Is the Dollar Entering a Period of Long-Term Structural Weakness?

Is the Dollar Entering a Period of Long-Term Structural Weakness?

By:Ilya Spivak

Sustained decline seems likely because the current sell-off isn’t following expected price action dynamics

- The U.S. dollar is dropping at a blistering speed against its major currency peers.

- Familiar support from rising interest rates and risk aversion has failed to appear.

- Enduring regime change to a weaker dollar means rebounds are likely to be sold.

The U.S. dollar has suffered steep losses since the beginning of the year. The currency is down nearly 10% against an average of its major counterparts—the euro, British pound, Japanese yen and Australian dollars.

This puts 2025 on pace to be the worst year for the greenback since 2017, and the second quarter has only just begun. Moreover, the sell-off has bucked familiar trading patterns, marking a worrying break from price action dynamics that have persisted since the currency’s tether to gold was broken in 1973.

U.S. dollar: thriving on extremes

The dollar occupies a special place in the global financial system. Data from the Bank of International Settlements (BIS)—the so-called “central bank for central banks”—reveals in its triannual survey of foreign exchange markets that as of 2022, the currency accounted for 88% of the total average daily turnover of $7.5 trillion.

That makes the greenback uniquely liquid, even when compared to broadly traded counterparts like the euro or the yen. For traders, this makes for price action dynamics unlike most other currencies. They have been famously illustrated by the Dollar Smile model, developed by economists Stephen Jen and Fatih Yilmaz.

This framework ties the dollar’s performance to the relative strength of the U.S. economy against that of its major peers. It reveals the currency tends to rise when U.S. growth either significantly leads or lags compared with average growth in the G7 economies (excluding the U.S. itself).

.png?format=pjpg&auto=webp&quality=50&width=891&disable=upscale)

The right side of the chart tells a familiar story. When the U.S. economy is outperforming, brisk growth is bidding up inflation and pushing the Federal Reserve to raise interest rates. That expands the dollar’s yield advantage against its lagging counterparts and pushes it upward. This is the way most currencies tend to work.

The left side is where the dollar’s unique properties shine. The U.S. is the world’s largest economy. If growth there is lagging in a meaningful way, the knock-on effect on overall global growth is understandably damaging. It isn’t difficult to imagine that markets might turn defensive in such a scenario, with money flowing away from risky assets and toward safety.

It likewise follows that much of this “cashing out” has tended to pour into the greenback. Its unrivaled liquidity means that it can absorb large-scale capital inflows with less volatility than the alternatives, which is a clear advantage when investors are in flight mode. Its ubiquity also means redeploying capital is easier after whatever scare subsides.

Currency markets in 2025: uncharted territory?

Look now at crumbling stock markets and surging Treasury bond yields, and you might expect the dollar to be thriving. Rates have stormed higher from early April lows, delivering the biggest weekly gains in seven months at the front end. The long end saw its best week since March 2022. The bellwether S&P 500 index is flirting with 15-month lows.

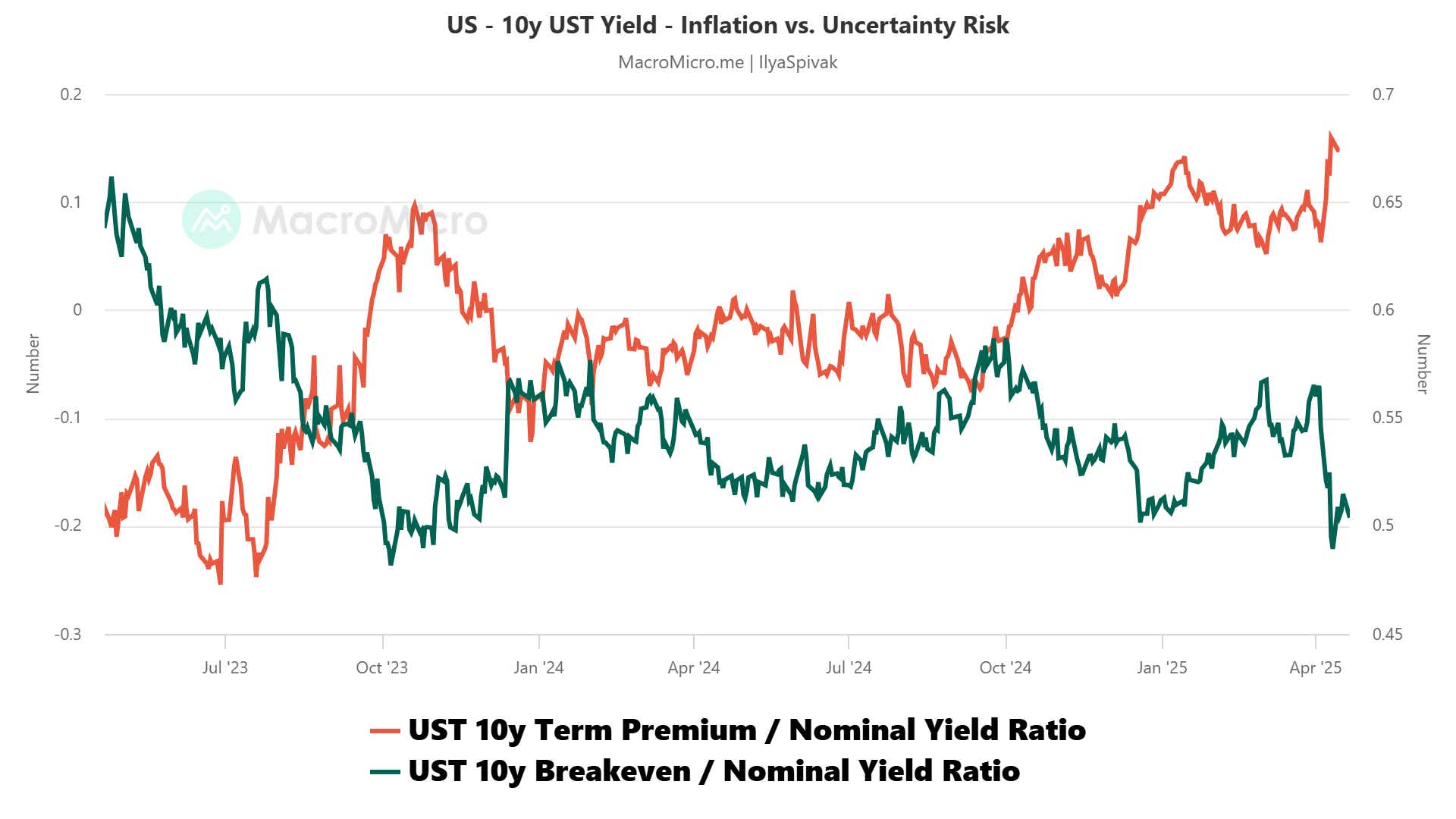

That neither yield appeal nor haven demand are able to underpin the beleaguered U.S. currency implies that its fundamental foundations have been challenged—and perhaps even wounded—in a critical way. Breaking down the constituent parts of U.S. Treasury bond yields reveals the nature of the threat.

The cost of compensation for duration risk embedded in the benchmark 10-year note, the so-called “term premium,” has jumped to the highest share of the interest rate since May 2021. That speaks to increasingly acute concern about the U.S. fiscal trajectory after the rocky rollout of a new tariff regime by the Trump administration.

Parallel declines in U.S. stocks, bonds and the currency point to an exodus from dollar-denominated assets. This shift seems likely to endure beyond the near- to medium-term impact of repricing for a vastly different approach to economic policymaking from Washington, DC.

That is because the undoing of global trade links will almost certainly reduce cross-border commerce and leave foreigners holding fewer dollars. Growing trade incentivized them to recycle this capital back into U.S. markets to sustain the dollar’s purchasing power, underpinning demand for imports. On current trends, these inflows may become a trickle.

Federal Reserve interest rate cuts to combat cyclical weakness are expected to follow from the breakdown of U.S.-led economic norms may hurt the dollar further. Still, markets don’t tend to move in straight lines. This means that any sizable near-term pullback in top dollar alternatives like the euro and the yen are probably buying opportunities.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices