Crude Oil Prices Rise as Key Spread Narrows: Where to for WTI?

Crude Oil Prices Rise as Key Spread Narrows: Where to for WTI?

Crude Oil Prompt Spread Falls to Multi-Year Lows

Crude oil prices rose about 1.5% on Monday after an upbeat U.S. housing sentiment survey buoyed worries about a slowing economy. The housing sentiment index from Fannie Mae showed that potential homebuyers were more confident in December than they were the month prior. While not directly linked to an oil-sensitive industry, the results are encouraging for the broader economy.

The Monday bounce comes after a heavy week of losses for crude oil prices. The U.S. benchmark—West Texas Intermediate (WTI)—fell more than 8% last week. Brent crude prices—the global benchmark—saw similar losses. Optimism quickly faded over China’s reopening as virus cases surged, forcing many to remain indoors out of fear of the virus.

Crude Oil Market Dynamics

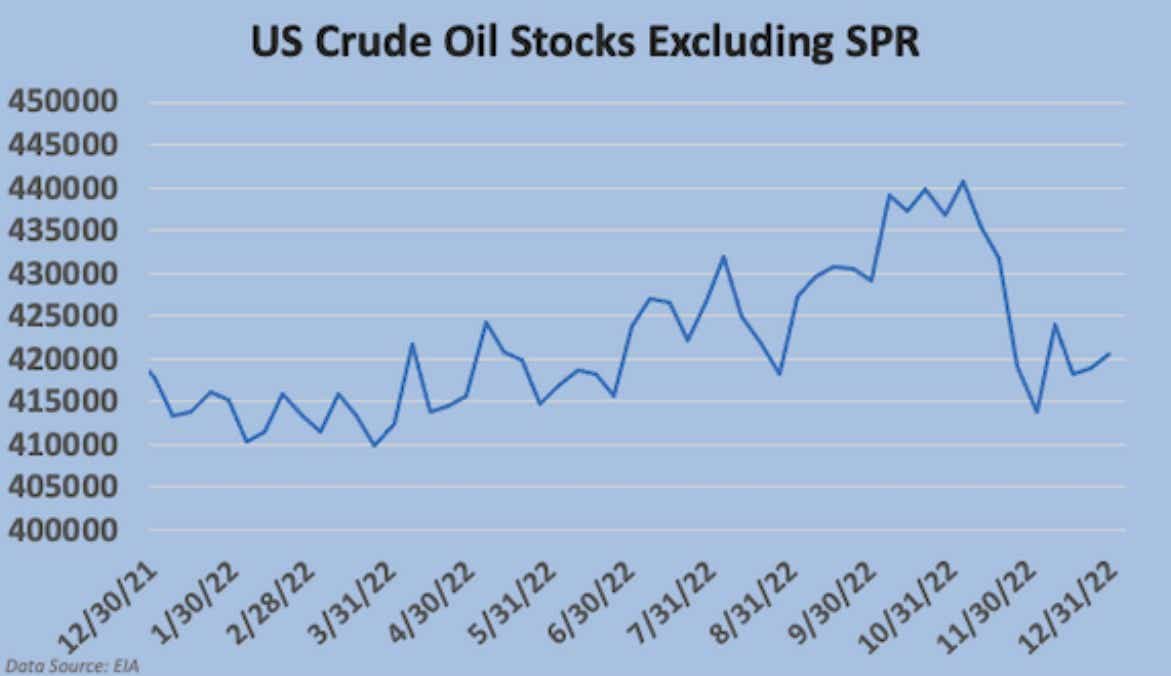

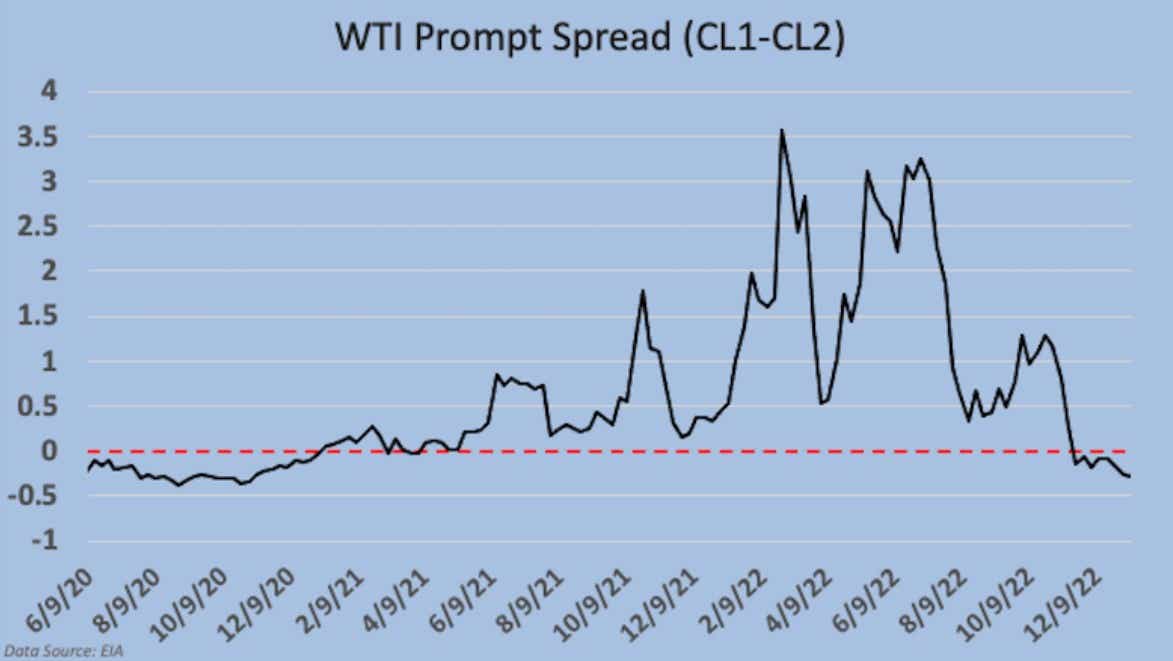

Low inventory levels around the globe have many analysts calling for higher oil prices. The United States has made only marginal progress in boosting storage. But slowing economic growth amid central bank tightening is throttling positive traction in sentiment. The WTI prompt spread, the difference between front-month and next-month prices in the futures market, fell to the lowest level since November 2020.

The discount for the front-month prices is typically seen as a bearish sign for price due to weakening supply and demand imbalances. The latest data from the U.S. Energy Information Administration (EIA) showed a 1.7-million-barrel increase in crude oil stocks for the week ending December 30.

That said, if this week’s weekly EIA data due on Wednesday shows another inventory build, crude prices may reverse lower and resume last week’s downward trend. The Bloomberg consensus forecast showed a -2.37-million-barrel draw on Monday. That potentially sets up oil prices for a volatile immediate reaction if we see a positive number cross the wires.

Potential Oil Trades to Play This Week

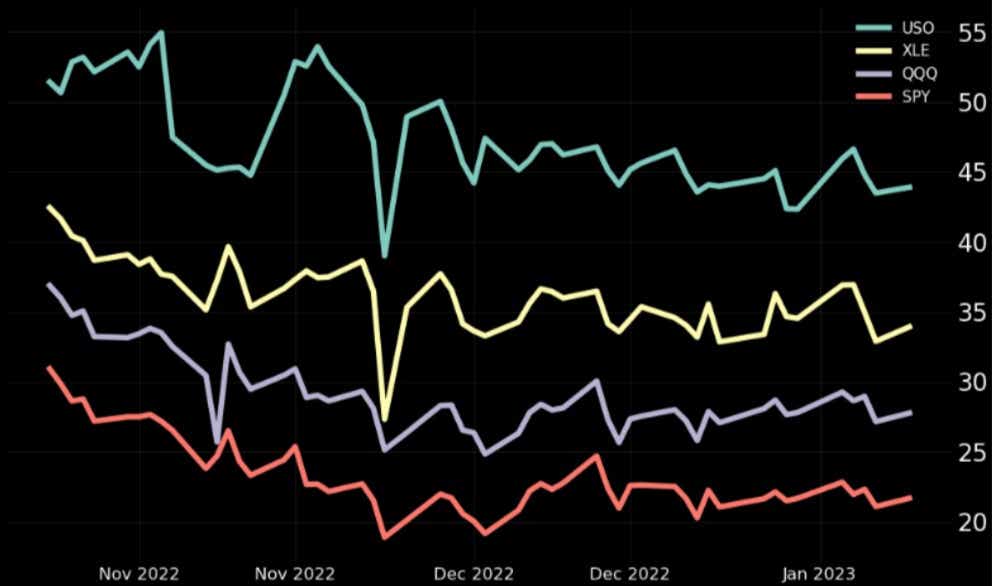

The high implied volatility in the USO fund and XLE energy ETF relative to SPY and QQQ (shown in the chart below) makes them a potentially interesting pick for traders who wish to sell premium. If a trader believes that oil stockpiles are set to increase, which would likely lead to a drop in prices, placing a short call spread may be a desirable trade setup in the weeks ahead.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices