Markets Face Volatility Risk on FOMC Minutes and Inflation Data

Markets Face Volatility Risk on FOMC Minutes and Inflation Data

By:Ilya Spivak

But many will step away from the markets next week for a long Thanksgiving break

- November FOMC meeting minutes are eyed as officials rethink dovish stance.

- U.S. PCE inflation data may reinforce the downshift in Fed rate cut bets.

- Eurozone CPI inflation data may overshoot expectations, lifting the euro.

A holiday-shortened week will bookend November as U.S. markets close for Thanksgiving on Nov. 28 and reopen for a shortened session on Nov. 29. The ranks of market participants tend to remain thin for this abridged outing, and many will be stepping way for a long break by the middle of the week.

The draining of liquidity from the world’s biggest financial markets against this backdrop might make for quiet consolidation. However, the shallower depth of buyers and sellers at every price level that this implies might make for amplified volatility if some sort of event risk jolts sleepy traders into action.

With that in mind, here are the key macro waypoints to consider.

Federal Open Market Committee meeting minutes

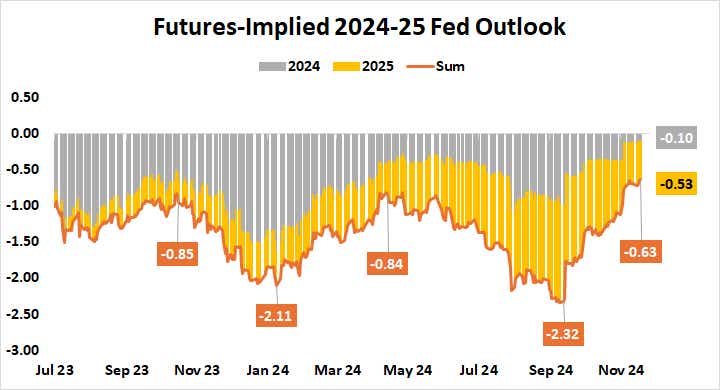

The U.S. central bank seemed to dial back dovish conviction with this month’s policy announcement. Officials seemed to have grown more cautious after September’s big-splash 50-basis-point (bps) rate cut and confident projection of 150bps in further stimulus to follow through the end of 2025.

This almost certainly reflects the markets’ repositioning for higher inflation after September’s moves. Fed Chair Jerome Powell made the point still more overt with a closely-watched speech last week (as expected). He forcefully argued that policy is not on dovish autopilot, reiterating that ensuring arrival at the 2% price growth target is a priority.

With that in mind, traders will be keen to size up just how much backpedaling officials did at this month’s Federal Open Market Committee (FOMC) conclave. If minutes from the meeting suggest the central bank is having second thoughts, another jump in bond yields may spook stocks and lift the U.S. dollar while gold prices retreat.

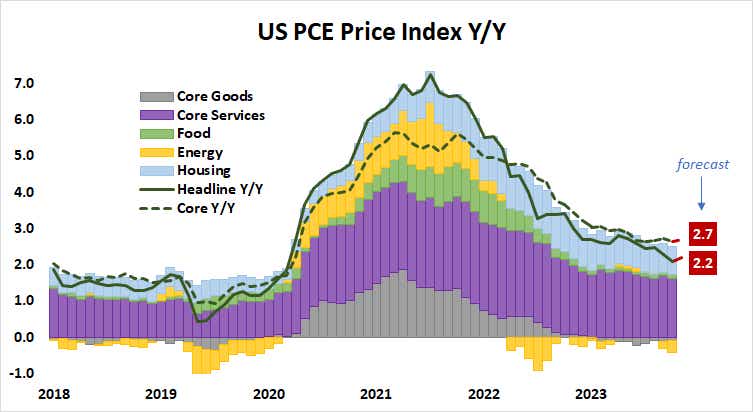

U.S. personal consumption expenditure (PCE) price index

The Fed’s favored inflation gauge is expected to show that headline price growth cooled in October, slowing to 2.1% year-on-year from 2.2% in the prior month. The core PCE measure excluding volatile food and energy prices—a focal point for central bank officials—is seen holding unchanged at 2.7%.

On balance, this would amount to four consecutive months without disinflation, echoing what has already appeared in consumer price index (CPI) figures for the same period. Citigroup analytics suggest U.S. economic data outcomes still tend toward outperformance relative to baseline forecasts, setting the stage for an upside surprise.

As with the FOMC minutes, any indication that the Fed rate cut outlook still appears more generous than realistic will send Treasuries lower as yields and the greenback rise in tandem. Stock markets are unlikely to be pleased.

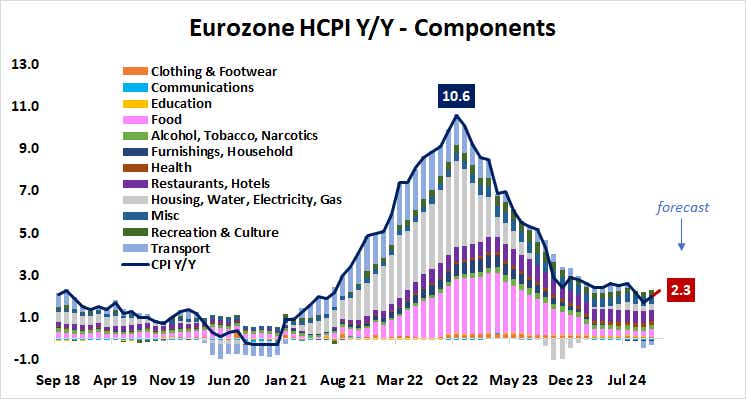

Eurozone consumer price index (CPI) data

Meanwhile, inflation in the Euro Area is expected to tick up to 2.3% year-on-year in November, marking the highest reading since July. Here too, Citigroup tracking of economic data surprises from the currency bloc suggests a skew toward overshooting on the topside has emerged in recent weeks.

If that foreshadows a sharper rebound in price growth, the euro may rise as European Central Bank (ECB) rate cut speculation cools. As it stands, the markets have priced in a commanding 82% probability of another 25bps cut before year-end and 86bps in further easing next year.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices