamentals from a supply and demand standpoint, we may decide to place a trade that profits when this spread tightens.

Trading The Crack Spread When We Expect It To Contract

If we expect that the current simple crack spread will contract, then we can sell the refined product contract (/RB) and buy the crude oil contract (/CL) in the same expiration month.

What we’re hoping is that /RB will decrease in price, while /CL increases and the price of the spread will revert back to more ‘normal’ prices.

This is one way to trade the “crack spread’ but it’s not the only way. We can also set up diversified crack spread trades using a ratio of crude oil, gasoline, and heating oil contracts. There are several different types of crack spreads, which you can find listed below.

Types Of Crack Spreads

3:2:1 Crack Spread

5:3:2 Crack Spread

Crack Spread Options

*Prices are from the time this article was written and may not reflect current prices

Want more options trading coverage? Tune-in to tastylive live every weekday from 7 a.m. to 3:30 p.m. (ct)!

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.