Fed Watch: February 2023 FOMC Meeting Preview

Fed Watch: February 2023 FOMC Meeting Preview

Rate Hikes Are Not Done Yet

On the eve of the Federal Reserve’s February monetary policy decision, we’ll review comments and speeches made by various Fed policymakers before the communications blackout window. Between the December 2022 and February 2023 rate decisions, rates markets have begun to discount a ‘pause’ and ‘pivot’ in 2023, while Fed policymakers have oscillated between suggesting that more rate hikes are needed and the rate hike cycle is nearing its end.

25-bps in February

Fed Chair Jerome Powell was blunt at the December 2022 Fed meeting when he said, “we still have some ways to go.” But exactly how far is ‘some ways?’ Since then, the tone deployed by a few FOMC members has softened as US inflation pressures have eased, and alongside a resilient labor market, rampant speculation of when a 'pause’ or ‘pivot’ may arrive has helped fuel gains in equity markets and a rebound in bonds.

What Did Fed Officials Say Between Meetings?

December 16, 2022 – Daly (San Francisco president) said that the Fed is not done fighting inflation and “the labor market is out of balance.”

Williams (New York president) affirmed that the Fed “is going to have to do what’s necessary” to get inflation under control.

Mester (Cleveland president) noted “we have to continue to raise rates because we have more work to do on inflation.”

January 4, 2023 – Kashkari (Minneapolis president) foresaw the Fed’s main rate rising to 5.4% and that “any sign of slow progress that keeps inflation elevated for longer will warrant, in my view, taking the policy rate potentially much higher.”

The December FOMC meeting minutes showcased a strong desire to bring inflation pressures down, and it was noted that “an unwarranted easing in financial conditions, especially if driven by a misperception by the public of the committee’s reaction function, would complicate the committee’s effort to restore price stability.”

January 5 – Bullard (St. Louis president) commented that “the policy rate is not yet in a zone that may be considered sufficiently restrictive, but it is getting closer.”

January 6 – Cook (Fed governor), Bostic (Atlanta president), and Barkin (Richmond president) surmised that more interest rate hikes are necessary even though there is growing evidence that inflation pressures are receding.

January 9 – Bostic warned that a pivot might not materialize immediately, noting that “we are just going to have to hold our resolve.”

Daly said it’s “too early” to declare victory in the fight against inflation.

January 10 – Bowman (Fed governor) argued that the Fed had more work to do to fight inflation pressures, and that rates will need to stay elevated for some time in order to stabilize the situation.

January 11 – Collins (Boston president) said that she favors a 25-bps rate hike in February, but the outcome remains “data dependent.”

January 12 – Bullard reiterated his belief that the Fed’s main rate would need to rise above 5%.

Barkin hinted at his preference to slow down the pace of rate hikes moving forward, noting that “it makes sense to steer more deliberately as we work to bring inflation down.”

Harker (Philadelphia president) suggested that the Fed should only raise rates in 25-bps increments “moving forward” and that “the days of us raising them 75 basis points at a time have surely passed.”

January 13 – Bostic commented on recent data and argued that “inflation is moderating, and it gives me some comfort that we might be able to move more slowly now that we are in restrictive territory.”

January 17 – Barkin said that it’s too soon to end rate hikes as he would want “to see inflation convincingly back to our target.”

January 18 – The Beige Book showed that businesses anticipate price pressures easing back even as the labor market continued to grow at a moderate pace.

January 19 – Collins commented that “now that rates are in restrictive territory and we may — based on current indicators — be nearing the peak, I believe it is appropriate to have shifted from the initial expeditious pace of tightening to a slower pace.”

Brainard (Fed Vice Chair) hinted that a pivot is not likely anytime soon, saying “policy will need to be sufficiently restrictive for some time to make sure inflation returns to 2% on a sustained basis.”

January 20 – George (Kansas City president) offered an optimistic assessment, noting “this scenario — can there be a soft landing — is one we would all want to see. And there are some possibilities for that.”

More Hikes Before the Pause

We can measure whether a Fed rate hike is being priced-in using Eurodollar contracts by examining the difference in borrowing costs for commercial banks over a specific time horizon in the future. Chart 1 below showcases the difference in borrowing costs – the spread – for the front month and March 2023 contracts, in order to gauge where interest rates are headed through the end of this year.

Eurodollar Futures Contract Spread (February 2023-March 2023) [BLUE], US 2s5s10s Butterfly [ORANGE], DXY Index [RED]: Daily Timeframe (August 2022 to January 2023) (Chart 1)

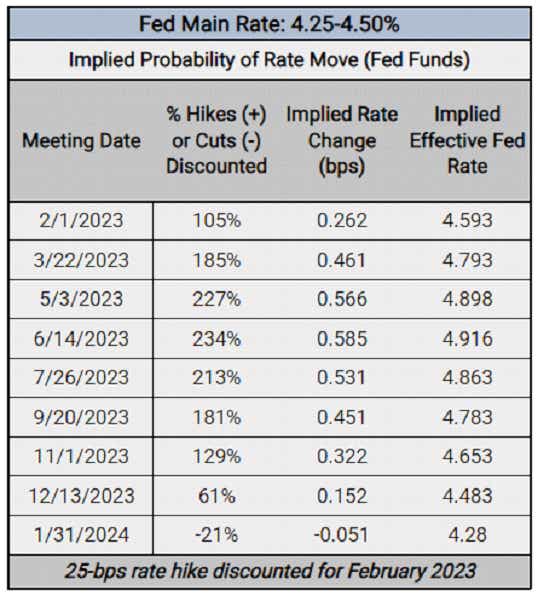

Federal Reserve Interest Rate Expectations: Fed Funds Futures (January 31, 2023) (Table 1)

Expectations for Markets

The February Fed meeting will only produce a policy statement, with a new Summary of Economic Projections (growth, inflation, and unemployment rate forecasts plus the dot plot) due in March. Accordingly, Fed Chair Powell’s press conference will likely be the more market-moving of the two events.

For bulls, if the Fed only raises rates by 25-bps (the base case scenario) and Fed Chair Powell signals that the rate hike cycle is nearing its endpoint, then the ‘upside’ scenario for risk assets could play out: stronger US stocks, gold, and bond prices; and weaker US Dollar. Further to this point, Fed Chair Powell will need to dismiss the recent loosening in financial conditions in recent months (a weaker US Dollar, lower Treasury yields, higher stock prices, and reduced volatility) as an issue.

For bears, the Fed could shock markets with a 50-bos rate hike, while Fed Chair Powell suggests that the rate hike cycle isn’t finished. To this end, Fed Chair Powell could complain that financial conditions have eased prematurely, and that the fight against inflation will take longer than markets have discounted. In this ‘downside’ scenario, risk aversion takes root: weaker US stocks, gold, and bond prices; and a stronger US Dollar.

--- Written by Christopher Vecchio, CFA, Head of Futures and Forex

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices