Credit Risk May Rise as PMI Data Hints Global Growth is Stuck

Credit Risk May Rise as PMI Data Hints Global Growth is Stuck

By:Ilya Spivak

Muted global economic growth is a worry as markets digest a record debt pile.

U.S. and Eurozone PMI data warns that global debt-to-GDP ratios may rebound.

The British pound is under pressure as Bank of England policymakers turn more dovish.

The Japanese yen may stage a rebound as rising inflation hints the BOJ isn’t finished.

Economic growth is anchoring at an anemic level in the world’s leading consumer markets.

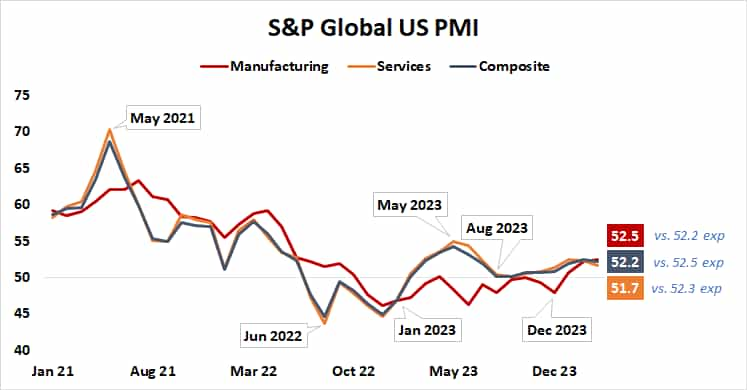

Purchasing managers index (PMI) data from S&P Global showed that the pace of U.S. economic activity growth was little changed in March for a second consecutive month. Momentum picked up in January as the manufacturing sector returned to growth, but a soggy service sector has stymied overall acceleration since then.

Europe has arrived at a similar destination by a somewhat different route. Eurozone PMI data shows regional activity shrank for a ninth consecutive month, although the pace of decline slowed enough that contraction was all but arrested. Improving conditions in the service sector were offset by deepening turmoil on the manufacturing side.

Taken together, the U.S. and the Euro Area account for a commanding 34% of global gross domestic product (GDP), according to data from the World Bank. That understates their contribution to worldwide economic growth because their consumers power an outsized share of demand for the remaining two thirds of output.

With that in mind, PMI data showing economic activity struggling to find consistent uplift amounts to a vulnerable backdrop at a time when global debt has reached a record $313 trillion by the end of 2023. Soft growth that pushes up debt-to-GDP ratios will make servicing massive obligations after a rapid rise in interest rates much harder.

The Bank of England is getting closer to cutting interest rates

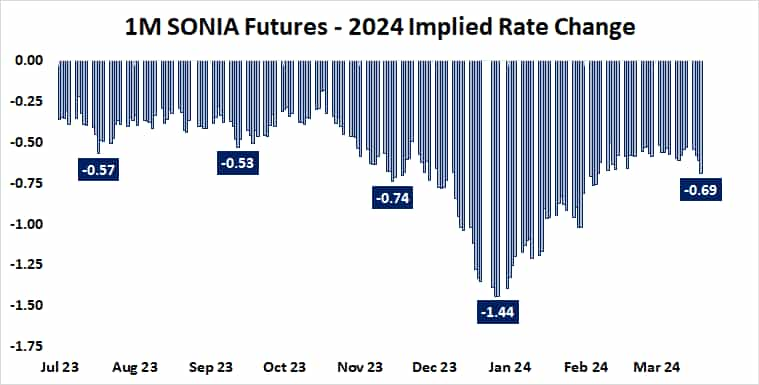

PMI data from the United Kingdom spoke to similar conclusions – economic activity is anchoring as improving manufacturing and slowing services diverge—but it was a dovish turn at the Bank of England that dominated the spotlight. The holdout hawks on the rate-setting MPC committee gave up, signaling that the start of stimulus is nearing.

Two members of the nine-strong group were calling for still higher rates in February. Both have now shifted into the “on-hold” camp, while a lone dove continues to press for cuts to begin. The markets reacted by pushing up the priced-in easing tally from 61 to 69 basis points (bps), sending the British pound lower (as expected).

Japanese inflation may revive the yen

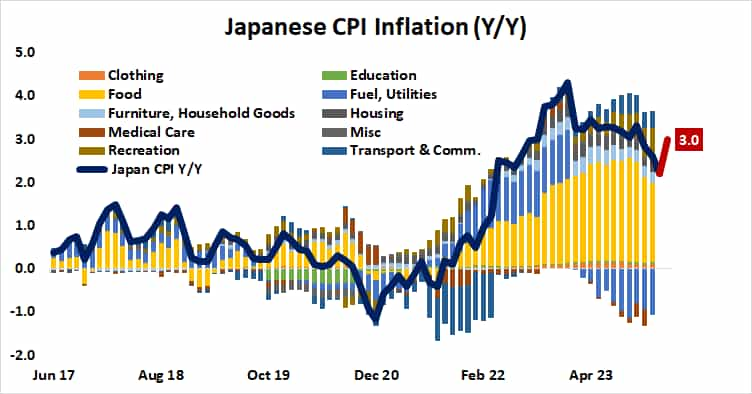

Meanwhile, inflation in Japan is expected to have re-accelerated in February, rising to 3% year-on-year. That would mark the highest reading since October 2023.

Stronger price growth might dilute the sense that the Bank of Japan (BOJ) has already delivered all of the near-term tightening in scope when it scrapped negative rates and yield curve control earlier this week. The Japanese yen sold off sharply as the central bank made its move. It may try for recovery if further action seems needed after CPI data.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.