Equity Smackdown: Long S&P vs. Short Put Strategies

Equity Smackdown: Long S&P vs. Short Put Strategies

Which bullish approach yields the most consistent returns?

- Short-put strategies can reduce volatility vs. long-only portfolio.

- Cheer up! Inflation shrinks the value of your debt.

- Alpha-boost trade ideas

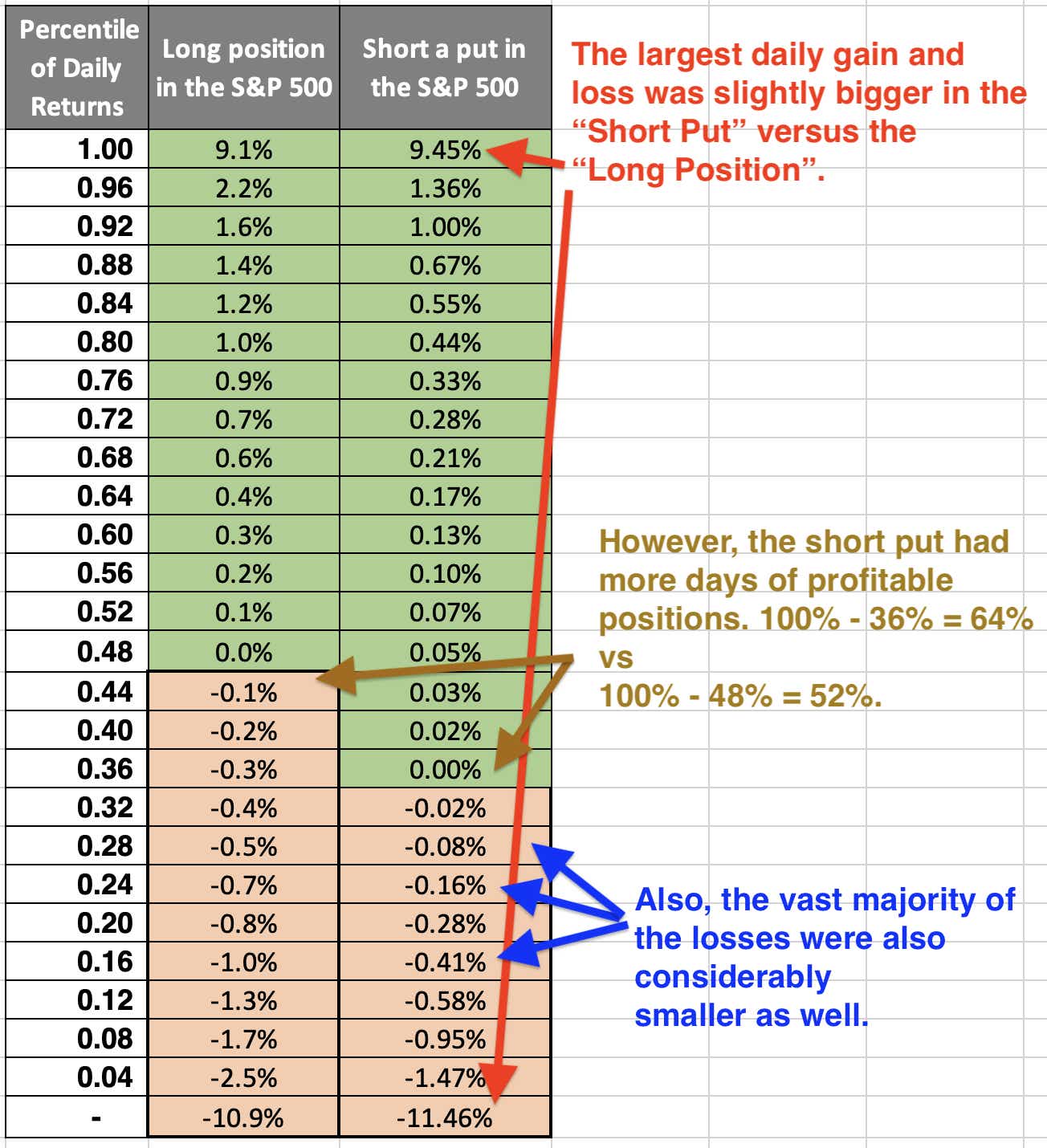

In this analysis, we evaluate and compare the daily yields of two bullish stances: investing directly in the S&P 500 and taking a short position in a put option, using the CBOE PUT index as a benchmark.

Directly investing in the S&P 500 often provides superior results in a market strongly trending upwards. However, a short-put position tends to perform more consistently, exhibiting lower volatility. This is because a short put strategy tends to profit more days due to the inherent option decay, which cushions minor daily declines (refer to the chart below).

From our data, we notice that 64% of short-put strategies result in positive returns, compared to 52% from the straight S&P 500 daily movement.

Takeaway

The outright long stock portfolio might outperform in a bullish market as compared to the short put but will tend to do so with more volatility. A short-put position tends to perform more consistently, exhibiting lower volatility.

Inflation

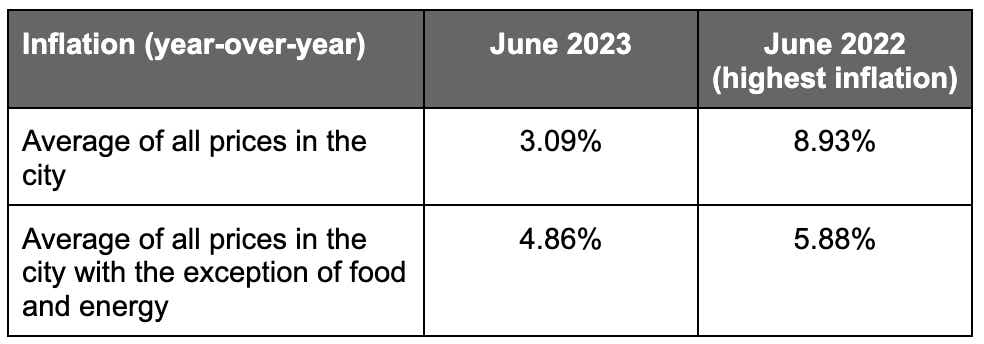

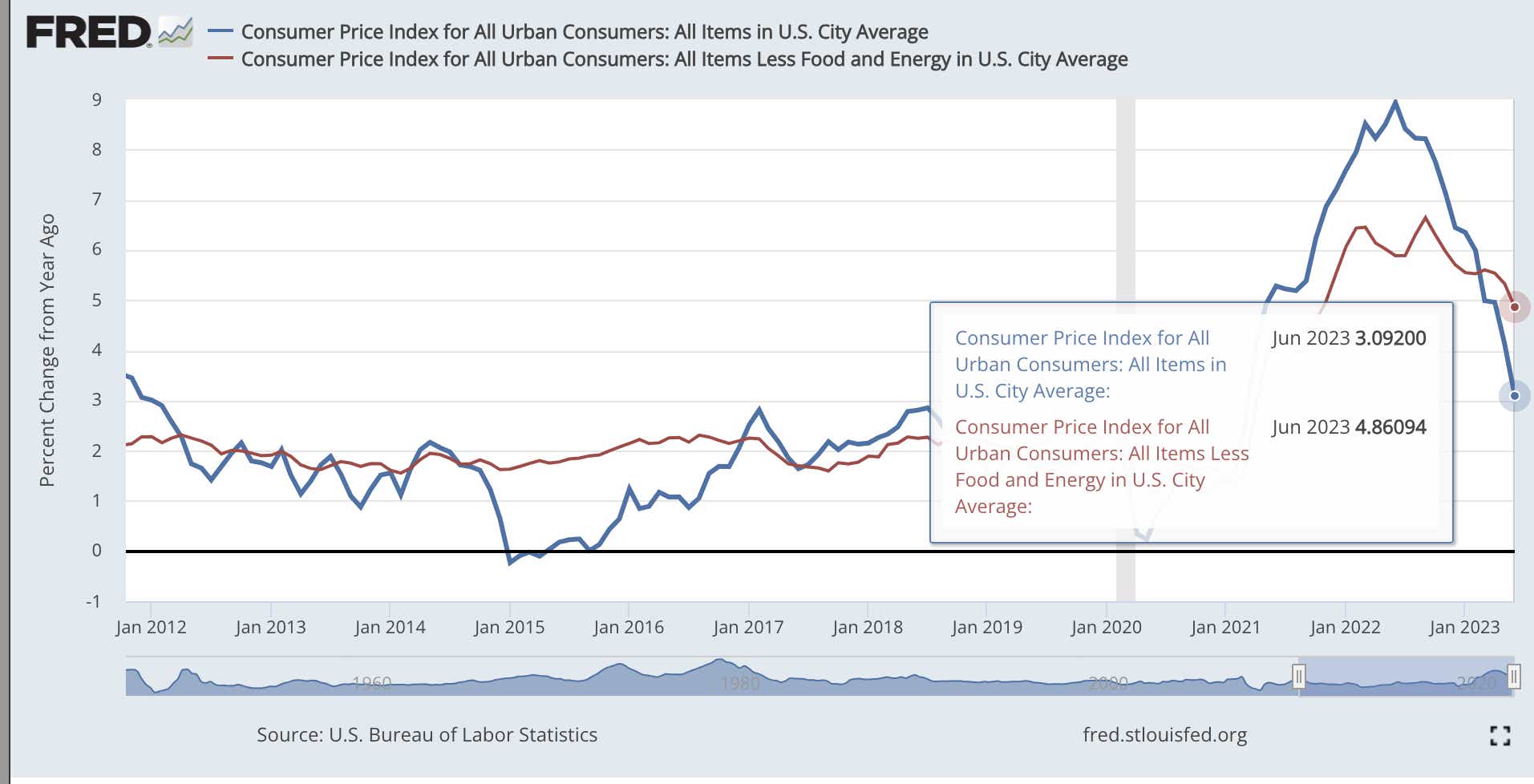

The St. Louis Federal Reserve Bank has a good website–see it here. Tons of data to play around with.

Inflation blows. But look on the bright side. Your debt is worth less than it used to be.

When inflation increases, the real value of money (your purchasing power) decreases, which reduces the value of your debt/mortgage/car loan/student loan/etc. in real terms.

Thus, the debt will be paid back with dollars that are worth less in terms of purchasing.

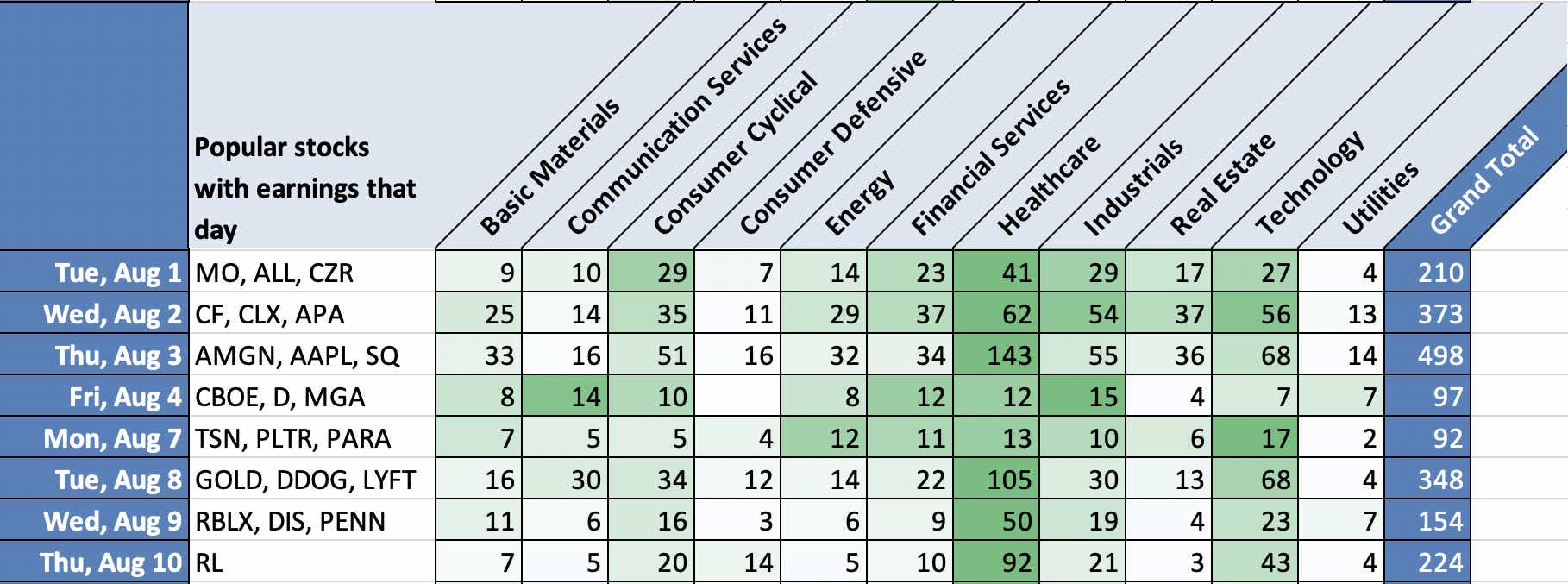

Healthcare earnings

Healthcare stocks begin at the beginning of August.

FYI, the healthcare ETF is XLV.

Apple (AAPL) is Thursday.

Alpha-boost trade ideas

Amazon (AMZN) has been trading rangebound between roughly $125 to $135 since the start of June. This strangle leans slightly long with a high potential return on capital (roughly ~30%) if the stock stays within the same range through September.

Implied volatility is low, but this would be part of a continuously bullish strategy of getting long the S&P 500 for people that like taking a bullish stance on the S&P 500 via SPY.

Michael Rechenthin (aka “Dr. Data”), managing director of Research and Development, has 25 years of trading and markets experience. He is best known for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.