Debt Ceiling: The US Will Not Default. What’s Next for Markets?

Debt Ceiling: The US Will Not Default. What’s Next for Markets?

We’ve seen this movie, right? The US is on the verge of a catastrophic debt ceiling breach, which will lead to a US default (at least, technically speaking), and lawmakers in Washington, D.C. just can’t seem to get their acts together.

But after several weeks of playing a game of chicken, Democrats and Republicans announce that a deal has been struck that will prevent the US from making one of the worst self-inflicted economic and financial wounds in history.

At least, that’s what happened to varying degrees in 2011, 2013, 2017, and more recently, in 2019. And while no official deal has been struck thus far, it appears that we’re on the path to another ‘close, but no cigar’ US default in 2023.

What is the TGA?

For all the ink spilled over what a US default may bring to financial markets, not much has been said about what financial markets may look like on the other side of a deal to avert calamity. To start, it’s important to understand how a US default would actually unfold.

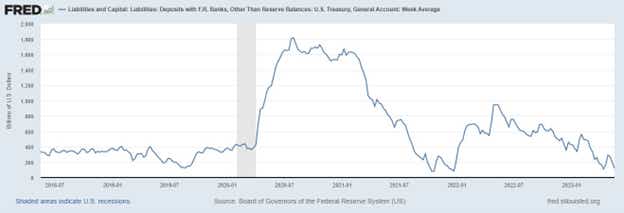

The US would default if it ran out of money to pay back its bills and obligations. How do we see how much money the US has in its accounts? We can head over to the Treasury General Account (TGA). The TGA is the general checking account, which the Department of the Treasury uses and from which the US government makes all of its official payments.

Here’s where the TGA stands as of May 10, 2023:

On the other side of a deal to avert a US default, the TGA will have to be replenished. The mechanics of how this works in the banking system are important for understanding how markets may behave over the coming weeks.

How Does the TGA Work?

When individuals or businesses receive a government check, they deposit it into their regular bank accounts. The banks then send these checks to the Fed, which then takes the money from the Treasury's account and adds it to the bank's account at the Fed. This increases the amount of money the bank has in reserves.

The TGA is listed as a liability on the Fed's financial records, along with things like physical money (like coins and notes) and bank reserves. The Fed needs to make sure that its liabilities match its assets. So, if the amount of money in the TGA goes up (say, after a US debt deal), the amount of bank reserves goes down.

When money flows into the TGA, it decreases the amount of bank reserves. A drop in bank reserves can lead to reduced liquidity for banks, potentially leading to less lending or investment in the economy or financial markets.

Replenishing the TGA Might Hurt

Bringing the TGA’s balance back to elevated levels such that the US can pay its bills and obligations should, in theory, be negative for liquidity conditions in the coming weeks. The mechanics of replenishing the TGA suggest that bonds will need to be sold in order to reestablish a more sustainable cash balance. By selling bonds, this will be akin to a quantitative tightening (QT) program, at least in the short-term.

A short-term drawdown of liquidity in financial markets centered around the selling of bonds to replenish the TGA appears to be in the cards over in the coming weeks. Theoretically, this type of environment would cater to higher US Treasury yields (weaker /ZN and /ZB), helping support a stronger US Dollar (weaker /6E and /6J), diminishing the appeal of precious metals (weaker /GC and /SI), and undercutting the initial enthusiasm seen in US equity markets (weaker /ES and /NQ). A temporary setback in risk appetite in June 2023 should not be ruled out, even as the US avoids a default.

--- Written by Christopher Vecchio, CFA, Head of Futures and Forex

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices