Fed Hikes and the Banking Crisis: End of Story?

Fed Hikes and the Banking Crisis: End of Story?

Interest Rate Hikes are Finished. Now What?

The Federal Reserve delivered a 25-bps interest rate hike as expected at their May meeting, and in the process effectively signaled the end of their rate hike cycle with their main rate at 5.00-5.25%. It was just two months that Fed policymakers were suggesting that the main rate could rise as high as 6.00% prior to any discussions about pausing efforts. In the interim, the failures of SVB, Signature Bank, and First Republic clearly changed the Fed's calculus.

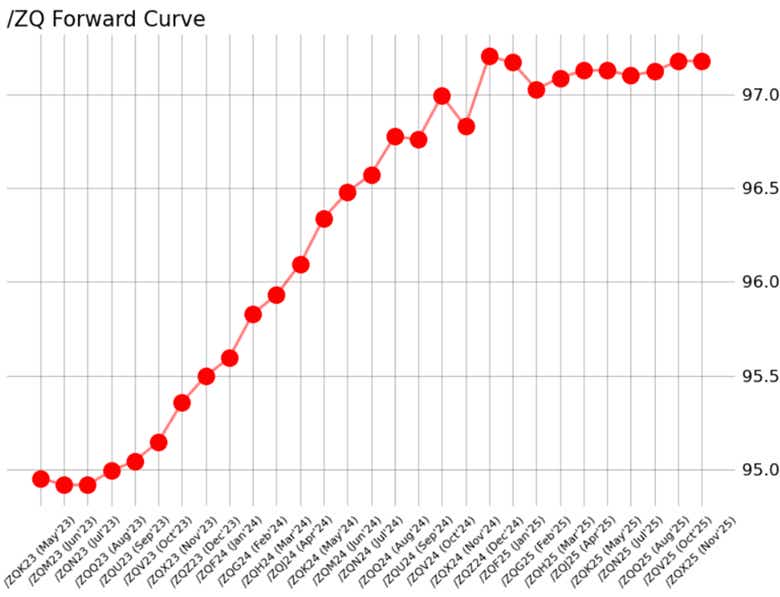

Look no further than the phrasing used in the May policy statement regarding weighing the cumulative effects of prior tightening efforts on the economy and financial system before any other hikes would be considered. One might say "cumulative effects" could translate to some of the recent bank failures. And yet, just because the rates hikes may be finished – according to both the Fed and market pricing, per /ZQ – there is no guarantee that other smaller and regional banks won't fail in the coming weeks or months.

Regional Banks May Still be in Trouble

While the failures of SVB, Signature Bank, and First Republic have been absorbed by broader markets without much widespread disruption (beyond the individual bank shares and corresponding ETFs), the reality of the situation is that no regulatory changes are likely in the near-term which could fundamentally alter the market's collective perception of the trouble that beleaguers smaller banks: asset-liability duration mismatch; unrealized losses on their balance sheet undermining their CET1; and a significant percentage of deposits north of $250,000 that fall outside of the FDIC's insurance purview.

No regulatory changes - through executive fiat or Congressional action - are likely in the near-term specifically because of the proximity to the debt ceiling. One might argue that any changes to FDIC insurance levels, for example, could be tied to a compromise around the debt ceiling debate, but would unlikely be treated as a separate, standalone issue in the next few weeks. In effect, none of the problems plaguing the smaller and regional banks have been solved, and sustainable solutions don't appear likely to come together before the month is over (it’s not sustainable for the bulge bracket banks to gobble up every smaller competitor, even for a song).

There are now some regional banks that are evolving in the unfortunate grey area of becoming zombie banks, whereby they aren't failed institutions outright, but they may not be able to stay operational without government support. This puts these smaller financial institutions on the path to receivership or being acquired absent significant regulatory changes at the federal level, particularly if the Fed maintains its main rate at an elevated level for a long time, allowing the asset-liability duration mismatch to persist, thus incentivizing more depositors to flee.

Regional Bank Stocks to Watch:

- IAT

- KRE

- KBE

- XLF

- WAL

- USB

- CMA

- PACW

- PNC

--- Written by Christopher Vecchio, CFA, Head of Futures and Forex

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices