GameStop: Another Gamma Squeeze for GME?

GameStop: Another Gamma Squeeze for GME?

Keith Gill, aka “Roaring Kitty,” is back unveiling a nine figure long position in GME. Everything you need to know.

Market update: GME up +123.6% in 2Q ’24

Keith Gill, aka “Roaring Kitty,” is back—again. When he returned after a three-year hiatus in May, he brought along the apes of yesteryear: His mercurial pronouncement on X/Twitter sent the rumor mill into action, propelling retail traders back into once-favored “meme stock” names like GameStop (GME) and AMC Theatres (AMC) soaring.

Now, at the start of June, a Reddit post from Gill, outlining a nine-figure position in GME, has rekindled animal spirits among retail traders. Today alone, the ramifications are already being seen elsewhere: Companies with high short interest have squeezed higher. In fact, an equal-weighted basket of 10 of the most heavily shorted Russell 2000 stocks (MPW, WOOF, KSS, LCID, HTZ, CHPT, PLUG, RUN, GME, and JWN) is up +7.32% week-to-date; excluding GME, this basket has still produced a +3.38% gain, easily outpacing broader markets (the Russell 2000 (/RTYM4) fell -0.51% on Monday).

Traders who have been shorting meme stocks are running for the hills once more. A broad-based short-covering rally is taking place. The question is whether the May and June 2024 meme stock short squeeze is anything like the January 2021 meme stock short squeeze (because any similarities or differences may help inform trading opportunities).

As of now, the answer may be no: while both events are short squeezes, the January 2021 move also produced a “gamma squeeze” in options markets, which did not materialize in May—nor does it appear likely in June thus far.

Different kinds of squeezes

In January 2021, a gamma squeeze was a significant contributing factor in the “to the moon” rise in GME during the Roaring Kitty-led short squeeze episode. But not all short squeezes produce gamma squeezes (e.g. shorts can cover without the options market wagging the dog), and not all gamma squeezes occur during short squeezes (e.g. a stock price can swing sharply lower because of the options market). Let's break down the difference in the squeezes and how they contribute to volatility:

1. What is a “short squeeze?”

A short squeeze is a rapid increase in the price of a stock that occurs when there is a lack of supply and an excess of demand for the stock. It typically happens when a stock is heavily shorted, meaning investors have borrowed shares and sold them in the expectation that the stock price will fall.

Here’s how it works: An investor, let’s call him Investor A, borrows shares of a company from another investor, Investor B, and immediately sells them in the open market. Investor A is betting that the stock price will drop, at which point he can buy the shares back at a lower price, return the borrowed shares to Investor B and pocket the difference.

However, if the stock price increases instead of falling, Investor A still has to return the borrowed shares to Investor B. This means Investor A has to buy the stock in the open market at the higher price, resulting in a loss. The higher the stock price goes, the bigger the loss.

Now, imagine many investors have shorted the stock. If the price starts to rise, these investors will all need to buy the stock to cover their short positions and limit their losses. This surge in demand can cause the stock price to increase even more rapidly, creating a feedback loop. This is a short squeeze.

2. The role of market makers in options

Options contracts are distinct from equity transactions in their trade execution. Typically, when initiating an options position, the counterparty is a market maker instead of a direct peer investor. These market makers are responsible for the issuance of options contracts, which encompass both the asset and liability components, adhering to regulated frameworks. Their primary objective is to generate revenue through the bid-ask spread inherent in these trades.

Furthermore, to mitigate risk exposure, market makers employ hedging strategies, such as taking positions in the underlying stock—either through acquisition or short-selling—aligned with the directional bias of the options they have written.

3. What is a “gamma squeeze?”

A gamma squeeze represents an advanced market dynamic that extends the concept of a short squeeze through its reliance on open options positions.

Operational mechanics are as follows:

- The Black-Scholes model prescribes risk metrics, notably gamma among other 'Greeks' like delta and theta.

- Gamma quantifies the sensitivity of an option's delta, which is the rate of change in the option's price relative to the underlying stock's price movement.

- Market makers leverage gamma to calibrate their hedging requirements.

- A swift ascent in stock prices alters gamma values, compelling market makers to modify their hedges accordingly.

- Such recalibrations can induce a cyclical effect: market makers procure additional stock for hedging, propelling the stock price upward.

- Rising stock prices transition more options into “in-the-money” status, precipitating further hedging.

In essence, a gamma squeeze escalates market volatility by necessitating augmented stock purchases because of the prevailing options positions, illustrating a sophisticated interaction between options valuation, market maker behavior and equity price fluctuations.

What Happened in January 2021 vs. May/June 2024?

Over three years, GME underwent an extraordinary gamma squeeze, where the escalation in its share price was propelled not solely by short sellers seeking to cover their positions, but also by market makers recalibrating their portfolios in response to dynamic gamma values. A lack of available weekly strikes in the options market forced dealers into buying GME shares outright to hedge their books. This confluence of retail investor fervor, short covering, and gamma-induced hedging activities culminated in unparalleled market turbulence in January 2021.

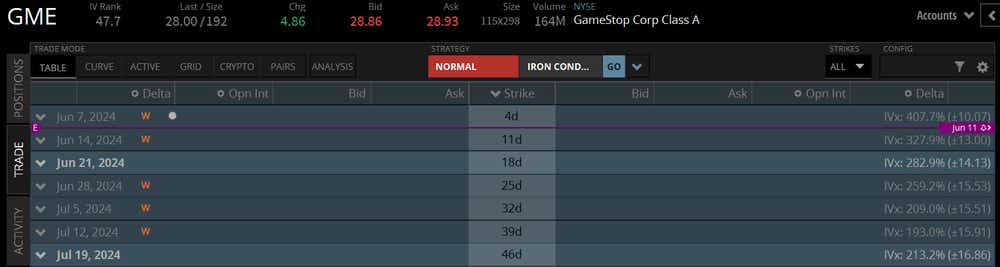

Unlike January 2021, and more like the move in May 2024, the price action at the start of this week in GME (and other meme stocks) appears more of the garden variety short covering rally than one amplified, by a gamma squeeze. Why? Learning from their mistakes in 2021, market makers have rolled out more weekly options at higher strikes in a more expedient fashion; instead of being forced to gamma hedge by buying GME, market makers are able to hedge their books by going to the options market instead.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices