FOMC March 2023 Meeting Preview: Can The Fed Keep Raising Rates?

FOMC March 2023 Meeting Preview: Can The Fed Keep Raising Rates?

Rate Hikes May Be Finished

Ahead of the Federal Reserve’s March monetary policy decision, we’ll review comments and speeches made by various Fed policymakers before the communications blackout window. Initially, between the February and March 2023 rate decisions, rates markets began the process of discounting a 50-bps rate hike. Accordingly, with much of the recent turmoil in markets coming after the Fed’s blackout window began, the slew of commentary made by Fed officials, largely geared towards inflation and effectively nothing geared towards financial stability, appears to be stale.

25-bps rate hike expected in March

Fed Chair Jerome Powell spent his, as did other FOMC officials, in the run up to the Fed’s communication blackout window extoling the benefits of a ‘higher for longer’ interest rate regime. The rationale was that a resilient US labor market coupled with a still-growing US economy meant that Fed policymakers had more work to do in order to bring down price pressures. Alas, with systemic issues now afoot, markets are expecting a less hawkish tone from the Fed moving forward.

What Did Fed Officials Say Between Meetings?

February 3 – Daly (San Francisco president) said “the most important thing to convey to listeners is that the direction for policy is for additional tightening and holding that restrictive stance for some time.”

February 6 – Bostic (Atlanta president) commented that a higher peak Fed funds rate could be necessary following the strong January US jobs report.

February 7 – Powell (Fed Chair), in an interview at The Economic Club of Washington, D.C., stated that the FOMC “think(s) we are going to need to do further rate increases,” indicating that rates may need to stay higher for a longer period as well.

February 8 – Waller (Fed governor) warned that “it might be a long fight, with interest rates higher for longer than some are currently expecting.”

Cook (Fed governor) remarked that she favored more measured rate increases moving forward, as “this will give [the FOMC] time to evaluate the effects of our fast actions on the economy.”

February 10 – Harker (Philadelphia president) said that he favors “a couple more” 25-bps increases.

February 13 – Bowman (Fed governor) commented that “we are still far from achieving price stability.”

February 14 – Barkin (Richmond president) said that the Fed might need to go higher for longer with interest rates, and that “inflation is normalizing but it’s coming down slowly.”

Harker argued that more needs to be done, but the Fed “is close” to being finished with its hike cycle.

Logan (Dallas president) spoke in hawkish tones, saying “we must remain prepared to continue rate increases for a longer period than previously anticipated, if such a path is necessary to respond to changes in the economic outlook or to offset any undesired easing in conditions.”

February 16 – Mester (Cleveland president) commented that she considered a 50-bps rate hike at the February FOMC meeting, and that “at this juncture, the incoming data have not changed my view that we will need to bring the fed funds rate above 5% and hold it there for some time.”

Bullard (St. Louis president) suggested that rate hikes will continue over the coming months, noting “it will be a long battle against inflation, and we’ll probably have to continue to show inflation-fighting resolve as we go through 2023.”

February 17 – Bowman said that the Fed needs to keep raising interest rates because inflation remains “too high.”

February 22 – Bullard explained where he sees interest rates going, outlining “I think we are going to have to get north of 5%. Right now I’m still at 5.375%.”

February 24 – Jefferson (Fed governor) warned that price pressures may not recede as quickly as hoped. “The ongoing imbalance between the supply and demand for labor, combined with the large share of labor costs in the services sector, suggests that high inflation may come down only slowly.”

February 27 – Jefferson says that changing the Fed’s 2% inflation target could “destabilize” inflation expectations.

February 28 – Goolsbee (Chicago president) suggests the Fed rely on the “real economy” more than what’s happening in financial markets, a nod to still-high inflation.

March 1 – Bostic writes that the Fed’s main rate will need to rise to between 5-5.25% and remain there “until well into 2024.”

Kashkari (Minneapolis president) declined to confirm he’s decided to back a 50-bps rate hike at the March FOMC meeting.

March 2 – Collins (Boston president) issued support for raising interest rates to a higher level and keeping them there for longer.

Waller indicated that he would support raising rates beyond his current outlook if US economic data continued to come in better than expected.

March 3 – Logan advised that the Fed needs to distinguish transparency, backstop pricing and separating market functioning support from monetary policy action.

Barkin says that inflation is “likely past its peak” but it will still take “time to return to target.”

The Fed’s Semi-Annual Monetary Policy Report to Congress notes that the FOMC believes that “ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive.”

March 7 – Powell, testifying before the Senate Banking Committee, echoed the ‘higher for longer’ mindset, saying “the latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated.”

March 8 – Powell, testifying before the House Financial Services Committee, relaxes his tone, backing off a commitment to a 50-bps rate hike and instead suggesting the FOMC will wait to see incoming inflation and jobs data before making any decisions.

The Fed’s Beige book is released and shows that the US economy is experiencing a solid pace of growth at the start of 2023.

More Hikes Before the Pause

We can measure whether a Fed rate hike is being priced-in using Eurodollar contracts by examining the difference in borrowing costs for commercial banks over a specific time horizon in the future. Chart 1 below showcases the difference in borrowing costs – the spread – for the front month and June 2023 contracts, in order to gauge where interest rates are headed through the middle of this year.

Eurodollar Futures Contract Spread (March-September 2023) [BLUE], US 2s5s10s Butterfly [ORANGE], DXY Index [RED]: Daily Timeframe (August 2022 to March2023) (Chart 1)

The rise in rate hike expectations, as evidenced by the 50-bps rate hike expectation build from February into early-March, proved to be a significant bullish catalyst for the US Dollar. And vice-versa: the sharp decline in hike odds over the next few months weighed on the greenback. Eurodollar spreads are favoring a rate hike in March, but beyond that, it’s not even a coinflip: there’s less than a 30% chance of an additional 25-bps rate hike.

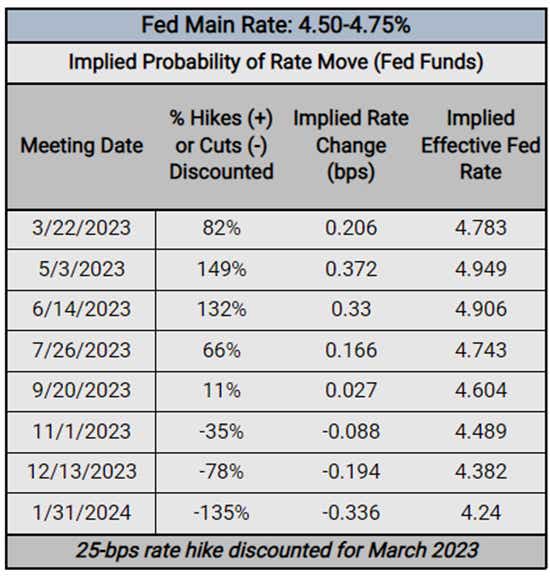

Federal Reserve Interest Rate Expectations: Fed Funds Futures (March 21, 2023) (Table 1)

Fed fund futures appear on equal footing to Eurodollar contract spreads in the near-term. Rates markets see an 82% chance of a 25-bps rate hike in March, with no rate move favored in May (51% of a hold, 49% chance of a 25-bps rate hike). In other words, the peak in the Fed’s main rate is here, or about to be here. Furthermore, rates markets are favoring a 25-bps rate hike by the December 2023 meeting (78% chance).

Expectations for Markets

The March Fed meeting will yield a policy statement and a new Summary of Economic Projections (growth, inflation, and unemployment rate forecasts plus the dot plot) for the first time since December 2022. With Fed policymakers having had ample time to have their forecasts reflect recent turmoil in the banking sector, the ‘dot plot’ will be particularly noteworthy this quarter.

For bulls, Fed Chair Powell has an exceedingly difficult act if equity markets are going to rally. The Fed can only raise rates by 25-bps (the base case scenario), while Fed Chair Powell signals that the fight against inflation is not finished. However, stress in the banking sector may be a sign that lending conditions have and will tighten further, which should help reduce inflation pressures. In any event (using the ECB’s language), the Fed stands by to deliver liquidity as needed to an already well-capitalized system. It is not a difficult message to deliver; it is more about whether markets believe Fed Chair Powell believes his own confident words. In this ‘upside’ scenario, risk appetite improves slightly: stronger US stocks; weaker bond and bond prices; and a softer US Dollar.

For bears, an outcome in their favor seems easier to envision. If the Fed comes across too dovish – no rate hike or a shocking rate cut – then markets will think that the banking crisis is much more dire than previously understood (risk off). If the Fed comes across too hawkish – a 50-bps rate hike or a dot plot that shows the terminal Fed funds rate will end up closer to 6%, as markets were pricing earlier in March – then markets will think that the banking crisis is only getting started. In this ‘downside’ scenario, risk aversion takes hold: weaker US stocks; stronger gold, and bond prices; and a stronger US Dollar.

--- Written by Christopher Vecchio, CFA, Head of Futures and Forex

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices